IRS plans to start tax season on Jan. 29

Accounting Today

JANUARY 8, 2024

The agency is anticipating over 128.7 million individual tax returns by the April 15, 2024, tax deadline.

Accounting Today

JANUARY 8, 2024

The agency is anticipating over 128.7 million individual tax returns by the April 15, 2024, tax deadline.

Insightful Accountant

JANUARY 8, 2024

If you use the QuickBooks Desktop Payroll Set-up Wizard, you may encounter an Error. There is a fix available.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JANUARY 8, 2024

NCCPAP's Frank Sands shares the major issues that tax pros should be paying attention to in the run up to April 15.

Outsourced Bookeeping

JANUARY 8, 2024

Are you thinking about selecting the ideal accounting software for your customers? They could find that FreshBooks is the game-changer they need! However, how can you tell whether it’s the right fit? By posing pertinent queries, you may determine whether FreshBooks meets the particular business requirements of your clients. FreshBooks has a lot of features, like monitoring costs and making invoicing easier.

Advertisement

Our 2025 Center Travel Survey is clear: as corporate travel increases, so does corporate credit cards distribution, and a rise in off-platform travel booking. This 61% rise causes various challenges: compliance, spend control, reporting problems, and a lack of visibility across organizations. To evolve with the ever-changing needs of travelers, decision-makers need a better solution.

Accounting Today

JANUARY 8, 2024

The deal includes speeding up $10 billion in cuts to the Internal Revenue Service.

Remote Quality Bookkeeping

JANUARY 8, 2024

Hopefully, your business made a profit last year. After all, that’s the primary purpose of most companies – to turn profits and generate earnings for owners and shareholders. But how do you know how much of a profit your business made in the past 12 months? Or in the past six months? The past quarter? Figuring out exactly how your business is performing requires more than just counting up your sales and the other money you have coming in the door.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Invoicera

JANUARY 8, 2024

Introduction So, you are a freelancer and have delivered a project but still waiting for the payment? We know this struggle is so frustrating. Not getting paid on time for your hard work can affect your finances & peace of mind. Do you know? Nearly 71% of freelancers reported having trouble getting paid at some point in their careers. If you’re experiencing this too, it might be due to unclear specifications of net terms in your invoices.

Accounting Today

JANUARY 8, 2024

Practitioners have always shared advice as part of tax prep, but the future of the field is in proactive, intentional tax advisory services.

Counto

JANUARY 8, 2024

Thinking of Changing Your Company’s FYE After Incorporation in Singapore? Here’s a Step-by-Step Guide In the dynamic world of business, circumstances can change rapidly, and sometimes, it becomes necessary to adapt. One such adaptation might involve changing your company’s Financial Year End (FYE) in Singapore. Whether it’s for better aligning with your business cycle or optimising tax exemptions, altering your FYE is possible.

Accounting Today

JANUARY 8, 2024

Here's a look back at some of the best pieces of advice from this past year.

Speaker: Susan Richards

Your past-due accounts are growing, cash flow is tightening, and the pressure is on. The big question: Do you handle the collections internally or outsource to experts? Both strategies come with advantages and risks - but which one delivers the best impact for your business? In this session we’ll dive deep into the in-house vs. outsourcing debate, examining cost-effectiveness, efficiency, compliance risks, and overall recovery success rates.

