Lights, camera, taxation! Accountants on screen

Accounting Today

APRIL 12, 2024

Some of our favorite CPAs of the silver and small screen.

Accounting Today

APRIL 12, 2024

Some of our favorite CPAs of the silver and small screen.

FinOps Foundation

APRIL 12, 2024

Key Insight: FinOps success results from getting FinOps practitioners, product teams, and engineers to think cost-first with architectural decisions, and that starts with clean, reliable data. One of Tim’s biggest challenges is bringing so much data together for analysis. Walmart built a data lake where they store several years of raw data in object storage so they can go back and re-parse it in different ways.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

APRIL 12, 2024

CohnReznick launches new digital advisory practice; Kruze Consulting and KPMG separately release CEO reports; and more news from across the profession.

Billing Platform

APRIL 12, 2024

Showing no signs of slowing, a recent Statista report forecasted that the software as a service (SaaS) market is expected to grow at an annual rate of 7.33% (CAGR 2024 – 2028), reaching $374.50 billion by 2028. However, when it comes to managing recurring billing, revenue recognition, plan renewals, etc., companies doing SaaS billing face hurdles in achieving their full revenue potential.

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Accounting Today

APRIL 12, 2024

Plus, DataSnipper releases new suites for cloud collaboration, data extraction; and other accounting tech updates.

CSI Accounting & Payroll

APRIL 12, 2024

When you need a payroll service for your small business, it’s usually because running payroll has started taking up too much of your time or your business has developed some unique payroll needs. Maybe you need a way for your employees to clock in and out of work, or maybe you need help with certain types of garnishments from an employee’s check. Regardless, you’ll want to know a payroll service’s capabilities before coming on board.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Invoicera

APRIL 12, 2024

Think about this: You are an accountant! You are back in the office, ready to start your job day! What do you see? You haven’t received payments for the invoices you generated! And what you see is a list of excuses for not getting timely payments. It’s not the first day of this happening, it occurs many times. Overdue invoices are frustrating as it affects cash flow of a business.

Accounting Today

APRIL 12, 2024

The Internal Revenue Service is getting ready for an onslaught of tax returns arriving by Tax Day on Monday, though many taxpayers will be eligible for automatic extensions due to natural disasters across the country.

Nanonets

APRIL 12, 2024

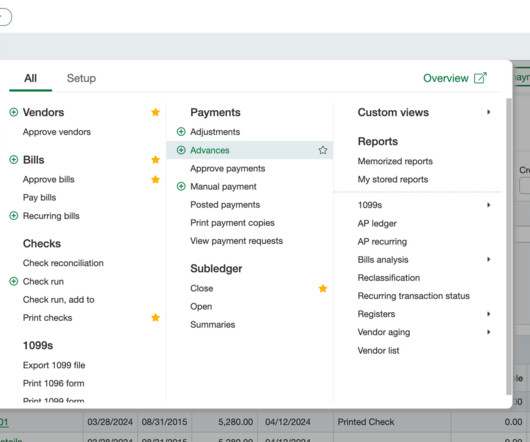

Invoices are a time-consuming hassle but a part of every business. Sage Intacct makes the entire process simple. It creates professional invoices for your accounts receivables and helps process invoices as part of your accounts payables. Sage Intacct has additional features to simplify both ends of invoices. With tracking and reporting, supporting recurring invoices, and recording payments, these extra features make Sage Intacct's capabilities one of the best.

Accounting Today

APRIL 12, 2024

The alleged bookmaker is under criminal investigation by the IRS as well.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Nanonets

APRIL 12, 2024

The Importance of Accounts Reconciliation Companies handle a variety of finance-related documents, ranging from bank statements to invoices and payroll records. Amidst this deluge of numbers and figures lies a crucial task: account reconciliation. Without accurate reconciliation, discrepancies can slip through unnoticed, leading to financial inaccuracies, compliance issues, and potential for fraud.

Accounting Today

APRIL 12, 2024

Use your expertise and knowledge to help guide your clients to create growing and more profitable businesses.

Nanonets

APRIL 12, 2024

Bank Reconciliation Vs. Book Reconciliation In accounting and financial management, we encounter the terms "Book Reconciliation" and " Bank Reconciliation " These terms are often used interchangeably, leading to ambiguity regarding their meanings. Book Reconciliation serves as the umbrella term, encompassing a broader spectrum of financial data matching that involves comparing the ledger entries with figures from other financial documents.

Economize

APRIL 12, 2024

Understanding AWS Data Transfer Costs AWS offers a vast array of services, offering scalability and flexibility to cater to your business needs. However, the costs associated with data transfer within these cloud services are a hidden aspect, significantly impacting your cloud bill.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Fun

APRIL 12, 2024

The expression "Morton's Fork" originates from a policy of tax collection. It was devised by John Morton, who was Lord Chancellor of England in 1487, under the rule of King Henry VII. Morton's approach was that if the subject lived in luxury and had clearly spent a lot of money on himself, he obviously had sufficient income to spare for the king. Alternatively, if the subject lived frugally, and showed no sign of being wealthy, he must have substantial savings and could therefore afford to give

Ace Cloud Hosting

APRIL 12, 2024

TaxWise Desktop is an all-in-one tax preparation software that helps firms file and manage U.S. tax returns with ease. With TaxWise, you can prepare both individual and business tax returns.

