The best and worst states for corporate taxes

Accounting Today

DECEMBER 12, 2024

From those with no corporate tax at all, to those that tax everything they can a guide to most and least competitive states when it comes to taxing businesses.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Corporation Tax Related Topics

Corporation Tax Related Topics

Accounting Today

DECEMBER 12, 2024

From those with no corporate tax at all, to those that tax everything they can a guide to most and least competitive states when it comes to taxing businesses.

Accounting Today

OCTOBER 2, 2023

Nearly half the leaders of corporate tax departments believe they're severely under-resourced when it comes to technology and hiring, according to a recent survey.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

How to Avoid Pitfalls In Automation: Keep Humans In the Loop

Automation, Evolved: Your New Playbook for Smarter Knowledge Work

Accounting Today

AUGUST 10, 2022

(..)

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

How to Avoid Pitfalls In Automation: Keep Humans In the Loop

Automation, Evolved: Your New Playbook for Smarter Knowledge Work

Accounting Today

OCTOBER 14, 2022

(..)

Accounting Today

AUGUST 29, 2023

Accounting firms are less important than the partner leading the team in terms of the impact on the business's effective tax rate and the probability it will face an audit.

Accounting Today

MARCH 7, 2024

President Joe Biden will propose increasing the minimum tax rates paid by major U.S. and multinational corporations to 21% and eliminating breaks for companies with high-paid executives in his election-year State of the Union address on Thursday night.

Accounting Today

NOVEMBER 18, 2022

(..)

Accounting Today

JULY 20, 2022

(..)

Counto

JANUARY 21, 2025

Minimum Corporate Tax Rate in Singapore 2025 As we approach 2025, small business owners in Singapore need to understand the implications of the minimum corporate tax rate and any updates in the tax landscape. This rate is stable, offering a consistent and predictable tax environment for businesses in Singapore.

Accounting Today

APRIL 15, 2024

The International Ethics Standards Board for Accountants has unveiled a set of ethical standards for business tax planning in response to complaints over tax avoidance by multinational companies.

Counto

MARCH 15, 2025

Singapore Corporate Tax Update 2025: What Your Business Needs to Know Good news! Budget 2025 has introduced significant tax benefits to help businesses manage cash flow better. Get accounting plans that combine bookkeeping with corporate tax filing to help you stay compliant at an affordable price.

Accounting Today

SEPTEMBER 6, 2023

Corporate tax departments are going through major transformation in response to the challenging legal and regulatory environment, according to a new survey from Deloitte.

LedgerDocs

FEBRUARY 25, 2025

Tax season 2025 is fast approaching, and for bookkeepers and accountants, staying on top of the important corporate tax deadlines is the key to completing smooth filings for their clients. Canadian-Controlled Private Corporations (CCPCs) that meet specific criteria may have three months to pay taxes owing for the year.

Accounting Today

MAY 6, 2024

taxes are likely to rise as lawmakers look to narrow the federal deficit, Warren Buffett said, as Washington prepares for major tax negotiations next year.

Accounting Today

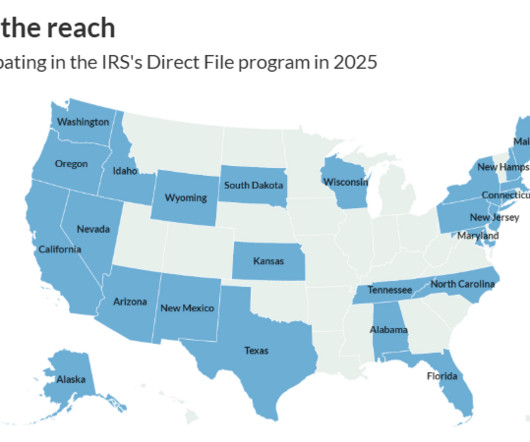

DECEMBER 3, 2024

The latest data on the growth of the IRS's Direct File program, how many corporate tax pros believe generative AI is beneficial in accounting, and other key metrics.

Accounting Today

JANUARY 3, 2024

Fifteen states are reducing either individual or corporate income taxes this year, with some states trimming both individual and corporate taxes, among 34 states starting the year with significant tax changes.

Insightful Accountant

MAY 13, 2024

Small business owners and tax practitioners are debating whether to elect S corporation status before the potential corporate tax rate increase in 2025 due to the expiration of TCJA provisions.

Accounting Today

OCTOBER 12, 2023

The dispute centers on a 2012 IRS audit into transfer pricing, a method used by companies to shift profits to tax havens and avoid the U.S. corporate tax rate.

Accounting Today

JUNE 10, 2024

Strategic tax leaders worry the election will lead to changes to Inflation Reduction Act renewable energy credits, while tax tacticians worry about changes to federal corporate tax rates.

Xero

MARCH 25, 2025

Tax codes If you were on a W1/M1 tax code, Xero will switch you back to the normal tax method at the start of the new tax year. Any tax code updates from HMRC (also known as P9X ) will be automatically applied in Xero.

Accounting Today

MARCH 15, 2024

Tax filing season can be an extremely trying time for corporate tax and accounting professionals as they have to navigate countless forms and compile extensive amounts of information without errors.

