The 'Security Six' protects tax pros against cyberattacks

Accounting Today

AUGUST 21, 2024

The Internal Revenue Service and its partners have identified half a dozen steps for safeguarding taxpayer information.

Accounting Today

AUGUST 21, 2024

The Internal Revenue Service and its partners have identified half a dozen steps for safeguarding taxpayer information.

Ace Cloud Hosting

AUGUST 21, 2024

Drake Software is one of the most widely used tax filing and preparation software for tax professionals and firms. Its intuitive interface simplified functionality, and competitive pricing make it a.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

AUGUST 21, 2024

Both presidential candidates have floated it, and there are benefits for both workers and employers — though not always how you'd expect.

Cloud Accounting Podcast

AUGUST 21, 2024

Blake and David leap into the latest updates from Xerocon, including new features like traditional bank reconciliations, embedded bill pay with Bill.com, and AI capabilities through JAX (Just Ask Xero). They look at Xero's strategy to double its US market share and how it compares to Intuit's mid-market growth focus. They also touch on the potential impact of QuickBooks' pricing strategy and Blake shares highlights from an EDM festival in Nashville to wrap things up.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

AUGUST 21, 2024

A boomer and a Gen X from BSB CPAs give their take on the newest generation to join the workforce.

Insightful Accountant

AUGUST 21, 2024

Sage recently announced significant global enhancements to its Sage Intacct platform, including AI-powered accounts payable processes that are now available worldwide.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Insightful Accountant

AUGUST 21, 2024

Thanks to our readers, we can now share stories of their good and bad migrations from QuickBooks Desktop to QuickBooks Online.

Accounting Today

AUGUST 21, 2024

Caseware and CPA Club announced a new collaboration that will combine each of their resources to facilitate the implementation and use of quality management solutions for firms.

Insightful Accountant

AUGUST 21, 2024

As data thieves continue evolving their tactics, the Internal Revenue Service and the Security Summit partners today reminded tax professionals of six essential steps to protect their sensitive taxpayer information.

Accounting Today

AUGUST 21, 2024

The Treasury Inspector General for Tax Administration found that IRS Tax-Exempt Compliance Unit examiners spent 6.1 hours on average per case in 2023, up 281% from 2020.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Future Firm

AUGUST 21, 2024

Niching is a powerful tool to cut through the noise. But should your firm do it? And if so, how? Listen to this episode to find out. The post Should Your Firm Niche? appeared first on Future Firm.

Accounting Today

AUGUST 21, 2024

Eligible taxpayers can apply between Sept. 4 to Oct.

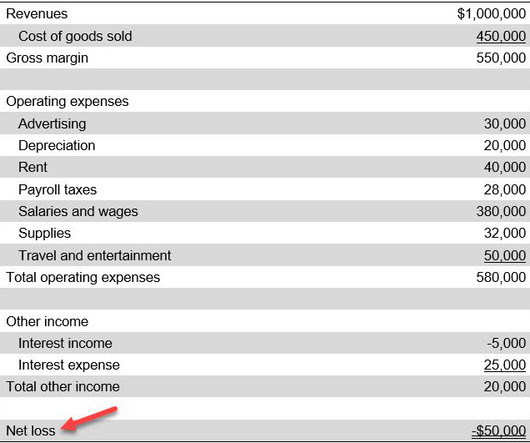

Accounting Tools

AUGUST 21, 2024

What is Net Loss? Net loss is the excess of expenses over revenues. All expenses are included in this calculation, including the effects of income taxes. For example, revenues of $900,000 and expenses of $1,000,000 yield a net loss of $100,000. Net losses are expected for a start-up business. However, a business must eliminate its net losses soon, or risk using up its cash reserves and going out of business.

Accounting Today

AUGUST 21, 2024

Big tech companies are using quirks in carbon reporting rules to mask the vast and growing emissions from artificial intelligence.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Insightful Accountant

AUGUST 21, 2024

You can head to Insightful Accountant's Accounting Insiders Podcast to hear Murph's summary of Xero product enhancements.

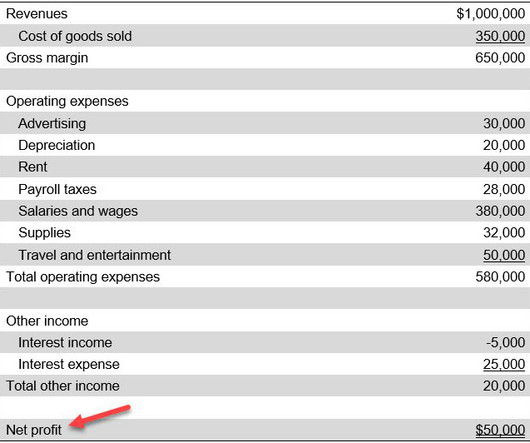

Accounting Tools

AUGUST 21, 2024

What is Net Profit? Net profit is the result after all expenses have been subtracted from revenues. This figure is the aggregate result of all operating and financing activities of an organization. As such, it is routinely relied upon by investors , creditors , and lenders to make decisions about how to deal with a firm. Net profit is also called the bottom line , because it is positioned at the bottom of the income statement.

Nanonets

AUGUST 21, 2024

Introduction Retrieval-augmented generation (RAG) systems are transforming AI by enabling large language models (LLMs) to access and integrate information from external vector databases without needing fine-tuning. This approach allows LLMs to deliver accurate, up-to-date responses by dynamically retrieving the latest data, reducing computational costs, and improving real-time decision-making.

Accounting Tools

AUGUST 21, 2024

What is Return on Capital Employed? The return on capital employed (ROCE) measures the efficiency of capital usage in generating earnings. For a company to remain in operation over the long term, its return on capital employed should be higher than its cost of capital ; otherwise, continuing operations gradually reduce the earnings available to shareholders.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Accounting Tools

AUGUST 21, 2024

What is the Required Rate of Return? The required rate of return is the minimum return an investor expects to achieve by investing in a project. An investor typically sets the required rate of return by adding a risk premium to the interest percentage that could be gained by investing excess funds in a risk-free investment. The required rate of return is influenced by the factors noted below: Risk of the investment.

Accounting Tools

AUGUST 21, 2024

What is Negative Goodwill? Negative goodwill arises from the bargain purchase of an acquiree. The amount of negative goodwill is the difference between the price paid and the fair market value of the acquiree's assets , when the fair market value exceeds the price paid. When negative goodwill exists, a bargain purchase has been made that favors the buyer.

Let's personalize your content