IRS debuts new process for third parties with bad ERC claims

Accounting Today

SEPTEMBER 27, 2024

Third-party payers like payroll providers can now withdraw claims for individual clients.

Accounting Today

SEPTEMBER 27, 2024

Third-party payers like payroll providers can now withdraw claims for individual clients.

Enterprise Recovery: Accounts Receivable

SEPTEMBER 27, 2024

Building trust is paramount in the debt recovery process, and communication is the foundation of trust. Clients are more likely to cooperate and engage positively when informed about the collections process and their options. Clear and honest communication helps to demystify the debt recovery process, reducing any anxiety or confusion the client may have.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

SEPTEMBER 27, 2024

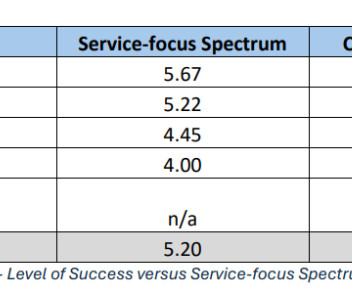

Recent data has found that successful firms maintain a balance of both advisory and compliance engagements.

Outsourced Bookeeping

SEPTEMBER 27, 2024

Did you know? Over 600 U.S.-listed companies reported resource shortages in internal financial controls in 2023. What’s more surprising is that this shortage represents an unprecedented 40.3% increase from 2022. Unfortunately, this shortage has no immediate solution, as the supply side still needs to balance. In 2020 alone, accounting graduates dropped by 2.8%, while master’s graduates saw an 8.4% decline.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

SEPTEMBER 27, 2024

Your Part-Time Controller appoints chief growth officer; LBMC launches family law support services practice; and more news from across the profession.

NextProcess

SEPTEMBER 27, 2024

Are Duplicate and Erroneous Payments Costing Your Company? Here’s How Automation Can Help Don’t you hate it when you find out you overpaid for something or catch a wrong charge on your credit card statement? As irritating as that can be when it happens in your personal life, duplicate or erroneous payments can be even worse when they occur in the finance department of your company.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Counto

SEPTEMBER 27, 2024

Allowable Business Expenses: What SMEs in Singapore Need to Know For small and medium enterprises (SMEs in Singapore), understanding allowable business expenses is key to optimising financial performance and minimising tax liabilities. By being aware of these expenses, you can enhance your tax planning strategies. Let’s explore the main categories of allowable business expenses that can help reduce your taxable income. 1.

Accounting Today

SEPTEMBER 27, 2024

Kirsch CPA Group in Hamilton, Ohio, is one of the first small firms to transition to an employee stock ownership program.

Counto

SEPTEMBER 27, 2024

Maximising Opportunities: The Business Grants Portal for SMEs in Singapore As a small business owner in Singapore, navigating the myriad of funding options can be overwhelming. The Business Grants Portal (BGP) is designed to simplify this process, providing you with a wealth of resources tailored specifically for small and medium enterprises (SMEs).

Accounting Today

SEPTEMBER 27, 2024

Private equity may bring valuable, if not entirely welcome, changes to the accounting profession.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Counto

SEPTEMBER 27, 2024

How Open Banking Is Revolutionising Financial Services for SMEs in Singapore As a small business owner in Singapore, understanding the impact of open banking can unlock new financial opportunities. Open banking is transforming how SMEs access financial services, manage cash flow, and engage with personalised products. Here’s how: 1. Enhanced Access to Financial Services Securing financial support has often been a challenge for SMEs due to limited data visibility.

AvidXchange

SEPTEMBER 27, 2024

Automating accounts payable (AP) is an effective way to streamline your invoice approval and payment processes, reduce costs, and strengthen supplier relationships. Traditional AP processes can be time-consuming, prone to human error, and involve a lot of manual data entry. By adopting automation tools, businesses can simplify invoice processing, speed up approval workflows, and gain better visibility into payment cycles.

Counto

SEPTEMBER 27, 2024

Reducing Utility Costs: Practical Tips for SMEs in Singapore For SMEs in Singapore, managing and reducing utility costs is crucial for maintaining a healthy profit margin amidst rising energy expenses. Effective strategies can help you lower your utility bills and enhance overall financial sustainability. Here’s a practical guide tailored for SMEs in Singapore to reduce utility costs and improve efficiency. 1.

Economize

SEPTEMBER 27, 2024

Amazon EC2 (Elastic Compute Cloud) instances offer flexible, scalable computing power for businesses of all sizes. However, this flexibility also introduces the challenge of controlling costs, especially when EC2 resources are not properly optimized. For organizations ranging from startups to large enterprises, fine-tuning EC2 instances is critical for balancing performance with cost-efficiency.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Counto

SEPTEMBER 27, 2024

Launching a Business in Singapore with a Dependant Pass Starting a business in Singapore as a Dependant Pass (DP) holder can be a rewarding venture. This guide provides a clear roadmap for establishing your business in Singapore while ensuring you meet all necessary requirements and legal obligations. 1. Understanding the Dependant Pass 1.1 What is a Dependant Pass?

