Tech news: Big Four firms announce strategic alliances

Accounting Today

JUNE 14, 2024

Plus, Bill360 solution offers AR automation; Certa announces gen AI capacities, new ESG module; and other accounting tech news.

Accounting Today

JUNE 14, 2024

Plus, Bill360 solution offers AR automation; Certa announces gen AI capacities, new ESG module; and other accounting tech news.

Accounting Department

JUNE 14, 2024

Andrea Boccard teams up with Dennis Najjar, co-founder of AccountingDepartment.com, to explore the pivotal role of transparency in business success.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JUNE 14, 2024

For tax pros, the IRS is also hosting recruiting events at its Nationwide Tax Forums.

LedgerDocs

JUNE 14, 2024

Digitizing bookkeeping documents has become necessary to keep up with modern business document filing standards, however the journey from paper to pixels can be a challenging one. Here are some common struggles faced during this transition and the LedgerDocs solution: 1. Volume and Variety of Documents The Problem: The sheer volume of invoices, receipts, financial statements and tax forms that need to be scanned, uploaded and filed can make this task overwhelming to start.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

JUNE 14, 2024

If you have clients with employees in more than one state, they must pay attention to the payroll-related rules and tax responsibilities in the states where those staff live and work.

Ace Cloud Hosting

JUNE 14, 2024

IRS Form Schedule 2 is one of the most common forms that many taxpayers need to fill if they are self-employed, have household employees, or have other situations shared in.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

NextProcess

JUNE 14, 2024

In the accounts payable department, the ideal invoice approval workflow should be seamless, efficient, and cost-effective. Invoices arrive in the department, they’re verified through document matching (with exceptions flagged for review), the approvers are notified that invoices are ready for review, approvals come through, payments are made, and the bookkeeping entry is finalized.

Accounting Today

JUNE 14, 2024

The Institute of Management Accountants held its annual conference this week in San Antonio, Texas, where it discussed ways to attract more people to join the profession.

CSI Accounting & Payroll

JUNE 14, 2024

As a small business owner, you have financial obligations to the government with every employee you hire. When considering the cost of an employee, you need to think of expenses beyond their salary – including how much you’ll need to pay in payroll taxes.

Accounting Today

JUNE 14, 2024

The Supreme Court asked the solicitor general to weigh in on whether a Pennsylvania tax case has federal ramifications.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Insightful Accountant

JUNE 14, 2024

Bill360, an end-to-end accounts receivable automation solution,

Accounting Today

JUNE 14, 2024

Intense scrutiny that began last year with revelations that the Australian arm of PricewaterhouseCoopers LLP shared confidential information from its work with the government on upcoming tax changes to generate new business at private firms.

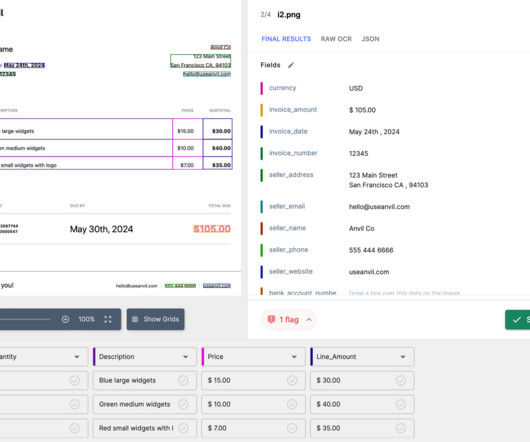

Nanonets

JUNE 14, 2024

Businesses today purchase various kinds of goods and services for different purposes. The procure-to-pay process encompasses all processes involved in the entire lifecycle of purchasing goods and services. From initial requisition to final payment, this process involves multiple stakeholders with complex workflows and necessitates significant financial checks and control over itself.

Accounting Today

JUNE 14, 2024

CFOs remain divided on the prospects for the economy and continue to see risks from inflation, cybersecurity, generative AI and talent shortages, according to a new survey from Deloitte.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Nanonets

JUNE 14, 2024

What is Balance Sheet Reconciliation? What is a Balance Sheet? A balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time. Balance sheet reconciliation is a critical financial process that aligns the financial statements with external documentation such as bank statements, invoices, and general ledger entries.

Accounting Today

JUNE 14, 2024

The century-old accounting and management consulting firm based is expanding its presence beyond its Midwestern base.

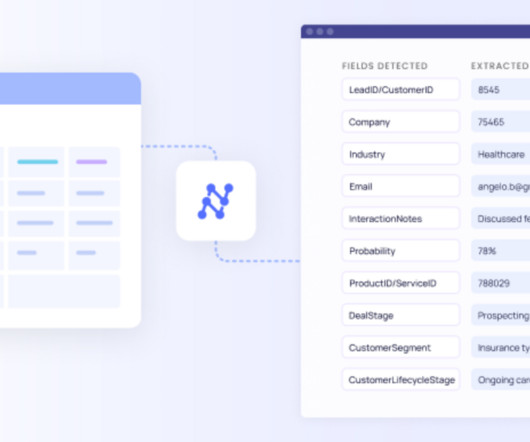

Nanonets

JUNE 14, 2024

Efficient management and juggling your business’s Accounts Payable (AP) is one of those accounting tasks that goes unnoticed by most – until there’s a problem. But effective AP management is key for a business’s financial health , helping balance cash flow with maintaining positive vendor or supplier relationships. Likewise, there’s more to the term “AP processes” than meets the eye; it encompasses the complete cycle from invoice receipt to paymen

Accounting Fun

JUNE 14, 2024

A firm of accountants (that shall remain nameless) wanted to engage their staff in an efficiency drive so that everyone understood the need to be careful with the firm's money. The partners introduced a suggestion scheme facility and promised a prize of £100 for the best suggestion each month - in terms of a simple to implement money saving measure.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Accounting Today

JUNE 14, 2024

Donald Trump promised to lower the corporate tax rate to 20%, further reducing the income levy on the largest U.S. companies that he already slashed while president.

Let's personalize your content