Gloom or boom? Tax pros differ on AI

Accounting Today

FEBRUARY 15, 2024

Whether they're enthusiastic or terrified, tax practitioners are anything but indifferent to the rise of artificial intelligence.

Accounting Today

FEBRUARY 15, 2024

Whether they're enthusiastic or terrified, tax practitioners are anything but indifferent to the rise of artificial intelligence.

Accounting Department

FEBRUARY 15, 2024

For a business, becoming a government contractor can open doors to a sea of lucrative opportunities – but these waters run deep with regulations, especially those set by the Defense Contract Audit Agency (DCAA). A critical cog in the machinery that is the U.S. Department of Defense (DoD), DCAA ensures that taxpayer dollars are used efficiently and effectively in the acquisition of defense-related goods and services.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

FEBRUARY 15, 2024

New technology systems and the addition of cryptocurrency on tax forms are just some of the IRS developments to watch in 2024.

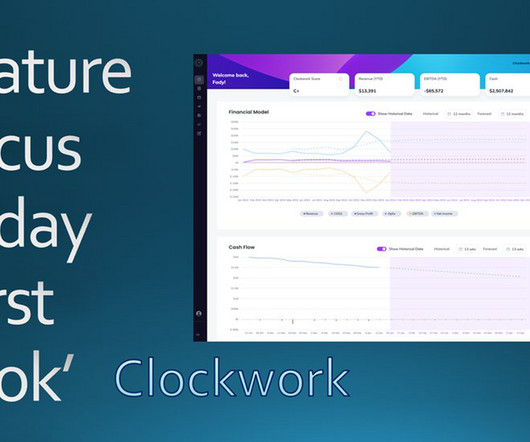

Insightful Accountant

FEBRUARY 15, 2024

Clockwork is a financial analytics and planning app that works with QuickBooks Online, Xero and QuickBooks Desktop. If you need more financial metrics and forecasting than your General Ledger can provide, check out this article.

Advertisement

Our 2025 Center Travel Survey is clear: as corporate travel increases, so does corporate credit cards distribution, and a rise in off-platform travel booking. This 61% rise causes various challenges: compliance, spend control, reporting problems, and a lack of visibility across organizations. To evolve with the ever-changing needs of travelers, decision-makers need a better solution.

Accounting Today

FEBRUARY 15, 2024

But the more you automate, the more human you have to be.

Plooto

FEBRUARY 15, 2024

What is accounts receivable and accounts payable? Find out why having good control over both is crucial for your business to have a smooth cash flow.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Counto

FEBRUARY 15, 2024

Why Working Capital is Super Necessary to Your Business In business, understanding the fundamentals of working capital is crucial. It serves as the backbone of your financial operations, dictating your ability to navigate day-to-day expenses and seize growth opportunities. What is Working Capital? Working capital is the difference between your company’s current assets and liabilities.

Accounting Today

FEBRUARY 15, 2024

Not a lot of Latitude; the cupboards are bare; lots of energy; and other highlights of recent tax cases.

Nolan Accounting Center

FEBRUARY 15, 2024

As renowned investor Warren Buffet has stated, “Accounting is the language of business.” Thus, it is critical for business leaders to get the “language” right. That includes properly and accurately recording, reporting, and acting on an organization’s financial statements, including a focus on assets and liabilities, including contingent liabilities.

Accounting Today

FEBRUARY 15, 2024

Due to technical issues, some batches may need to be resubmitted to IVES.

Speaker: Susan Richards

Your past-due accounts are growing, cash flow is tightening, and the pressure is on. The big question: Do you handle the collections internally or outsource to experts? Both strategies come with advantages and risks - but which one delivers the best impact for your business? In this session we’ll dive deep into the in-house vs. outsourcing debate, examining cost-effectiveness, efficiency, compliance risks, and overall recovery success rates.

MineralTree

FEBRUARY 15, 2024

Is your accounts payable (AP) check run holding your business back? The AP check run remains a pain point for many finance departments who rely on manual processes and outdated solutions to manage AP — in turn, causing check run delays and hiccups. This blog explores the intricacies of the AP check run and actionable tips to fortify your financial processes.

Accounting Today

FEBRUARY 15, 2024

A recent survey from Ernst and Young has found that people are both excited and fearful of AI in roughly equal measure.

Accounting Tools

FEBRUARY 15, 2024

What are Revenues? Revenues are the fees generated from the sale of goods and services, and are recognized when the seller’s earnings process has been completed. Under the cash basis of accounting , revenues are recorded when cash is received from a customer in payment of these items. Under the accrual basis of accounting , revenues are recorded when goods and services are delivered to customers.

Accounting Today

FEBRUARY 15, 2024

The existing guidance directs public companies, including banks, to count crypto they custody as liabilities on their corporate balance sheets.

Speaker: Danny Gassaway and Wayne Richards

Finance leaders are prioritizing efficiency and digital transformation, yet many hesitate to automate due to uncertainty. Without a clear understanding of its impact, organizations risk falling behind competitors who are leveraging automation to drive productivity and cost savings. Join Wayne Richards and Danny Gassaway from AvidXchange for a practical guide on bringing accounts payable (AP) automation to your organization.

Accounting Tools

FEBRUARY 15, 2024

What is a Financial Analysis Report? A financial analysis report is constructed by a person who is researching a company, usually with the intent of recommending its stock to investors. The report needs to cover the essentials of the target company, so that investors understand how it does business, what its competitive advantages are, and why it is a good investment.

