Beryl victims in Texas get tax relief

Accounting Today

JULY 23, 2024

Individuals and businesses in the affected counties now have until next Feb. 3 to file various federal individual and business tax returns and make tax payments.

Accounting Today

JULY 23, 2024

Individuals and businesses in the affected counties now have until next Feb. 3 to file various federal individual and business tax returns and make tax payments.

Accounting Department

JULY 23, 2024

In today's competitive business landscape, staying ahead of the competition requires more than just a great product or service. Entrepreneurs, small business owners, and financial analysts must focus on tracking key financial metrics to ensure their company's growth and financial health.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JULY 23, 2024

Preliminary results of a recent survey suggest that the location — and sources — of dissatisfaction in accounting firms may be surprising.

Xero

JULY 23, 2024

This guest blog was written by the team at GoCardless. Running a small business can mean moving between being a general manager to a customer services contact, marketing lead and, in some cases, debt collector. Without the proper processes in place, managing payments can take up too much time and even result in bigger problems. In fact, the Office of National Statistics shared that poor cash flow is responsible for up to 90% of new businesses failing.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

JULY 23, 2024

Going concern opinions have slowly decreased over the last two decades, with the exception of spikes during the 2008 financial crisis and the years of the COVID-19 pandemic.

Compleatable

JULY 23, 2024

Watch: Automate Purchasing & Invoice Matching Seamlessly into MIP Fill in the form to access the video recording of our Compleat for Non-Profits webinar looking specifically at our API integration with MIP Fund Accounting. Name Work Email Address Job Title Watch the video Automate Purchasing & Invoice Matching Seamlessly into MIP The post Automate Purchasing & Invoice Matching Seamlessly into MIP first appeared on Compleat Software.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

JULY 23, 2024

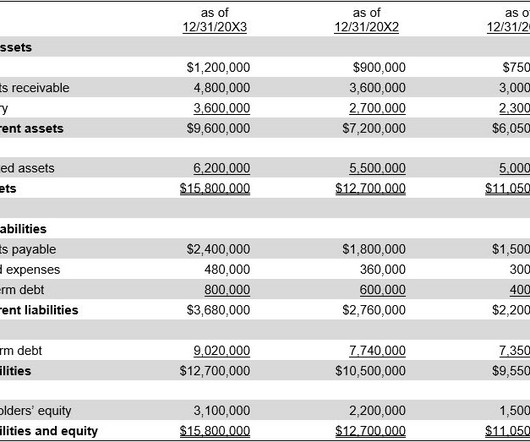

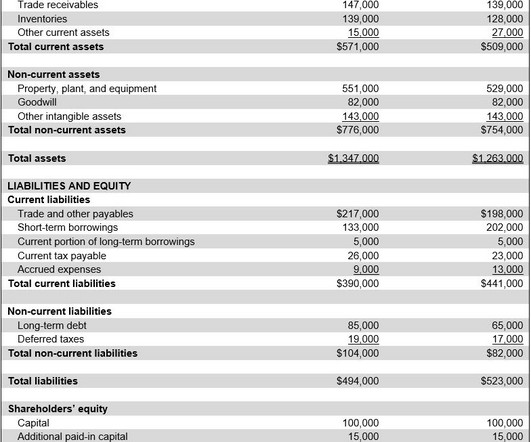

What are Comparative Financial Statements? Comparative financial statements are the complete set of financial statements that an entity issues, revealing information for more than one reporting period. The financial statements that may be included in this package are as follows: The income statement (showing results for multiple periods) The balance sheet (showing the financial position of the entity as of more than one balance sheet date) The statement of cash flows (showing the cash flows for

Accounting Today

JULY 23, 2024

The landscape of talent acquisition is rapidly shifting due to intense competition for top talent and the rise of the gig economy.