Accounting Tools

APRIL 12, 2024

What is an Allowance in Accounting? An allowance is a reserve that is set aside in the expectation of expenses that will be incurred at a future date. The creation of a reserve essentially accelerates the recognition of an expense into the current period from the later period in which it would otherwise have been recognized. The intent of a reserve is to match expenses with the sales transactions with which they are associated.

Accounting Tools

APRIL 12, 2024

What is a Discount Rate in Finance? A discount rate is the interest rate used to discount a stream of future cash flows to their present value. Depending upon the application, typical rates used as the discount rate are a firm's cost of capital or the current market rate. Management might also add a risk premium to a company’s cost of capital when it is evaluating the cash flows from an especially risky investment, in order to reduce the present value of its expected cash flows.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Accounting Tools

APRIL 12, 2024

What is a Dividend? A dividend is a payment made to shareholders that is proportional to the number of shares owned. It is authorized by the board of directors. Many larger publicly-held companies issue dividends on an annual or quarterly basis to their shareholders. Why are Dividends Paid? Dividends are usually issued by companies that will not reap significant growth by reinvesting profits , and so instead choose to return funds to shareholders in the form of a dividend.

Accounting Tools

APRIL 12, 2024

What is a Requisition? A requisition is a written request made by an employee for an organization's purchasing department to buy goods or services. This request specifies the exact item and quantity to be obtained, so that the purchasing staff can more efficiently source what is needed. A requisition form may be signed by the department manager whose department will be charged for the purchase; doing so gives the manager approval authority over every purchase.

Accounting Tools

APRIL 12, 2024

What is a Rebate? A rebate is a payment back to a buyer of a portion of the full purchase price of a good or service. This payment is typically triggered by the cumulative amount of purchases made within a certain period of time. Rebates are generally designed to increase the volume of purchases made by customers. Example of a Rebate As an example of a rebate, a seller offers a 10% volume discount to a buyer if the buyer purchases at least 10,000 units within one year.

Accounting Tools

APRIL 12, 2024

What is a Rollover? A rollover involves the transfer of funds from one investment to another. These transactions usually involve the transfer of funds between similar investment vehicles, though a treasury department may shift funds into investments with different maturities , depending on when the cash is expected to be needed. Rollovers are especially useful when shifting funds between retirement accounts, since rollover transactions do not trigger taxable events.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Accounting Tools

APRIL 12, 2024

What is a Recognized Gain? A recognized gain occurs when an asset is sold for an amount greater than its purchase price. It is calculated as the sale price of an asset, minus the purchase cost of the asset. This situation most commonly arises when an entity sells either a security or property. Depending on the nature of the asset and the circumstances of the sale , a recognized gain may qualify for capital gains treatment, which means that the income tax rate paid is significantly reduced.

Accounting Tools

APRIL 12, 2024

What is a Recognized Loss? A recognized loss occurs when an asset is sold for an amount less than its purchase price. This situation most commonly arises when an entity sells either a security or property. Depending on the nature of the asset and the circumstances of the sale , a recognized loss may qualify for capital gains treatment, which means that the loss can be deducted from any capital gains reported for tax purposes.

Accounting Tools

APRIL 12, 2024

What is a Reconciliation in Accounting? A reconciliation involves matching two sets of records to see if there are any differences. Reconciliations are a useful step in ensuring that accounting records are accurate. If a difference is found during a reconciliation, it may be caused by a timing issue, where documentation has been recorded in one of the accounting records, but not the other.

Accounting Tools

APRIL 12, 2024

What is a Restricted Fund? A restricted fund is used by a nonprofit entity to store funds that have a limited use, as per the requirements of donors. An example of a restricted fund is an endowment, where the principal is only to be used to generate investment income, and the uses to which the income can be put may also be restricted. Advantages of a Restricted Fund Restricted funds are preferred by many donors, since they can be used to ensure that donations are directed as desired by the donor

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Accounting Tools

APRIL 12, 2024

What is a Reporting Currency? A reporting currency is the currency in which a parent organization prepares its financial statements. The reporting currency is usually the currency used in an organization's home country. In order to issue financial statements in its reporting currency, a multi-national firm must first convert the reporting of its subsidiaries in other countries to the reporting currency.

Accounting Tools

APRIL 12, 2024

What is Depreciation Basis? Depreciation basis is the amount of a fixed asset's cost that can be depreciated over time. This amount is the acquisition cost of an asset, minus its estimated salvage value at the end of its useful life. Acquisition cost is the purchase price of an asset, plus the cost incurred to put the asset into service. Thus, the acquisition cost can include sales taxes , customs duties, freight charges, on-site modifications (such as wiring or a concrete pad for the asset), in

Accounting Tools

APRIL 12, 2024

What is a Duplicate Payment? A duplicate payment is an additional payment made to a supplier that has already been paid. When these additional payments are for smaller amounts, they may be difficult to detect, resulting in a permanent increase in your expenses and a related cash outflow. A duplicate payment for a larger amount is generally relatively easy to spot, but can require a substantial amount of work to retrieve from the recipient.

Accounting Tools

APRIL 12, 2024

What is Diversifiable Risk? Diversifiable risk is the possibility that there will be a change in the price of a security because of the specific characteristics of that security. Diversification of an investor’s portfolio can be used to offset and therefore eliminate this type of risk. Diversifiable risk differs from the risk inherent in the marketplace as a whole.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content