Accounting Today

FEBRUARY 15, 2024

Some Taxpayer Assistance Centers will be open on Feb. 24, March 16, April 13 and May 18.

Accounting Tools

FEBRUARY 15, 2024

What is Total Cost? Total cost is the total expenditure incurred to produce some type of output. From an accounting perspective, the total cost concept is more applicable to financial reporting, where overhead costs must be assigned to certain assets. Total cost is less applicable to short-term decision making, where it is more likely that only variable costs will be considered.

Accounting Today

FEBRUARY 15, 2024

The IRS is pushing back filing and payment deadlines for those impacted in the Great Lake State.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Outsourced Bookeeping

FEBRUARY 15, 2024

For both business owners and Certified Public Accountants (CPAs) in the United States, the annual tax return season is a critical and challenging period. Business owners must comprehend the intricate details of tax obligations to ensure compliance with the ever-evolving tax code and optimize financial outcomes. Simultaneously, CPAs help in tax and accounting services as they navigate through complex tax codes and regulations to ensure their clients comply with the law while maximizing returns.

Accounting Today

FEBRUARY 15, 2024

Ten tax stories from the past year that may make you raise an eyebrow.

accountingfly

FEBRUARY 15, 2024

Hire the Best Remote Accountants Are you struggling to hire remote accountants? Accountingfly is ready to partner with you. Gain full access to a pool of highly skilled and experienced remote accountants with Always-On Recruiting. Plus, there’s no up-front cost! Every week we share a sneak peek of a few top accounting candidates available. If you want to learn more about a candidate, you can sign up and mention their ID number below to get connected!

Accounting Today

FEBRUARY 15, 2024

Helping clients comply with the Corporate Transparency Act's reporting requirements represents an opportunity for accountants.

Speaker: Jennifer Hill

Payroll compliance is a cornerstone of business success, yet for small and midsize businesses, it’s becoming increasingly challenging to navigate the ever-evolving landscape of federal, state, and local regulations. Mistakes can lead to costly penalties and operational disruptions, making it essential to adopt advanced solutions that ensure accuracy and efficiency.

CSI Accounting & Payroll

FEBRUARY 15, 2024

If you asked a room full of small business owners to raise their hands if they like paying business taxes, you’re probably not going to see very many hands. However, even if you legally didn’t owe any taxes, there are still a few issues. Have you ever thought about how getting your tax liability to zero could hurt your business? At CSI Accounting & Payroll, we’ve worked with small business taxes for over 50 years.

Accounting Today

FEBRUARY 15, 2024

Not a lot of Latitude; the cupboards are bare; lots of energy; and other highlights of recent tax cases.

Nanonets

FEBRUARY 15, 2024

Procurement is a pivotal function for any business upon which the pillars of efficiency, cost management, and strategic sourcing rest. This is more than just buying; it's about acquiring goods and services in a way that optimizes value for an organization. Ultimately, understanding and refining this process is essential for steering your business towards more profitable and sustainable futures.

Insightful Accountant

FEBRUARY 15, 2024

MODEX, the largest manufacturing and supply trade event is being held in Atlanta starting March 11th. More than 1175 suppliers will be presenting the future of supply chain, warehousing, distribution and manufacturing technology.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

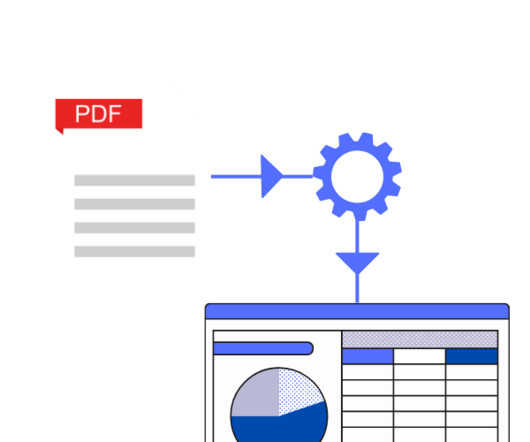

Nanonets

FEBRUARY 15, 2024

Traditional invoice processing methods often fall short in the ever-evolving landscape of business operations, where time is money and precision is paramount. Cumbersome, time-consuming, and prone to errors, manual invoice data capture has long been a bottleneck for businesses striving for efficiency. However, finance is changing, and artificial intelligence's transformative power marks a new era.

Insightful Accountant

FEBRUARY 15, 2024

Intuit has opened a new Atlanta office serving as the new home to Mailchimp.

Tipalti

FEBRUARY 15, 2024

A critical part of great financial planning is knowing where your organization’s money goes. Spend visibility provides key insights into business spend, for better planning and resource allocation.

Nanonets

FEBRUARY 15, 2024

OCR (Optical Character Recognition) is a game changer for anyone who works with PDF documents. PDFs are notorious for being difficult to edit and search through. When you OCR a PDF, it ensures the text is scanned and extracted, making it fully searchable, editable, and accessible. In this guide, we will compare various methods of OCR-ing PDFs to help you choose the best one that suits your requirements.

Speaker: Debra L. Robinson

CPAs know the drill: taxes, compliance, rinse, repeat. But what about the sneaky cash flow that’s quietly messing with your organization’s success? It’s time to step into the spotlight and expose the “dirty little secrets” of cash flow to fuel strategic growth. By upskilling your accounting practices and shifting focus from tax compliance to the strategic movement of money, you can transform your role from reactive accountant to proactive financial strategist.

Let's personalize your content