"The Accountant 2" books release date

Accounting Today

AUGUST 12, 2024

The Ben Affleck-starring sequel will continue the saga of lethal and brilliant small-town CPA Christian Wolff.

Accounting Today

AUGUST 12, 2024

The Ben Affleck-starring sequel will continue the saga of lethal and brilliant small-town CPA Christian Wolff.

Xero

AUGUST 12, 2024

“We believe that Australian music is a vital part of life and we want to help musicians make a living from their craft,” shared Kathy Wilson, co-founder of Suitcase Records. The family-run business operates out of Brisbane, Australia, and aims to support local musicians by providing a more sustainable PVC compound to produce high-quality vinyl records.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

AUGUST 12, 2024

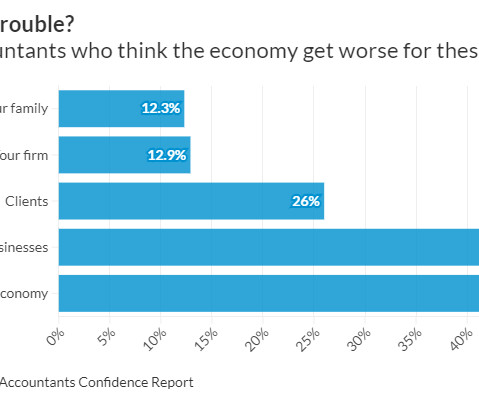

Accountants are generally pessimistic about the economy as a whole, but feel much more confident when it comes to their own firm and clients.

accountingfly

AUGUST 12, 2024

“You can’t win the race for talent without hiring freelancers.” Is your accounting firm struggling to find the right talent? Freelancer staffing might be the solution you’ve been missing. In the latest episode of the Accounting Talent Podcast , Rob Brown sits down with Jeff Phillips, CEO of Accountingfly, to explore the growing impact of freelancer staffing in the accounting industry.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

AUGUST 12, 2024

There's still room for improvement, say experts.

Accounting Tools

AUGUST 12, 2024

How to Value a Business There are several standard methods used to derive the value of a business. When calculated, each one will likely result in a different valuation, so an owner wanting to sell a business should use every formula and then decide what price to use. The valuation methods are noted below. There is no perfect valuation formula. Each one has issues, so the buyer and seller can be expected to argue over the real value of the entity.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Outsourced Bookeeping

AUGUST 12, 2024

Businesses seeking financial insights to optimize their operations, CPA firms wanting to attract more clients or add value through advisory services, and accounting entrepreneurs striving to establish or scale their firms all face one critical challenge: a lack of skilled accounting talent. The Accounting Talent Crunch: Why Finding the Right People is Tough?

Accounting Today

AUGUST 12, 2024

The SEC charged electric vehicle company Ideanomics and three of its executives with fraud for misleading the public about its financial performance from 2017 and 2019.

CSI Accounting & Payroll

AUGUST 12, 2024

All small business owners hope to successfully exit their business one day. If that time is coming soon (in the next few years), you need to have a plan – and exit strategies aren’t “one size fits all”.

Accounting Today

AUGUST 12, 2024

Financial Cents, which makes practice management software for accountants, announced a new $9 a month plan for solo practitioners.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Insightful Accountant

AUGUST 12, 2024

If you believe you're a QuickBooks Social Media Rock Star or Social Media Mogul, then Murph wants to help ensure you maximize your Top 100 Award potential.

Accounting Today

AUGUST 12, 2024

Regional Leader Yeo & Yeo is growing in Southeast Michigan, while two firms in New Jersey have joined forces.

Insightful Accountant

AUGUST 12, 2024

As we navigate the complexities of the modern tax landscape, one thing becomes increasingly clear: technology is no longer just an asset; it's a necessity. The tax industry is undergoing a digital revolution, and staying ahead is crucial.

Accounting Today

AUGUST 12, 2024

Consider this "introduction" as a sales effort to make the advisory services' sale.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Insightful Accountant

AUGUST 12, 2024

There's always an exception to the rule. And there's always an exception to the exception! It’s one thing to master routine bookkeeping techniques, but it’s completely something else to use QuickBooks for rare business transactions.

Economize

AUGUST 12, 2024

To achieve financial stability and long-term success, setting up a well-planned budget is essential. To achieve this financial stability, AWS offers several pricing options. These diverse pricing mechanisms are designed to facilitate more effective budget management in the cloud environment.

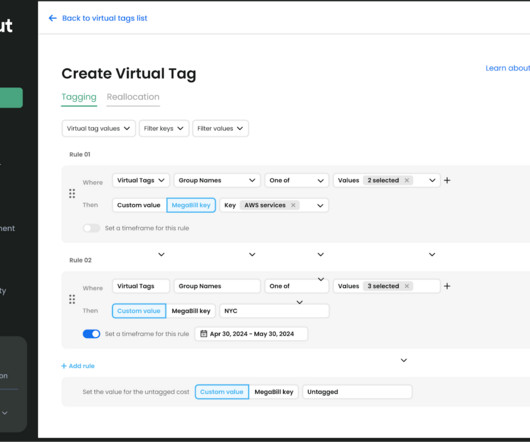

finout

AUGUST 12, 2024

Visibility is the foundation of every FinOps process and the starting point covered in the inform phase of the FinOps framework. Knowing who is spending what, where, and why is essential to understanding spending patterns and establishing financial accountability within an organization. But how exactly do we gain this visibility? Through cloud cost allocation!

Tipalti

AUGUST 12, 2024

Discover custom-built Acumatica modules for various industries, from manufacturing to retail. With Acumatica add-ons, you can start optimizing your accounts payable processes.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Accounting Tools

AUGUST 12, 2024

What is a Quantity Variance? A quantity variance is the difference between the actual usage of something and its expected usage. For example, if a standard quantity of 10 pounds of iron is needed to construct a widget, but 11 pounds are actually used, then there is a quantity variance of one pound of iron. The variance typically applies to direct materials in the manufacture of a product, but it could apply to anything - the number of hours of machine time used, square footage used, and so on.

Tipalti

AUGUST 12, 2024

Explore top Expensify competitors with AP automation. Compare features and pricing to find the best expense management solution for your business.

Accounting Tools

AUGUST 12, 2024

What is a Working Trial Balance? A working trial balance is a trial balance that is in the process of being adjusted. In concept, it is an unadjusted trial balance , to which is added any adjusting entries needed to close a reporting period (such as for the monthly, quarterly, or annual financial statements ). These additional entries are then entered in the general ledger , resulting in a completed trial balance.

Tipalti

AUGUST 12, 2024

Unlock the full potential of Microsoft Dynamics 365 Business Central by using its API capabilities. From advanced customization to powerful data management, explore more.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Accounting Tools

AUGUST 12, 2024

What are Revenue Variances? Revenue variances are used to measure the difference between expected and actual sales. This information is needed to determine the success of an organization's selling activities and the perceived attractiveness of its products. There are three types of revenue variances, which are noted next. All three of these variances can be used to develop insights into the reasons why actual sales differ from expectations.

Accounting Today

AUGUST 12, 2024

Republican vice presidential candidate JD Vance floated more than doubling the Child Tax Credit, seeking to reframe a "pro-family" stance that has come under attack.

Accounting Today

AUGUST 12, 2024

Vice President Kamala Harris said she would seek to end taxes on tipped income for service industry workers — matching a proposal that her 2024 rival Republican Donald Trump has also made in a bid to court young people and working-class voters.

Let's personalize your content