Bank reconciliation definition

Accounting Tools

MAY 14, 2023

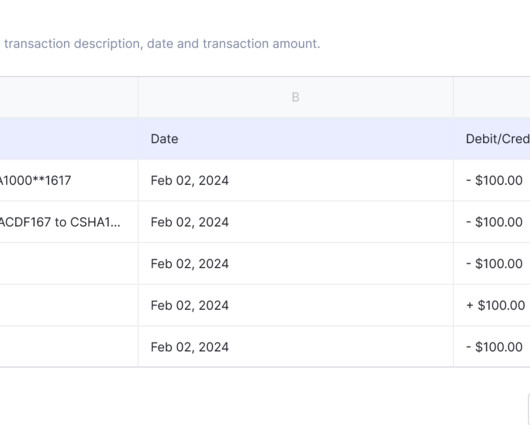

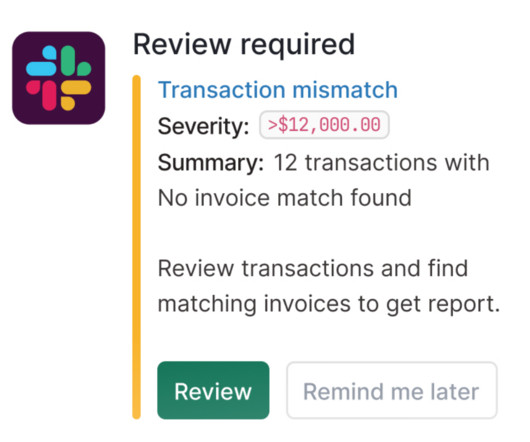

Related Courses Bookkeeping Guidebook Corporate Cash Management How to Audit Cash What is a Bank Reconciliation? A bank reconciliation is the process of matching the balances in an entity's accounting records for a cash account to the corresponding information on a bank statement.

Let's personalize your content