Accountants feel more upbeat about global economy

Accounting Today

APRIL 18, 2024

Accounting and finance professionals are expressing greater confidence about the world economy this year, according to a new survey.

Accounting Today

APRIL 18, 2024

Accounting and finance professionals are expressing greater confidence about the world economy this year, according to a new survey.

Accounting Department

APRIL 18, 2024

Last week, the AccountingDepartment.com team attended the 2024 Entrepreneurial Operating System (EOS) Conference in San Diego, CA.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

APRIL 18, 2024

If an enterprise doesn't accurately measure and manage cash flow effectively, it won't be able to make sound financial decisions for the future.

Cevinio

APRIL 18, 2024

How AI and RPA Are Transforming Accounts Payable Processes in the Year Ahead Introducing Our Whitepaper: “8 Accounts Payable Trends to Watch” In the dynamic landscape of financial operations, staying ahead means understanding the evolving trends shaping the future of Accounts Payable (AP). Our latest whitepaper delves into “8 Accounts Payable Trends to Watch: How AI and Robotics Are Transforming Accounts Payable Processes in the Year Ahead.” As businesses navigate through

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

APRIL 18, 2024

Speedy decision; trouble in paradise; diplomatic imbecility; and other highlights of recent tax cases.

Insightful Accountant

APRIL 18, 2024

Murph takes a first look at 'Figured', a cloud-based agribusiness software app that works with either QuickBooks Online or Xero and that he thinks is '"perfect for farming and ranching.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Jetpack Workflow

APRIL 18, 2024

Podcast Summary In this insightful episode of the “Growing Your Firm” podcast, brought to you by Jetpack Workflow, host David Cristello is joined by special guest Adam Lean , CEO and co-founder of The CFO Project. Adam shares his expertise on how accountants can go beyond traditional number-crunching by engaging with clients through meaningful conversations that resemble therapeutic sessions.

Accounting Today

APRIL 18, 2024

The process of becoming a remote partner isn't much different from the traditional path — but it may take a little extra effort.

Plooto

APRIL 18, 2024

Managing cash flow effectively is an essential aspect of running a business smoothly. However, many small businesses struggle with cash flow management, especially if they don’t have a lot of experience in bookkeeping and accounting.

Accounting Today

APRIL 18, 2024

Ernest John Nedder, a partner and chief strategy officer at RSM US LLP, will be the next CEO of the RSM International network, succeeding longtime CEO Jean Stephens on June 1.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Accounting Tools

APRIL 18, 2024

What is a Contingency? A contingency arises when there is a situation for which the outcome is uncertain, and which should be resolved in the future, possibly creating a loss. This situation commonly arises when a business is the defendant in a lawsuit, or has guaranteed the payment of a debt incurred by a third party. Examples of Contingencies As an example of a contingency, Armadillo Industries has been notified by the local zoning commission that it must remediate abandoned property on which

Accounting Today

APRIL 18, 2024

Ross Tennenbaum said he intends to improve its customer experience, and hinted at an e-invoicing partnership with a blue chip company.

Economize

APRIL 18, 2024

Google Axion Processor is a groundbreaking development in custom silicon chips, a result of Google’s relentless pursuit of innovation. These custom Arm®-based CPUs represent a significant leap forward in computing technology, with industry-leading performance and energy efficiency.

Accounting Today

APRIL 18, 2024

The lawsuit accuses the SEC of acting without authority to create the Consolidated Audit Trail.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Invoicera

APRIL 18, 2024

Introduction Starting out a new business venture? Catching up on a few business terms can help you become a Pro early! While starting out your own new business venture can be really exciting, it can be nerve-wrenching too at the same time. Unfamiliarity with new business terms can cause a hindrance in understanding and communicating with clients. Especially, when related to the sale of physical goods, you need to catch up fast with the inside business terms.

Accounting Today

APRIL 18, 2024

Some remote partners act as a beachhead in new markets, allowing access to clients far beyond a firm's local geography.

CSI Accounting & Payroll

APRIL 18, 2024

When you buy a fixed asset for your small business, how are you supposed to handle that in your books? Over the years, the government has created a few methods to choose from. At CSI Accounting & Payroll, we’ve worked with monthly accounting for small businesses for over 50 years. We’ve advised thousands of prospective clients on how they can handle fixed assets, including the newest method: the De Minimis Safe Harbor election.

Accounting Today

APRIL 18, 2024

Experts from the Fed, Intuit and the Urban-Brookings Tax Policy Center explored ideas for more effective ways to advance the goals of the mortgage interest deduction.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Insightful Accountant

APRIL 18, 2024

This is the day that I rise early and head to the cemetery to remember my friend, Ted L. Allen, who died in the bombing of the Alfred P. Murrah Federal Building in Oklahoma City.

oAppsNet

APRIL 18, 2024

In today’s fast-paced digital landscape, cash apps have revolutionized how we manage our finances. Among these innovative platforms, oAppsNET Cash Apps stand out for their versatility and comprehensive features. From personal budgeting to business expense management, oAppsNET Cash Apps offer various use cases to streamline financial transactions and optimize cash flow.

