IRS regs on transferring clean energy and vehicle tax credits take effect

Accounting Today

JULY 19, 2024

Accounting firms are helping clients navigate the tax incentives available under the Inflation Reduction Act.

Accounting Today

JULY 19, 2024

Accounting firms are helping clients navigate the tax incentives available under the Inflation Reduction Act.

Fidesic blog

JULY 19, 2024

We had a blast at Summit Roadshow on Wed. If you missed our live recap yesterday we'll be sharing highlights form it here over the next couple of weeks, starting with Jim Bertler's session Dynamics GP.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JULY 19, 2024

You need to be on your toes if you work in sales tax, as states are known to make substantial sales tax policy changes with little to no notice. Vermont, North Carolina, New Jersey and Ohio provide standout examples this summer.

Fidesic blog

JULY 19, 2024

We had a blast at Summit Roadshow on Wed. If you missed our live recap yesterday we'll be sharing highlights form it here over the next couple of weeks, starting with Jim Bertler's session Dynamics GP.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Accounting Today

JULY 19, 2024

Intelligize announces AI solution for SEC filing; Bloomberg Tax and Accounting unveils new AI features; and other news from the accounting technology world.

Accounting Tools

JULY 19, 2024

What are Traceable Costs? A traceable cost is a cost for which there is a direct, cause-and-effect relationship with a process, product, customer , geographical area, or other cost object. If the cost object goes away, then the traceable cost associated with it should also disappear. A traceable cost is important, because it is an expense that you can reliably assign to a cost object when constructing an income statement showing the financial results of that cost object.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

JULY 19, 2024

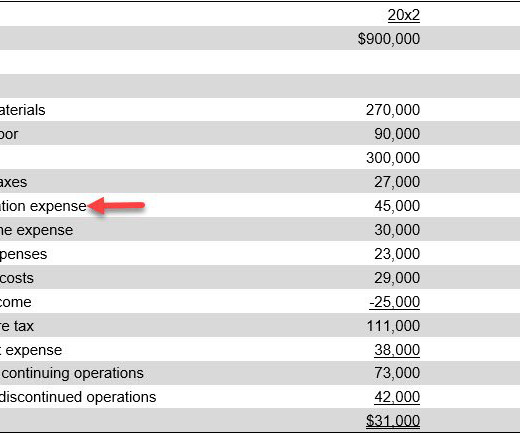

What is the Purpose of Depreciation? The purpose of depreciation is to match the expense recognition for an asset to the revenue generated by that asset. This is called the matching principle , where revenues and expenses both appear in the income statement in the same reporting period , thereby giving the best view of how well a company has performed in a given reporting period.

Accounting Today

JULY 19, 2024

If CFOs were students, their grades would be taking a hit due to late homework.

Jetpack Workflow

JULY 19, 2024

If you want a more modern and productive accounting firm, there are certain categories of software that you should consider implementing into your workflows. We’ve spoken with thousands of accounting firms over the years, and these are the type of tools we see most of them integrate into their operations: Accounting software Payroll software Document management software Project/Workflow management software Practice management software CRM software Client collaboration software In this guide, we

Tipalti

JULY 19, 2024

Learn what’s new, improved, and coming soon to Tipalti Mass Payments customers in 2024.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Economize

JULY 19, 2024

What is an AWS storage gateway? AWS Storage Gateway is an important cloud service that bridges the gap between your on-premise environments and AWS cloud storage. As the demand for scalable, secure, and reliable storage solutions grows, businesses are increasingly adopting cloud technologies to meet these needs.

Accounting Tools

JULY 19, 2024

What is a Tax Anticipation Note? Tax anticipation notes are used by state and local governments to obtain financing before tax revenues have been received. When the issuing government entity eventually receives tax revenues, the resulting funds are used to retire the tax anticipation notes. The funds received from issuance of the notes are useful for smoothing out the differences between the need to pay for obligations and the inflow of cash from tax receipts, and may be used to pay for capital

Let's personalize your content