Average audit fees are rising as auditors turn more to technology

Accounting Today

NOVEMBER 14, 2023

Average audit fees increased by 4.6% from 2021 to 2022, and more auditors are using data analytics in their audits, according to a new report.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Accounting Today

NOVEMBER 14, 2023

Average audit fees increased by 4.6% from 2021 to 2022, and more auditors are using data analytics in their audits, according to a new report.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

Accounting Today

SEPTEMBER 3, 2024

The Internal Revenue Service is ramping up its scrutiny of large partnerships, leveraging increased funding under the Inflation Reduction Act of 2022.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

Xero

JUNE 2, 2022

That’s right – I’m talking about the incomparable Xero Roadshow 2022. . Given everything that’s going on in the world, Roadshow 2022 was all about optimism, opportunity and the power of connection. What’s more, it’ll soon come with one of the most requested payroll features to date – Payroll Audit History.

Xero

JUNE 30, 2022

Organisations on a flat rate scheme can now add non-posting adjustments to boxes in the VAT return and access a new VAT audit report, Non-Posting adjustments by VAT box. The post Latest product news — July 2022 appeared first on Xero Blog. Adjust your VAT flat rate scheme returns — UK. Improve your workflows in Xero Tax — UK.

Xero

OCTOBER 3, 2022

made changes to the audit report, so transactions associated with unmapped tax rates are grouped for easy identification. Document packs will go live in the UK on 4 October 2022. The post Latest product news — October 2022 appeared first on Xero Blog. Our feed for Bank of Ireland will follow soon.

Xero

SEPTEMBER 7, 2022

We shared the first phase of this new feature — employee records — and explained how it will help you identify, audit, and reconcile your clients’ payroll quickly and accurately. . The post Product wrap from Xerocon Sydney 2022 appeared first on Xero Blog. Helping your clients avoid the cash flow crunch.

Xero

SEPTEMBER 1, 2022

It offers an easy-to-access audit trail of changes made within Xero by a small business owner, advisor or app partner. The post Latest product news — September 2022 appeared first on Xero Blog. One of our most highly requested product updates is now live in Xero Payroll: payroll history.

Accounting Today

APRIL 19, 2024

Seventeen percent of comment forms in 2021 and 2022 contained auditor evaluation deficiencies, according to the PCAOB.

Accounting Today

DECEMBER 16, 2024

The average audit fee increased to $3.01 million from 2022 to 2023, up from $2.83 million in the previous cycle, according to a new report.

Xero

JULY 26, 2022

Xerocon London 2022 boasted everything from inspirational keynotes, to major product announcements , and fantastic guest speakers. First, is to carry out sustainability audits. But, most importantly, it offered us an opportunity to come together and reconnect with our amazing community.

Xero

OCTOBER 31, 2022

We’ve added so much value to new invoicing that we’re going to make it the default invoicing experience for new Xero customers from 16 November 2022. New Xero customers will default to new invoicing. Don’t worry, classic invoicing is still available and everyone can continue to switch between classic and new at any time.

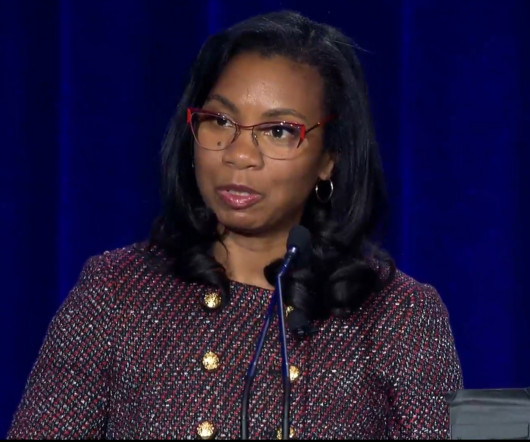

Accounting Today

OCTOBER 25, 2024

Williams, who began her first term in January 2022, will now helm the Public Company Accounting Oversight Board through Oct. 24, 2029.

Intuit

JANUARY 9, 2024

Intuit’s recently published TurboTax Tax Trends Report showed only 37% of single tax filers in the lowest income category received a refund in tax year 2022—down from 59% in the prior year. times more likely to be targeted by current IRS systems for an audit. So what are we doing about it?

Nolan Accounting Center

SEPTEMBER 15, 2023

Most of the time, small business returns are not audited. In November 2021, the IRS announced that audits would increase by 50% in 2021. In August 2022, the Inflation Reduction Act was passed, which included $80 billion in funding for the IRS, with approximately $45 billion of that going towards enforcement.

Jetpack Workflow

FEBRUARY 5, 2025

Podcast Summary In this episode of Growing Your Firm, host David Cristello speaks with Michael Meihaus , the owner of Meihaus CPA , who transitioned from a decade in public accounting to launching his own firm focused exclusively on retirement plan audits.