Billing Platform

JULY 23, 2024

TechTarget defines consumption-based pricing – also referred to as pay-as-you-go billing, metered billing or usage-based pricing – as a service provision and payment scheme in which customers pay according to the resources they use. Historically, this pricing model was the choice for utility companies. However, since its pioneering days by companies like Amazon Web Services (AWS) and Azure, this pricing scheme gained popularity and become commonplace among cloud computing, SaaS, PaaS, and IaaS c

Accounting Today

JULY 23, 2024

AitM; IRS strategies after Chevron; the taxman's jackpot; and other highlights from our favorite tax bloggers.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Accounting Tools

JULY 23, 2024

What is a Self-Constructed Asset? A self-constructed asset is one that a business elects to build under its own management. A common example of a self-constructed asset is when a company chooses to build an entire facility. Or, the management team might elect to design its own production equipment, usually because its products are so unique that there are no standardized machines on the market that can manufacture them.

Billing Platform

JULY 23, 2024

TechTarget defines consumption-based pricing – also referred to as pay-as-you-go billing, metered billing or usage-based pricing – as a service provision and payment scheme in which customers pay according to the resources they use. Historically, this pricing model was the choice for utility companies. However, since its pioneering days by companies like Amazon Web Services (AWS) and Azure, this pricing scheme gained popularity and become commonplace among cloud computing, SaaS, PaaS, and IaaS c

Accounting Tools

JULY 23, 2024

A fixed asset is written off when it is determined that there is no further use for the asset, or if the asset is sold off or otherwise disposed of. A write off involves removing all traces of the fixed asset from the balance sheet , so that the related fixed asset account and accumulated depreciation account are reduced. There are two scenarios under which a fixed asset may be written off.

LedgerDocs

JULY 23, 2024

Creating a system for document management is a great way to improve the accuracy and efficiency of your bookkeeping process, but there are a few common mistakes that can be made when setting up your system that can prevent you from experiencing the positive improvements. 1. Not Standardizing Document Naming Conventions The first and most common pitfall is using inconsistent naming conventions.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Accounting Tools

JULY 23, 2024

What are Market Value Ratios? Market value ratios are used to evaluate the current share price of a publicly-held company's stock. These ratios are employed by current and potential investors to determine whether a company's shares are over-priced or under-priced. The most common market value ratios are noted below. Book Value Per Share The book value per share is calculated as the aggregate amount of stockholders' equity , divided by the number of shares outstanding.

Tipalti

JULY 23, 2024

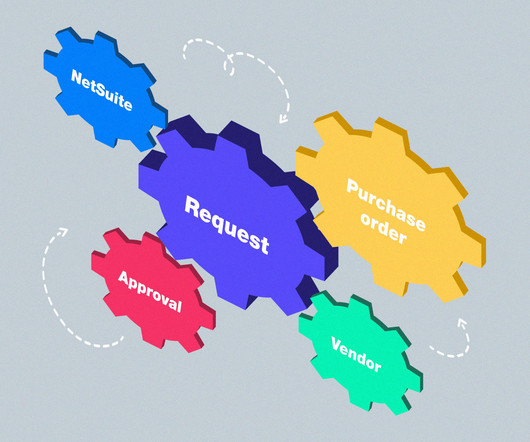

Whether you’re part of a purchasing team, a procurement department, or an employee making a purchase, odds are you’re following some kind of outlined requisition process. There’s no one correct way to initiate a requisition process, but having a working process in place is essential to making smooth, and smart, purchases in most companies.

Accounting Tools

JULY 23, 2024

What is an Inventory Cutoff? An inventory cutoff is a procedure that is designed to ensure that all inventory transactions associated with a reporting period are actually recorded within that period. Without careful attention to this procedure, it is quite likely that some transactions will be recorded in the wrong period, resulting in an incorrect cost of goods sold figure for the targeted reporting period.

Nanonets

JULY 23, 2024

Snapping or clicking an image is the easiest way to capture text from paper documents conveniently in your phone or computer. Imagine having a bunch of handwritten notes that you need to organize for a project, or a bunch of receipts that you want to digitize to better track your expenses. While storing text as an image is convenient, you can't readily modify, copy or edit the text in an image.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Insightful Accountant

JULY 23, 2024

The Internal Revenue Service and the Security Summit partners today urged tax professionals to learn the signs of data theft so they can respond quickly to protect their business and their clients.

oAppsNet

JULY 23, 2024

Monitoring greenhouse gas (GHG) emissions is essential to comprehending and reducing the environmental damage caused by human activity. As concerns about climate change intensify, businesses, governments, and organizations worldwide focus on quantifying their carbon footprints. Accurate measurement of GHG emissions enables entities to identify significant sources of emissions, develop strategies to reduce them and comply with global standards and regulations.

