Technological transformation: Be mindful, purposeful, and flexible

Accounting Today

APRIL 24, 2024

Firms need to adapt to changes in technology at a pace that makes sense for them and their clients.

Accounting Today

APRIL 24, 2024

Firms need to adapt to changes in technology at a pace that makes sense for them and their clients.

Compleatable

APRIL 24, 2024

Join Compleat Education as we run through our purchasing and accounts payable automation software especially for schools and multi-academy trusts. We’ll go over ways to save your school/s time, money, and increase visibility on every purchase. The post Purchasing & AP Automation for Schools and MATs Like Yours first appeared on Compleat Software.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

APRIL 24, 2024

The IRS has long offered alternative dispute resolution, but says use has declined in recent years, and it hopes to make it more attractive and accessible.

Insightful Accountant

APRIL 24, 2024

Tax technology is changing, and tax professionals are looking for reliable resources when it comes to the future of AI within tax tech. Today, Thomson Reuters is announcing their upcoming tax launch.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

APRIL 24, 2024

Thomson Reuters announced the release of CoCounsel, a generative solution within Checkpoint Edge meant to help tax professionals with complex research.

Insightful Accountant

APRIL 24, 2024

A lot of ProAdvisors and Accountants voiced their opinions at the April 24th QuickBooks Live Strategy (briefing) webinar. a lot of those opinions were negative, but this might not be as bad as your thinking.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Insightful Accountant

APRIL 24, 2024

While rare, tax preparers must disclose reportable transactions on most returns. Understanding which transactions require disclosure is crucial for all preparers to ensure compliance.

Accounting Today

APRIL 24, 2024

Lindsay Stevenson's transformation team drives innovation for Top 50 Firm BPM

Blake Oliver

APRIL 24, 2024

Podcasting is the new blogging. Everyone's doing it, and you should, too, right? Not so fast.

Accounting Today

APRIL 24, 2024

Its investigators identified a scheme to improperly claim COVID relief tax credits.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Accounting Tools

APRIL 24, 2024

How to Correct Financial Statement Errors An error correction is the correction of an error in previously issued financial statements. This can be an error in the recognition , measurement, presentation, or disclosure in financial statements that are caused by mathematical mistakes, mistakes in applying GAAP , or the oversight of facts existing when the financial statements were prepared.

Accounting Today

APRIL 24, 2024

$28 million in grants are available for Low Income Taxpayer Clinics, with a particular emphasis on states and counties that aren't currently covered.

Accounting Tools

APRIL 24, 2024

What is a Semi-Fixed Cost? A semi-fixed cost is a cost that contains both fixed and variable elements. As a result, the minimum cost level that will be experienced is greater than zero; once a certain activity level is surpassed, the cost will begin to increase beyond the base level, since the variable component of the cost has been triggered. A cost that is classified as semi-fixed does not have to contain a certain proportion of fixed costs or variable costs to be classified as such.

Accounting Today

APRIL 24, 2024

In "The Black Tax," professor and historian Andrew W. Kahrl explores how the racial wealth gap in America has roots in unfair tax practices.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Accounting Tools

APRIL 24, 2024

What is Liquidity Ratio Analysis? Liquidity ratio analysis is the use of several ratios to determine the ability of an organization to pay its bills in a timely manner. This analysis is important for lenders and creditors , who want to gain some idea of the financial situation of a borrower or customer before granting them credit. There are several ratios available for this analysis, all of which use the same concept of comparing liquid assets to short-term liabilities.

Accounting Today

APRIL 24, 2024

The events will be held in Chicago, Baltimore, Dallas, Orlando, and San Diego this year.

Accounting Tools

APRIL 24, 2024

Fraud Schemes Related to Cash There are a number of ways in which an individual can commit fraud by stealing cash from a business. Since cash is essentially untraceable once stolen, someone intent on stealing assets will be particularly focused on this type of asset. Several ways in which cash fraud can be committed are noted below. Note that all of the following types of cash fraud are perpetrated by corporate insiders.

Gaviti

APRIL 24, 2024

Dunning workflows are a series of automated emails and actions that A/R teams use to collect invoices from customers. Having the best dunning workflow for each customer is the key to increasing your cash flow. In some companies, the implementation of dunning workflows increases cash flow by a significant percentage almost instantly. With automated dunning and flexible customer segmentation, options for dunning workflows are numerous.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Accounting Tools

APRIL 24, 2024

What is a Reporting Period? A reporting period is the span of time covered by a set of financial statements. It is typically either for a month, quarter, or year. Organizations use the same reporting periods from year to year, so that their financial statements can be compared to the ones produced for prior years. On rare occasions, a reporting period may be for a shortened time period, such as a week or a few days.

Insightful Accountant

APRIL 24, 2024

New Xero data shows signs that sales decline is stabilizing for US small businesses.