Future Firm

APRIL 4, 2022

Do you want to know how to start a bookkeeping business or accounting firm in 2022? You: Seeing as you say your books not be fully accurate, how would it make you feel if the government audited your books? These elements are crucial in 2022 if you want to know how to start a bookkeeping business. Let’s make this simple.

Xero

SEPTEMBER 8, 2022

Transactions that take place on a public blockchain are time-stamped and transparent, which creates a clear audit trail for all to see. Accountants would be able to see transactions in real time and verify records via a trusted audit trail.” . Time delays caused by trust intermediaries and process inefficiencies (i.e.

AvidXchange

FEBRUARY 11, 2022

We’re taking a look at the current state of AP in banks and how key financial services industry trends are predicted to impact the way they manage their invoicing and payments to better serve their business in 2022 and beyond. In fact, $60 billion in deal activity is expected in 2022. What does it mean for AP departments?

AvidXchange

MARCH 17, 2025

McKinsey reports that 82% performed a digital payment in 2022 up from 78% in 2021. Additionally, they ease report generation, tax compliance and auditing. In this piece, well address five trends impacting K-12 schools and share how automating financial operations can help so you can focus on educating your students.

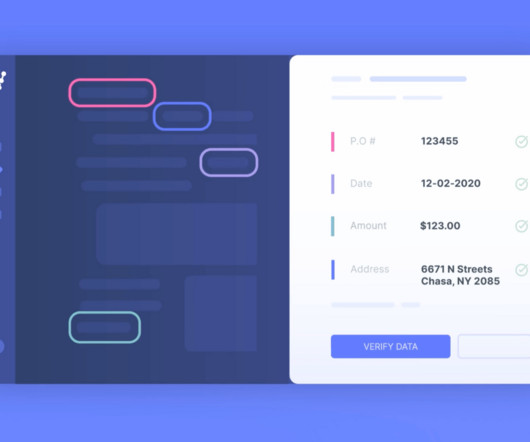

Nanonets

AUGUST 1, 2023

Internal audits play a crucial role in assessing a company's internal controls, corporate governance, and accounting processes. These audits are essential for ensuring compliance with laws and regulations, as well as maintaining accurate and timely financial reporting and data collection.

AvidXchange

SEPTEMBER 1, 2021

Here are four tips for speeding up your 2022 budget process: 1. EVALUATE YOUR CURRENT PROCESSES TO IDENTIFY INEFFICIENCIES It’s crucial to ask these questions: When was the last time you audited your business processes? The process includes negotiating and securing all necessary buy-ins and approvals. Many companies take even longer.

Cloud Accounting Podcast

MARCH 22, 2023

Subscribe to the Earmark Accounting Podcast: [link] Get CPE for listening to podcasts with Earmark CPE: [link] (00:00) - CAP 324 (00:17) - Preview: The job of a lawyer in setting up businesses (00:49) - Introduction and welcome Matt to the show (04:18) - What does a tax lawyer do? (25:28) We appreciate you!

RevCycle

SEPTEMBER 25, 2024

A study by Kodiak Solutions shows that the denial rate from initial RFI’s has increased by nearly 9% since 2022. The first five months of 2024 had $6B in claims delayed across more than 1900 hospitals, which when prorated over the year would be $14.4B, versus $11B in 2022.

Counto

MAY 4, 2024

It was recently updated on 14 March 2022 to include features like auto-renewal submissions and an offline payment process, enhancing the overall user experience. Certification Audit and Ongoing Inspections Post-application submission and fee payment, a certification audit will be conducted at your premises by MUIS.

Intuit

JANUARY 19, 2024

A Certified Public Accountant is an accounting professional who performs tasks such as auditing books or analyzing financial statements. CPAs work closely with clients to review financial statements and perform audits to ensure compliance. What Is a CPA? First, you must have a bachelor’s degree and at least 150 credits of coursework.

Nanonets

AUGUST 1, 2023

Over the years, the auditing landscape has undergone remarkable transformations, and among the most significant advancements has been the advent of audit automation software solutions. Computer-Assisted Audit Tools and Techniques (CAATTs) have been available to auditors since the early 1990s. The situation has changed now.

Blake Oliver

NOVEMBER 8, 2024

If working on two clients at the same time isn't ethical, maybe EY should audit their timesheets and see who's double-dipping there. This CPE crackdown might be tied to EY's $100 million fine from the SEC in 2022 for employees cheating on ethics exams. You've got to hit those hourly billing minimums somehow. What do you think?

Compleatable

JUNE 15, 2023

These steps are absolutely necessary; they’ll be reviewed during the annual audit and have to be correct for fiscal statutory returns. Amazon Business and Compleat announced the global launch of the ultimate online buying experience in February 2022 – Amazon Business Punch-In- and it’s causing quite a stir.

