IRS officially launches Direct File free tax-filing program

Accounting Today

MARCH 12, 2024

The pilot program is expanding in the 12 states where it's available.

Accounting Today

MARCH 12, 2024

The pilot program is expanding in the 12 states where it's available.

Accounting Department

MARCH 12, 2024

Non-profit organizations often stand at the frontier of social change, operating with the noblest of causes but facing challenges unique to their sector, particularly in the financial realm. With a mission-driven focus and often a limited budget, navigating the complex financial landscape of a non-profit can be daunting.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

MARCH 12, 2024

While every company is different, there are 12 operational areas distressed businesses often miss, which can foretell a deteriorating financial condition.

Intuit

MARCH 12, 2024

Intuit is an advocate for taxpayers and is committed to tax simplification. Every year, we help millions of taxpayers navigate an ever-complex tax code so they can confidently file their taxes. Our mission is to power prosperity around the world, and that commitment is why we fight to ensure our customers receive every single dollar they’ve earned and deserve.

Advertisement

Our 2025 Center Travel Survey is clear: as corporate travel increases, so does corporate credit cards distribution, and a rise in off-platform travel booking. This 61% rise causes various challenges: compliance, spend control, reporting problems, and a lack of visibility across organizations. To evolve with the ever-changing needs of travelers, decision-makers need a better solution.

Accounting Today

MARCH 12, 2024

Criminals are exploiting networks of innocent people to move illicit funds between bank accounts, currencies and blockchains in an effort to evade law enforcement.

Insightful Accountant

MARCH 12, 2024

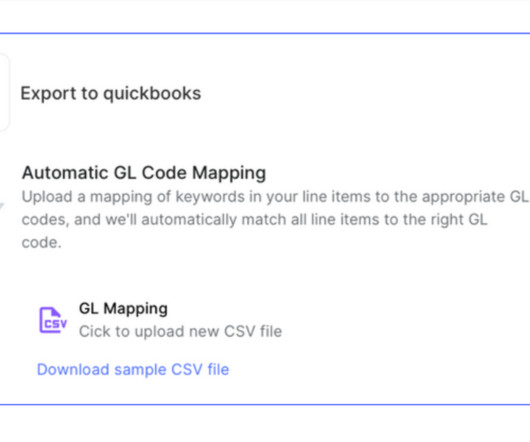

If you're into revenue recognition you better reconnoiter our upcoming QB Talks on Wednesday, March 20, 2024 at 2:00 PM Eastern when Alicia Katz Pollock will teach you all about this new feature in QBO Advanced.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Insightful Accountant

MARCH 12, 2024

In this episode,Roman Kepczyk, a CPA and director of firm technology strategy at Rightworks, discusses the importance of security in accounting firms.

Accounting Today

MARCH 12, 2024

A recent survey from Gartner found that few audit executives report using generative AI in their department, but many say they expect to do so in the future.

Nanonets

MARCH 12, 2024

We’re super thrilled to announce that we’ve raised $29 million in our Series B funding round led by Accel India in our journey to reimagine how businesses manage workflows! The funding round also saw participation from existing investors Elevation Capital, YCombinator and others. This takes the total funding raised till date to $42M. Where We are Today For a few years now Nanonets has been the go-to choice to manage documents, capture information and simplify communication –

Accounting Today

MARCH 12, 2024

Company leaders think their employees and customers trust them more than they actually do, according to PwC's Trust Survey.

Speaker: Susan Richards

Your past-due accounts are growing, cash flow is tightening, and the pressure is on. The big question: Do you handle the collections internally or outsource to experts? Both strategies come with advantages and risks - but which one delivers the best impact for your business? In this session we’ll dive deep into the in-house vs. outsourcing debate, examining cost-effectiveness, efficiency, compliance risks, and overall recovery success rates.

Ace Cloud Hosting

MARCH 12, 2024

Lacerte from Intuit is one of the most popular tax filing software for professionals and businesses. Working with Lacerte tax software on your local system can be cumbersome and a.