Future Firm

APRIL 24, 2024

Many firm owners work too much without a break. In this episode, I'll share a system to boost your profits while cutting your work hours. The post 150 – The Firm Freedom System [6 Steps] appeared first on Future Firm.

Insightful Accountant

APRIL 24, 2024

Investment from Periphas Capital and Lavelle Capital will support FinQuery’s mission to make lives easier by simplifying complex workflows with technology.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

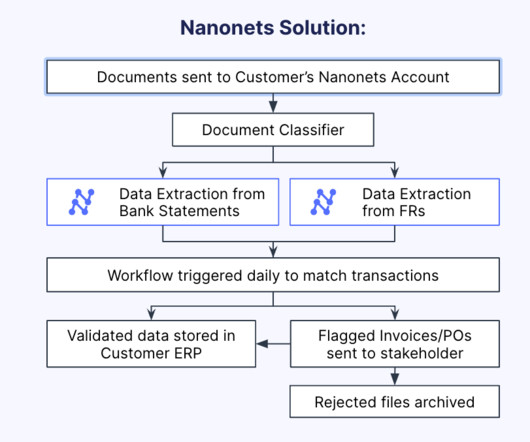

Nanonets

APRIL 24, 2024

Business leaders have moved on from discussing whether or not software solutions and business applications can change how business is done; now, they’re focused on what SaaS platforms can fulfill their organization’s needs. For accounting and finance professionals, accounting software is paramount, but when it comes to accounting software, there are right and wrong choices.

Insightful Accountant

APRIL 24, 2024

It's time to recertify for most QuickBooks Online ProAdvisors ('Core' or 'Advanced'). The recertification window opens May 1 with a June 30, 2024 deadline for exam completion.

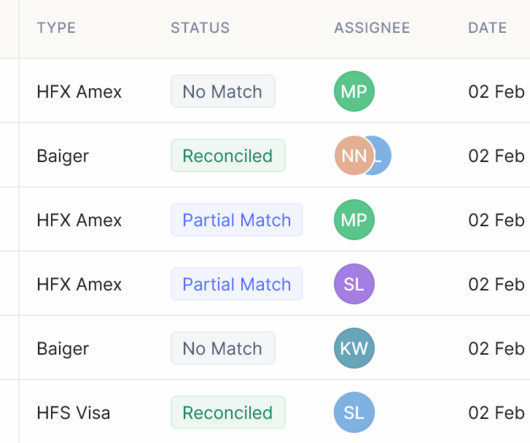

Nanonets

APRIL 24, 2024

Audit Bank Reconciliation Guide Both internal and external accounting audits are essential parts of financial management as well as organizational risk management. A bank reconciliation audit is one such process that helps in identifying financial gaps or discrepancies. In addition to companies performing bank reconciliations internally at least once a month, it is recommended that external auditors conduct a thorough bank reconciliation process biannually or annually to verify the interna

Gaviti

APRIL 24, 2024

With the right dunning process in place, your A/R team can significantly minimize the need for collection calls. While some customers only need a single email to prompt them into action, others require a more complex dunning process. The right approach should be based on a number of factors, such as the type of industry, size of the client, customer risk, payment history, and length and history of the customer relationship.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Nanonets

APRIL 24, 2024

Introduction Accuracy and efficiency are non-negotiable in the processing of payments in any company, be they payments received by the company for products/services rendered, or made to vendors for products/services received. Payment reconciliation is the process of verifying all payment transactions. It involves comparing transaction records from various sources, such as invoices, bank statements , and payment receipts, to identify discrepancies and errors.

Accounting Tools

APRIL 24, 2024

What is a Registered Bond? A registered bond is a bond for which the issuing entity maintains a list of the owners and the interest paid. A registered bond may state the name of its owner on its face, and is only transferable with the owner's endorsement. This approach is useful for the issuer , since it can send dividend payments to bond owners based on its internal records.

NACM

APRIL 24, 2024

The goal for B2B credit managers is to wisely offer credit to customers, minimize nonpayment risk and foster business relationships. It is through NACM's Professional Certification Program, that credit professionals are able to learn or re-educate themselves on various aspects of trade credit, becoming a more efficient credit leader in the process.

Accounting Tools

APRIL 24, 2024

What is Faithful Representation? Faithful representation is the concept that financial statements be produced that accurately reflect the condition of a business. For example, if a company reports in its balance sheet that it had $1,200,000 of accounts receivable as of the end of June, then that amount should indeed have been present on that date. The faithful representation concept should extend to all parts of the financial statements, including the results of operations, financial position ,

Speaker: Yohan Lobo

In the accounting world, staying ahead means embracing the tools that allow you to work smarter, not harder. Outdated processes and disconnected systems can hold your organization back, but the right technologies can help you streamline operations, boost productivity, and improve client delivery. Dive into the strategies and innovations transforming accounting practices.

Let's personalize your content