CFOs seeking tech solutions need change management

Accounting Today

MAY 16, 2024

Partly in response to the talent crunch, CFOs are reaching for digital platforms to automate, streamline and spare the highest-value talent for highest-value work.

Accounting Today

MAY 16, 2024

Partly in response to the talent crunch, CFOs are reaching for digital platforms to automate, streamline and spare the highest-value talent for highest-value work.

Accounting Department

MAY 16, 2024

Outsourced client accounting services play a crucial role in helping businesses take control of their financials. These services involve outsourcing the accounting and bookkeeping tasks to a third-party service provider, allowing businesses to focus on their core operations. The role of outsourced client accounting services goes beyond basic bookkeeping; it includes managing accounts payable and receivable, payroll processing, financial reporting, and more.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

MAY 16, 2024

The Top 10 Firm based in Chicago is adding a Top 75 Firm headquartered in Redwood City, California in July, only a few months after receiving private equity funding.

Fidesic blog

MAY 16, 2024

Healtchcare AP Automation Case Study Fidesic and MB2 Dental. Dental practice management service provider saves 100s of hours using Fidesic.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

MAY 16, 2024

The American Institute of CPAs' Auditing Standards Board voted to approve a set of revisions to the rules for attestation engagements to align them with the AICPA's quality management standards.

Insightful Accountant

MAY 16, 2024

Insightful Accountant is hosting Future Forward 2024 next Tuesday and Wednesday. If you are a QuickBooks Pro or Premier user you will want to attend my two sessions on Migration from those products.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

MAY 16, 2024

What is Inventory Control? Inventory control is the management of a company's inventory to maximize its use. The goal of inventory control is to generate the maximum profit from the least amount of inventory investment without intruding upon customer satisfaction levels. Given the impact on customers and profits, inventory control is one of the chief concerns of businesses that have large inventory investments, such as retailers and distributors.

Accounting Today

MAY 16, 2024

This beauty's a steal; what a Lady; medical miscreants; and other highlights of recent tax cases.

Accounting Tools

MAY 16, 2024

What is a Tangible Asset? A tangible asset is physical property - it can be touched. The term is most commonly associated with fixed assets , such as machinery, vehicles, and buildings. It is not used to describe shorter-term assets, such as inventory , since these items are intended for sale or conversion to cash. Tangible assets comprise the key competitive advantage of some organizations, especially if they use the assets efficiently to produce sales.

Accounting Today

MAY 16, 2024

Proposals to crack down on private placement insurance contracts aren't close to becoming law. Here's how advisors and their clients can use them for the time being.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

AvidXchange

MAY 16, 2024

As the workplace evolves, the shift towards electronic invoicing represents more than a technological upgrade; electronic invoicing and payments transform how businesses manage their financial processes. For finance and accounting teams, e-invoicing benefits many aspects of their work – from improving visibility into transactions to facilitating remote work.

Accounting Today

MAY 16, 2024

A KPMG survey found 72% of companies are using AI in their financial reporting process to some extent, and executives expect auditors will start examining controls around the technology.

Tipalti

MAY 16, 2024

Learn how to create a purchase order step-by-step and optimize the purchase order creation process so your business can streamline PO management.

Accounting Today

MAY 16, 2024

There is still a dispute between the defense and government as to whether Bryan Waugh knowingly engaged in insider trading using information Joe Lewis provided.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

oAppsNet

MAY 16, 2024

Managing past-due invoices is a delicate task that requires a careful balance between maintaining healthy cash flows and preserving strong customer relationships. When invoices become overdue, it disrupts a business’s financial planning and signals a need for effective communication and negotiation strategies. This article explores comprehensive approaches for handling past due invoices, emphasizing practical strategies, communication tips, and legal considerations to recover owed funds wh

accountingfly

MAY 16, 2024

Top Remote Accounting Candidates This Week Looking for remote accountants? Accountingfly can help! With our ‘ Always-On Recruiting ‘ program, you can access highly skilled and experienced remote accountants with no upfront cost. These are just a few of our top candidates this week. Sign up now to receive the full list of top accounting candidates available weekly!

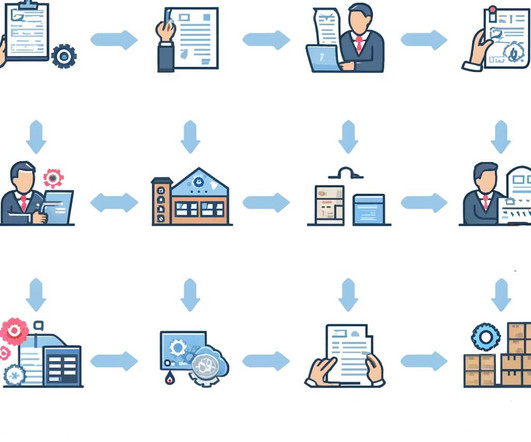

Nanonets

MAY 16, 2024

The advent of AI and automated workflows in recent years have paved the way for procure to pay software - and these tools have completely streamlined the cumbersome processes associated with the procure to pay cycle. Businesses are increasingly aiming to streamline their P2P process with the aid of procure to pay software and stay ahead of the competition.

