Accounts Payable Trends: What to Expect in the Coming Years

oAppsNet

OCTOBER 22, 2024

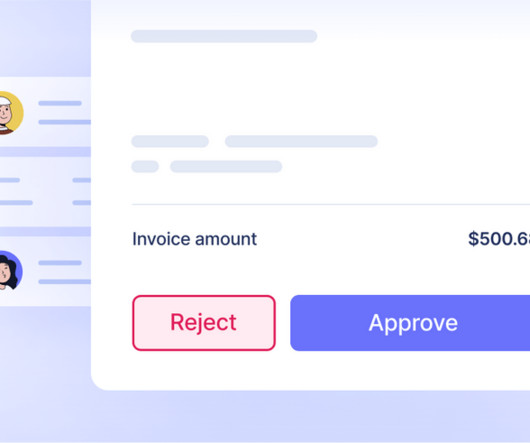

Accounts Payable (AP) is a critical business function. It manages outgoing payments to suppliers, vendors, and other creditors. Traditionally, this process involved manual tasks like invoice processing, approvals, and payment disbursement, which were prone to errors and inefficiencies.

Let's personalize your content