Nanonets

SEPTEMBER 27, 2024

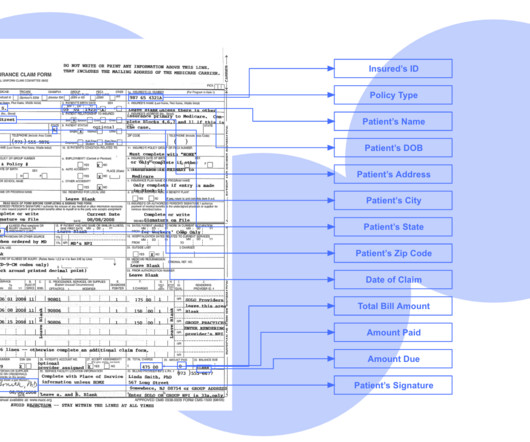

The need for automation in the insurance industry is more pressing than ever. According to a recent study by Datos Insights , the insurance industry lags in terms of digitisation, with only 20% automation in underwriting and less than 3% automation in claims processing across sectors. This gap represents a significant opportunity for improvement and cost savings.

Counto

SEPTEMBER 27, 2024

Navigating PDPA Compliance: A Practical Guide for SMEs in Singapore As a small business owner in Singapore, understanding and adhering to PDPA compliance is crucial for managing personal data effectively. The Personal Data Protection Act (PDPA) governs how personal data is collected, used, and disclosed by organisations. This guide provides a detailed overview of PDPA compliance and its implications for SMEs in Singapore. 1.

Nanonets

SEPTEMBER 27, 2024

Traditional (manual) underwriting processes often struggle to keep pace with the growing complexity of modern risk assessment, data collection, and policy management. 🧐 According to a McKinsey report , manual underwriting processes can increase operational costs by up to 40% and extend the underwriting cycle time by several days to weeks ! Scaling traditional underwriting operations becomes increasingly challenging as underwriters spend a significant amount of time gathering and verifyin

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Counto

SEPTEMBER 27, 2024

Exploring the Four-Day Work Week in Singapore: Is It Right for Your Small Business? The idea of a four-day work week has been gaining traction globally, and Singapore is no exception. According to a recent survey by recruitment firm Robert Walters, nearly 70% of employers in Singapore see this work arrangement as feasible. This statistic reflects a growing interest in more flexible work models, fuelled by the potential for improved productivity and better work-life balance. 1.

CapActix

SEPTEMBER 27, 2024

Managing accounting tasks without the right expertise can lead to mistakes, inefficiencies, and lost time. As businesses grow, the need for accurate financial management becomes critical. Many companies find that managing QuickBooks in-house is too time-consuming and prone to errors. This is where hiring QuickBooks bookkeeper becomes an effective solution.

Counto

SEPTEMBER 27, 2024

Understanding the Reverse Charge Mechanism for SMEs in Singapore Navigating the GST landscape can be complex, particularly with the introduction of the Reverse Charge Mechanism (RCM) in Singapore. This tax policy significantly impacts how small and medium-sized enterprises (SMEs) handle GST for imported services and low-value goods (LVG). Effective from 1 January 2020, for services and extended to LVG from 1 January 2023, the RCM introduces new requirements for GST-registered businesses.

Accounting Fun

SEPTEMBER 27, 2024

I have always been a fan of Star Trek. Here are some crossover ideas for accountants: Encourage staff to think like Spock when making deductions—logical, precise, and with the odd raised eyebrow. Take inspiration from the Borg and assimilate new software updates: "Resistance is futile." Declare "red alert" status whenever a client’s tax return deadline is looming.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Counto

SEPTEMBER 27, 2024

CorpPass and Corporate Tax Filing: A Complete Guide for Foreign Entrepreneurs in Singapore Navigating Singapore’s regulatory landscape can be challenging for foreign entrepreneurs, especially when it comes to managing corporate tax responsibilities. CorpPass (Corporate Access) is a critical tool that streamlines these processes by providing a centralised system for business-to-government (B2G) interactions.

Counto

SEPTEMBER 27, 2024

How GDPR Impacts SMEs in Singapore: A Comprehensive Guide For small and medium enterprises (SMEs) in Singapore, understanding the General Data Protection Regulation (GDPR) is crucial, especially if your business processes personal data of individuals from the European Union (EU). This guide outlines how GDPR affects SMEs in Singapore and provides practical tips for compliance. 1.

Let's personalize your content