Accounting Tools

MAY 16, 2024

What is a Tax Loss? A tax loss occurs when total expenses are greater than total revenues under the tax reporting rules of the applicable government jurisdiction. A tax loss reduces an entity's tax liability only in proportion to its tax bracket. Businesses and individuals will frequently reduce their reportable revenues or increase their reportable expenses for tax purposes in order to reduce their tax payments.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Accounting Today

MAY 16, 2024

The measures include expanded tariffs, tax policy guidance that could heighten demand for some U.S.-made solar equipment and promises of heightened vigilance for signs of unfair trade.

Accounting Tools

MAY 16, 2024

A tax position is taxpayer’s decision regarding how to treat a line item on their tax return. The position taken may be a specific interpretation of the tax laws or regulations as they pertain to a variety of tax-related items, such as an asset classification, the recognition of income, or when to record a transaction. A tax position can yield a permanent reduction or deferral of income taxes payable.

Accounting Tools

MAY 16, 2024

What is a Troubled Debt Restructuring? A troubled debt restructuring occurs when a creditor grants a concession to a debtor that it would not normally consider. A concession may involve restructuring the terms of a debt (such as a reduction in the interest rate or principal due, or an extension of the maturity date ) or payment in some form other than cash , such as an equity interest in the debtor.

Accounting Tools

MAY 16, 2024

What is a Treasury Note? A treasury note is an interest -bearing debt security that is issued by the United States government. It has the following characteristics: Maturity. A treasury note matures anywhere within a range of one to 10 years. Interest rate. The interest rate associated with a treasury note is fixed. Payment intervals. Interest payments are made to investors at six-month intervals.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Accounting Tools

MAY 16, 2024

What is a Treasury Bond? A treasury bond is an interest -bearing debt security that is issued by the United States government. It has the following characteristics: Maturity. A treasury bond matures over a period of more than 20 years. Interest rate. The interest rate associated with a treasury bond is fixed. Interest payments. Interest payments are made to investors at six-month intervals.

Accounting Tools

MAY 16, 2024

What is a Time Variance? A time variance is the difference between the standard hours and actual hours assigned to a job. The concept is used in standard costing to identify inefficiencies in a production process. The variance is then multiplied by the standard cost per hour to quantify the monetary value of the variance. How to Calculate Time Variance In order to calculate a time variance, subtract the actual duration of an activity from its planned duration.

Accounting Tools

MAY 16, 2024

What is a Time Ticket? A time ticket is a document used by an employee to record hours worked. The purpose of a time ticket is to accumulate the hours that an employee will be paid in the next payroll. Once a pay period has ended, they are used by the payroll staff to compile hours worked, which is the basis for the calculation of gross pay. A common format for a time ticket is for it to be printed in an oblong heavy paper format, which is then inserted into a time clock when an employee clocks

Accounting Tools

MAY 16, 2024

What are Trading Securities? Trading securities is a category of securities that includes both debt securities and equity securities , and which an entity intends to sell in the short term for a profit that it expects to generate from increases in the price of the securities. This is the most common classification used for investments in securities.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Accounting Tools

MAY 16, 2024

Temporarily restricted net assets are the assets of a nonprofit entity that have a special restriction imposed by the donor. There are two variations on this restriction, which are as follows: Usage restriction. There is a restriction on the assets that requires the assets to be used in a certain way, such as for a student meal program. Time restriction.

Accounting Tools

MAY 16, 2024

What is a Treasury Bill? A treasury bill is a short-term debt security that is issued by the United States government to raise money. It has the following characteristics: Maturity dates. It is issued with maturity dates of either four weeks, 13 weeks, or 26 weeks. Interest rate. There is no stated interest rate on the instrument; instead, it is sold at a discount to the face amount, and the buyer earns interest on the difference between the discounted purchase price and the redemption amount.

Accounting Tools

MAY 16, 2024

What is Double Taxation? Double taxation occurs whenever income tax is paid twice on the same income. The situation arises in a C corporation , where the corporation pays income tax on its earnings and then issues dividends to its shareholders , who are taxed again on their dividend income. This situation arises because a C corporation is considered to be a separate legal entity from its shareholders.

Accounting Tools

MAY 16, 2024

What is a Rubber Check? A rubber check is a check that has been rejected by the bank on which it was drawn. This situation arises when the maker did not have sufficient funds in the underlying account to cover the amount of the check. A rubber check is a sign of poor cash management by the maker. When this situation occurs, the bank will likely charge a fee to the maker.

Speaker: Yohan Lobo

In the accounting world, staying ahead means embracing the tools that allow you to work smarter, not harder. Outdated processes and disconnected systems can hold your organization back, but the right technologies can help you streamline operations, boost productivity, and improve client delivery. Dive into the strategies and innovations transforming accounting practices.

Let's personalize your content