Accounting Today

MARCH 12, 2024

Arvo Tech, a tax strategy technology provider for small businesses, has acquired Mark Murphy & Associates and Lee & Associates.

Economize

MARCH 12, 2024

What is AWS EDP? The surge in cloud consumption necessitates exploring cost-optimization strategies. Amazon Web Services (AWS) Enterprise Discount Program (EDP), is one such program designed to incentivize high-volume users with significant savings and discounts. AWS EDP is a customized program tailored to meet the specific needs of high-spending enterprise customers.

Accounting Today

MARCH 12, 2024

Changes in rates and rules at every level require advisors to stay on their toes.

Speaker: Danny Gassaway and Wayne Richards

Finance leaders are prioritizing efficiency and digital transformation, yet many hesitate to automate due to uncertainty. Without a clear understanding of its impact, organizations risk falling behind competitors who are leveraging automation to drive productivity and cost savings. Join Wayne Richards and Danny Gassaway from AvidXchange for a practical guide on bringing accounts payable (AP) automation to your organization.

Billing Platform

MARCH 12, 2024

The subscription economy is booming , and with good reason. Whether a consumer or business, you can purchase a subscription for virtually anything – from clothing and coffee to software and data storage. Today, nearly everything and anything is offered on a subscription model basis, including products and services previously thought unsuitable for this business model such as vehicles, healthcare, and accommodations.

Accounting Today

MARCH 12, 2024

A Brazilian-American businessman who lives in Florida was charged with using Credit Suisse Group AG, UBS Group AG and other Swiss banks to hide more than $20 million in assets from U.S. tax authorities over 35 years.

oAppsNet

MARCH 12, 2024

In an era of technological advancement and digital innovation, organizations across industries increasingly embrace paperless initiatives as a strategic imperative for driving operational efficiency, enhancing collaboration, and reducing environmental impact. Going paperless involves digitizing manual, paper-based processes and transitioning to electronic alternatives, such as digital documents, electronic signatures, and cloud-based storage solutions.

Accounting Today

MARCH 12, 2024

The agency had intended to block access to tax data by most lenders on June 30 as part of a policy change that sought to protect taxpayer privacy. But drew broad opposition from the financial services industry.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Nanonets

MARCH 12, 2024

Record-to-Report (R2R) is a critical finance management process in corporate finance, which focuses on collecting, processing, and delivering accurate financial data. This process encapsulates everything from recording financial transactions to the preparation and reporting of financial statements and performance reports that stakeholders use to make key decisions.

Accounting Today

MARCH 12, 2024

R&D and China; billable versus subscription; trailblazers; and other highlights from our favorite tax bloggers.

Accounting Tools

MARCH 12, 2024

What is Accrued Rent Income? Accrued rent income is the amount of rent that a landlord has earned in a reporting period , but which has not yet been received from the tenant. A landlord using the accrual basis of accounting should record this income, in order to recognize it in the period in which it was earned. Accounting for Accrued Rent Income The amount of any accrued rent income should not be recorded if it is probable that the tenant will not pay, and there is no alternative method for rec

NACM

MARCH 12, 2024

Earning the Credit Business Associate (CBA) was a way for Tina Rodgers, CBA, credit manager at Spartan Chemical Company, Inc. (Maumee, OH) to deepen her understanding of credit principles. "I wanted to earn this designation to enhance my credibility in the field of credit management," Rodgers said.

Speaker: Jennifer Hill

Payroll compliance is a cornerstone of business success, yet for small and midsize businesses, it’s becoming increasingly challenging to navigate the ever-evolving landscape of federal, state, and local regulations. Mistakes can lead to costly penalties and operational disruptions, making it essential to adopt advanced solutions that ensure accuracy and efficiency.

Cloud Accounting Podcast

MARCH 12, 2024

We're celebrating surpassing 10,000 YouTube subscribers! Thank you! Blake and David look into H&R Block's new reality show about teaching people life skills like doing their taxes. They also talk about workflow automation challenges for accounting firms, how the IRS is contacting wealthy non-filers, and the Trump Organization CFO pleading guilty to perjury.

Let's personalize your content