Billah and Associates

JANUARY 27, 2021

Corporate tax return filings are due 6 months after the year-end For eg, a December 31, 2022 year-end would have a June 30, 2023, due date. Note Down These Important Dates for Corporate Income Tax 2023: RRSP Contribution Deadline : The deadline for contributions toward the 2022 tax year must be made before March 1, 2023.

Cloud Accounting Podcast

NOVEMBER 4, 2022

link] 29:46 – Matt Foreman on Twitter: "Tell me you’re taking incredibly aggressive tax positions that won’t withstand audit without saying you’re taking incredibly aggressive tax positions that won’t withstand audit. I’m looking at you @sweatystartup [link] 49:12 – How the FedNow(SM) Service will work [link] Federal Reserve Gov.

Nanonets

AUGUST 23, 2023

Lastly, this workflow makes it easier to create an audit trail, ensuring that your business remains compliant and maintains a clean record of all data processing activities. Compliance made easy: Nanonets creates automatic audit trails and ensures your documents are aligned with regulatory standards. in 2018 to 3.8

Nanonets

MARCH 23, 2023

These roles will complement the tasks performed by cognitive technology and ensure the work of machines is effective, responsible, fair, transparent, and auditable. According to Ipsos and McKinsey , in 2022, 58% of Americans had the option to work from home at least once a week, and 38% were not required to work in the office regularly.

SSI Healthcare Rev Cycle Solutions

AUGUST 18, 2022

August 17, 2022. A Path Forward: SSI Solutions (Claims Reporting and Analytics, Denial Management, Audit Management). SSI AUDIT MANAGEMENT: Gain insight into the root cause of denials and maximize appeal recoveries. SSI Wins Oracle Cerner 2022 Collaboration Award. Infographic: Get Out of the Denial Danger Zone.

Cloud Accounting Podcast

MAY 16, 2023

Subscribe to the Earmark Accounting Podcast: [link] Get CPE for listening to podcasts with Earmark CPE: [link] Show Notes KPMG pens deal with MindBridge to apply AI to digital audits | Accounting Today [link] We ran the CPA exam through ChatGPT and it failed miserably | Accounting Today [link] I Cloned Myself With AI.

Cloud Accounting Podcast

JANUARY 26, 2023

million bill that caused it to quit the cloud [link] Accountant must repay employer after software shows ‘time theft’ [link] George Clooney to Headline Expensicon 2023 [link] U.S. accounting watchdog faces lawsuit over its 'secretive. [link] TaxBit Announces Acquisition of Digital Asset Accounting Startup.

Cloud Accounting Podcast

NOVEMBER 21, 2023

Billion Deal for Melio [link] Bill Holdings stock sinks amid report of $1.95B deal talks for Melio. Billion Deal for Melio [link] Bill Holdings stock sinks amid report of $1.95B deal talks for Melio.

Cloud Accounting Podcast

JANUARY 6, 2022

We appreciate you! Follow and tweet @BlakeTOliver and @DavidLeary.

Invoicera

FEBRUARY 5, 2024

A 2022 study by McKinsey & Company revealed that companies with effective cross-selling strategies experience a 15-25% increase in revenue. 81% of consumers crave more self-service options, as the 2022 Digital-First Customer Experience Report revealed. No more phone calls or emails about lost invoices!

Cloud Accounting Podcast

NOVEMBER 25, 2022

link] 23:00 – Meet the Metaverse Nightclub–Loving Audit Firm That Presided Over FTX’s Financials [link] 35:29 – Imagine McDonald’s makes its own money [link] Get in Touch Thanks for listening and for the great reviews!

Analytix Finance & Accounting

JUNE 23, 2023

dollars in 2022. dollars in 2022, whereas corporate income taxes totaled 425 billion U.S. Reducing Errors : Late or rushed filing often leads to errors, which results in penalties, interest charges, and audits. The Cost of Missed Tax Benefits: According to a study by Statista , the total revenue of the U.S. trillion U.S.

NextProcess

JULY 20, 2023

According to the Association of Certified Fraud Examiners (ACFE)’s “ Occupational Fraud 2022: A Report to the Nations ,” organizations lose about 5% of their revenue to fraud every year. Internal audit (16%), management review (12%), and document examination (6%) are the next most common detection methods.

Cloud Accounting Podcast

AUGUST 16, 2023

18:45) - Smaller firms are the ones really impacted by this talent shortage (20:04) - PCAOB says 40 percent of 2022 audits are deficient (24:35) - What are the things younger accountants are really complaining about? (30:34) (13:28) - Are substantial equivalency and mobility really a roadblock? (18:45)

Atlassian

FEBRUARY 14, 2022

access to audit and oversee capabilities to ensure they have the information they need to do their own risk assessments. As we head into 2022, we’ll continue to double down on our commitment to bolster our security and compliance program in Cloud to ensure that our policies maintain the integrity of consumer data. Looking forward.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content