Insightful Accountant

JULY 23, 2024

Murph shares how you can be a 'code-breaker' in the 2025 U.S. ProAdvisor Awards and potentially score more points by ensuring you get ranked in every applicable category for your practice.

Accounting Tools

JULY 23, 2024

What are the Objectives of Financial Reporting? The objectives of financial reporting cover three areas, dealing with useful information, cash flows, and liabilities. The objectives are noted below. Objective #1: Provide Useful Information The first objective is to provide useful information to the users of financial reports. The information should be useful from a number of perspectives, such as whether to provide credit to a customer , whether to lend to a borrower , and whether to invest in a

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

AvidXchange

JULY 23, 2024

In today’s fast-paced business environment, efficient financial management is crucial for success. Enter AI billing, a game-changer for invoicing and accounts receivable (AR). By leveraging artificial intelligence (AI) for billing, companies can streamline their accounting processes, cut costs, improve security, and enhance overall accuracy. Read on to learn more about AI billing, including related benefits and challenges.

Counto

JULY 23, 2024

Shareholders’ Agreements: Essential Protection for Singapore Small Businesses As a Singapore small business owner, have you considered the crucial role of a shareholders’ agreement? At Counto, our company secretary service often finds this vital document overlooked. Yet, it’s key to protecting your business and fostering shareholder harmony.

AvidXchange

JULY 23, 2024

With the advent of artificial intelligence (AI), procurement processes are poised to experience a significant transformation. AI in procurement leverages technologies like machine learning and predictive analytics to enhance decision-making, streamline operations, and reduce costs. Procurement plays a crucial role in supply chain management, helping organizations source the right products at the best prices.

Accounting Tools

JULY 23, 2024

What is Accounting Theory in Financial Reporting? Accounting theory is the cluster of accounting frameworks and historical practices that is used to apply principles of financial reporting. The bulk of accounting theory is based on the applicable accounting framework, such as Generally Accepted Accounting Principles or International Financial Reporting Standards.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Accounting Tools

JULY 23, 2024

What is Current Value Accounting? Current value accounting is the concept that assets and liabilities be measured at the current value at which they could be sold or settled as of the current date. This varies from the historically-used method of only recording assets and liabilities at the amounts at which they were originally acquired or incurred (which represents a more conservative viewpoint).

Accounting Tools

JULY 23, 2024

What is Material Costing? Material costing is the process of determining the costs at which inventory items are recorded into stock, as well as their subsequent valuation in the accounting records. We deal with these concepts separately. Material Costing for Initial Inventory Acquisition A company must decide whether it will record acquired materials at their purchased prices, or if additional costs will be added, such as freight in , sales taxes , and customs duties.

Accounting Tools

JULY 23, 2024

What is a Cost Object? A cost object is any item for which costs are being separately measured. It is a key concept used in managing the costs of a business. Several types of cost objects are noted below. Output-Related Cost Objects The most common cost objects are a company's products and services, since it wants to know the cost of its output for profitability analysis and price setting.

Accounting Tools

JULY 23, 2024

How to Process Cash Receipts The process of receiving cash is highly regimented, because the task of processing checks is loaded with controls. They are needed to ensure that checks are recorded correctly, deposited promptly, and not stolen or altered anywhere in the process. The procedure for check receipts processing is outlined below. Step 1. Record Checks and Cash When the daily mail delivery arrives, record all received checks and cash on the mailroom check receipts list.

Speaker: Yohan Lobo

In the accounting world, staying ahead means embracing the tools that allow you to work smarter, not harder. Outdated processes and disconnected systems can hold your organization back, but the right technologies can help you streamline operations, boost productivity, and improve client delivery. Dive into the strategies and innovations transforming accounting practices.

Let's personalize your content