Accounting Today

FEBRUARY 28, 2024

The move would make New Jersey's corporate tax the highest rate in the country.

Billah and Associates

SEPTEMBER 23, 2024

Understanding corporate taxes in Canada can be challenging, especially since businesses are subject to both federal and provincial taxes. Knowing the differences between these two tax systems and how they impact your business is crucial for ensuring compliance and maximizing tax savings.

Billah and Associates

FEBRUARY 18, 2025

Lets explore common corporate tax issues, and actionable strategies to avoid them, along with the benefits of working with a corporate tax accountant. Late or Inaccurate Filings The Issue Missing deadlines for T2 corporate tax returns trigger penalties5% of unpaid taxes plus 1% monthly interest (up to 12 months).

Accounting Today

FEBRUARY 14, 2024

The OECD's Pillar Two international corporate tax rules will impose significant new compliance obligations on midsize multinational enterprises.

Xero

MARCH 16, 2023

Corporation Tax UTR for CIS suffered – To be able to claim CIS suffered on your Employer Payment Summary (EPS) you will need to complete the Corporation Tax UTR reference field under the Payroll settings on the HMRC tab.

Counto

SEPTEMBER 27, 2024

CorpPass and Corporate Tax Filing: A Complete Guide for Foreign Entrepreneurs in Singapore Navigating Singapore’s regulatory landscape can be challenging for foreign entrepreneurs, especially when it comes to managing corporate tax responsibilities. 30 November: Deadline for annual corporate tax returns.

Xero

DECEMBER 20, 2022

We’ll continue to work closely with HMRC to support MTD for ITSA as it evolves, and also support MTD for Corporation Tax when it becomes mandated. Not yet timelined: MTD for ITSA for those with income under £30,000 annually. MTD for ITSA for general partnerships.

Xero

JUNE 18, 2023

What’s new for UK practices in Xero Tax In addition to delivering a single client record across Xero HQ and XPM, we’ve made a number of updates to Xero Tax in the UK, to help you further streamline accounts and tax work.

Xero

AUGUST 11, 2022

You’ll see your UTR number at the top of the page, while it will also appear on letters relating to your tax account sent by HMRC, as well as notices to file your return and payment reminders. Limited companies can request their Corporation Tax UTR number online. Where to find more information.

Counto

APRIL 7, 2025

Low Corporate Tax Rate : Singapore offers one of the lowest corporate tax rates in Asia at 17%, and theres no capital gains tax, which means businesses get to keep more of their profits.

Counto

FEBRUARY 23, 2025

Understanding the accounting considerations and corporate tax benefits of incorporating in Singapores FTZs is essential for SMEs aiming to maximise financial efficiency. Business Growth and Expansion Opportunities Incorporating in an FTZ can provide businesses with: Improved access to corporate tax incentives and global investors.

Counto

JANUARY 26, 2025

Taxes and Government Support Singapore has one of the lowest corporate tax rates globally, making it an attractive destination for foreign entrepreneurs. Understanding the tax obligations is crucial for managing your finances. Learn more here.

Counto

NOVEMBER 14, 2024

Experience the Counto advantage Counto is the trusted provider of accounting, tax preparation and CFO services for startups and SMEs. Get accounting plans that combine bookkeeping with corporate tax filing to help you stay compliant at an affordable price.

Counto

MARCH 24, 2025

Calculate Estimated Taxes After deducting allowable expenses, calculate your chargeable income and apply the standard 17% corporate tax rate. Dont forget to account for tax exemptions that may lower your liability. Seek Expert Guidance Tax regulations can be complex.

Xero

MAY 13, 2022

However, if you’re a landlord and you’re registered as a limited company, you’ll need to continue sending limited company accounts and corporation tax to Companies House and HMRC. As well as residential property, the scope of MTD for ITSA includes Furnished Holiday Lettings (FHL), commercial property, and non-UK property. .

Counto

MARCH 24, 2025

Why ECI Filing Matters Filing ECI allows IRAS to assess your corporate tax early and may result in early instalment plans for tax payments. Cash Flow Planning for Tax Payments Filing ECI early can unlock instalment payment plans for corporate tax, easing cash flow pressures.

Counto

MARCH 24, 2025

Summary The right reporting frequency keeps you informed, compliant, and in control.

Counto

JANUARY 11, 2025

Explore our transparent, all-in-one pricing here.

Counto

APRIL 10, 2024

This results in a total tax exemption of $125,000, which can be a game-changer for a growing business. The Financial Impact after applying the SUTE: Final chargeable income: $ 175,000 (original profit of $300,000 minus the $125,000 exemption) With the current corporate tax rate at 17%, the tax payable would be $ 29,750.

Counto

JANUARY 7, 2025

Experience the Counto advantage Counto is the trusted outsourced provider of accounting, tax preparation and CFO services for startups and SMEs. Get accounting plans that combine bookkeeping with corporate tax filing to help you stay compliant at an affordable price.

Counto

NOVEMBER 2, 2024

Experience the Counto advantage Counto is the trusted outsourced provider of accounting, tax preparation and CFO services for startups and SMEs. Get accounting plans that combine bookkeeping with corporate tax filing to help you stay compliant at an affordable price.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content