AvidXchange

APRIL 18, 2024

Payment fraud is a major concern in accounts payable (AP) departments. According to a recent survey, “ The State of B2B Payment Security in 2024 ,” conducted by AvidXchange and the Institute of Finance & Management (IOFM), 76% of AP leaders said their department has experienced payment fraud in the past calendar year. Though opportunities for payment fraud are prevalent in today’s AP departments and the related financial losses are significant, many organizations do not have adequate measure

accountingfly

APRIL 18, 2024

Top Remote Accounting Candidates This Week Looking for remote accountants? Accountingfly can help! With our ‘ Always-On Recruiting ‘ program, you can access highly skilled and experienced remote accountants with no upfront cost. These are just a few of our top candidates this week. Sign up now to receive the full list of top accounting candidates available weekly!

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Reconciled Solutions

APRIL 18, 2024

With the right metrics to track your small biz performance, you can avert disaster before it strikes your business. Find out how. The post Dashboard metrics to Keep a Pulse on your Small Biz Performance appeared first on Reconciled Solutions.

Nanonets

APRIL 18, 2024

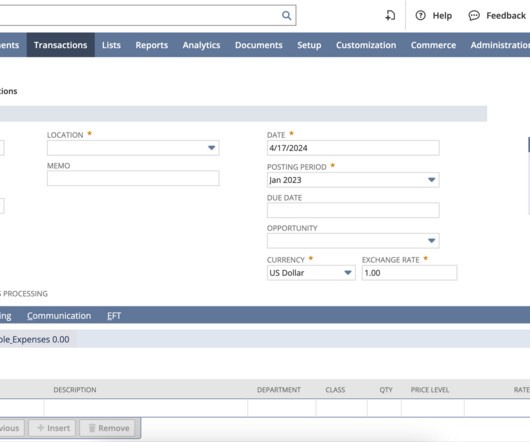

In today's fast-paced business environment, efficient management of accounts receivable (AR) and accounts payable (AP) is crucial for maintaining a healthy cash flow. Invoices are an essential part of this. Invoice creation and Invoice processing are critical steps in these processes. NetSuite's robust invoice management system offers a powerful solution to automate and streamline the invoicing process, boosting efficiency and improving your bottom line.

Gaviti

APRIL 18, 2024

As an assessment and diagnostic tool, it’s hard to overstate the importance of your company’s accounts receivable (AR) collections aging report. Also known as “ accounts receivable reconciliation ,” this is a common report that offers a broad overview of a company’s financial status as well as the status of its customers and their abilities to pay. What Is an AR Aging Report?

Accounting Tools

APRIL 18, 2024

What is Income Tax Payable? Income tax payable is a liability that an entity incurs that is based on its reported level of profitability. The tax can be payable to a variety of governments, such as the federal and state governments within which the entity resides. Once the organization pays the income tax , the liability is eliminated. As an alternative to payment, the income tax liability can be reduced through the application of offsetting tax credits granted by the applicable government entit

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Accounting Today

APRIL 18, 2024

Biden's pitch for a fair Tax Code and Werfel's quest for a digitally transformed IRS are among the key issues to pay attention to after the dust has settled on tax season.

Accounting Tools

APRIL 18, 2024

What is a Consignor? A consignor is the owner of goods, which it has sent to a consignee to be sold to a third party. The consignor designation commonly arises when a producer of goods does not have a sales function, and so transfers the goods to another party that has the capability to sell them on behalf of the consignor. What is a Consignee? A consignee is the recipient of goods shipped to it by a consignor.

Accounting Today

APRIL 18, 2024

Donald Trump is under pressure from economists in his circle to embrace a flat tax rate, softer trade stance and to hold the line on the state and local tax deduction.

Accounting Tools

APRIL 18, 2024

What is Property, Plant, and Equipment? Property, plant, and equipment (PP&E) includes tangible items that are expected to be used in more than one reporting period and that are used in production, for rental, or for administration. This can include items acquired for safety or environmental reasons. In certain asset-intensive industries, PP&E is the largest class of assets.

Speaker: Yohan Lobo

In the accounting world, staying ahead means embracing the tools that allow you to work smarter, not harder. Outdated processes and disconnected systems can hold your organization back, but the right technologies can help you streamline operations, boost productivity, and improve client delivery. Dive into the strategies and innovations transforming accounting practices.

Let's personalize your content