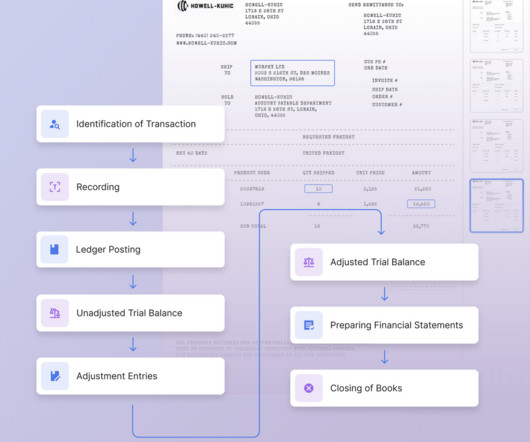

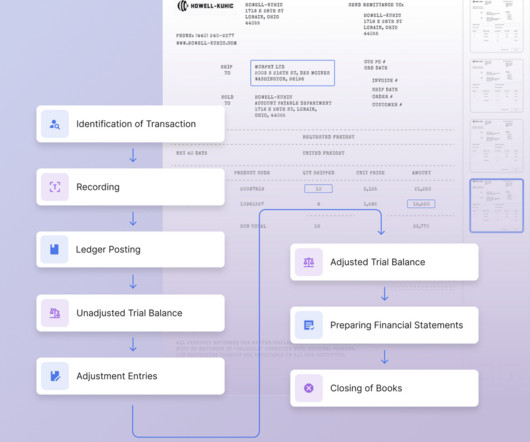

Nanonets

JANUARY 8, 2024

Bank Reconciliation is the process of matching the company's cash books to the bank statement. The aim is to ensure all transactions are accurately recorded in the company's cashbooks and to find any errors or fraud. Reconciliation includes matching the company’s balance sheet, income statement, bank statements, and expenses. Having an accurate set of financial statements is essential, or it can lead to complications in financial planning, tax compliance, and legal matters.

Accounting Today

JANUARY 8, 2024

The Association of Certified Fraud Examiners has joined a collective effort of organizations including the Center for Audit Quality, Financial Executives International, the Institute of Internal Auditors and the National Association of Corporate Directors.

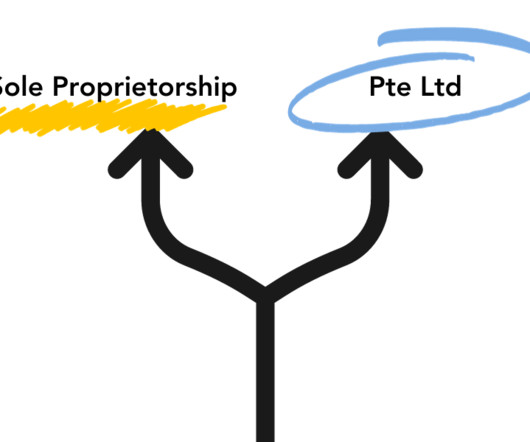

Counto

JANUARY 8, 2024

Converting Your Singapore Sole Proprietorship into a Pte Ltd Company Starting a business as a sole proprietorship can be a straightforward and cost-effective option, but as your business grows, you might consider converting it into a private limited company, also known as a Pte Ltd in Singapore. This transition offers numerous advantages, including limited liability, tax benefits, wider funding options, and more.

Accounting Today

JANUARY 8, 2024

The International Auditing and Assurance Standards Board is planning to make some minor adjustments in its quality management and global audit standards to align them more closely with international ethics rules for accountants.

Speaker: Danny Gassaway and Wayne Richards

Finance leaders are prioritizing efficiency and digital transformation, yet many hesitate to automate due to uncertainty. Without a clear understanding of its impact, organizations risk falling behind competitors who are leveraging automation to drive productivity and cost savings. Join Wayne Richards and Danny Gassaway from AvidXchange for a practical guide on bringing accounts payable (AP) automation to your organization.

Nanonets

JANUARY 8, 2024

Bank Reconciliation is the process of matching the company's cash books to the bank statement. The aim is to ensure all transactions are accurately recorded in the company's cashbooks and to find any errors or fraud. Reconciliation includes matching the company’s balance sheet, income statement, bank statements, and expenses. Having an accurate set of financial statements is essential, or it can lead to complications in financial planning, tax compliance, and legal matters.

Accounting Today

JANUARY 8, 2024

A survey of Hoosier accounting and business students found some encouraging news.

Counto

JANUARY 8, 2024

Singapore GST Registration Guide for Foreign Businesses Expanding your business to Singapore and wondering about Goods and Services Tax (GST)? Look no further! This comprehensive guide will walk you through the essentials of GST registration for foreign businesses in Singapore. Our aim is to simplify the process, help you understand your obligations, and ensure your compliance with Singapore’s GST regulations.

Accounting Today

JANUARY 8, 2024

The Governmental Accounting Standards Board released guidance requiring state and local governments to disclose information about certain risks.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Counto

JANUARY 8, 2024

Sole Proprietorship vs Pte Ltd: Pros and Cons in Singapore When starting a business in Singapore, one of the critical decisions you’ll face is choosing the right business structure. Two common options are a Sole Proprietorship and a Private Limited Company (Pte Ltd). Each has its own set of pros and cons, and understanding the differences between them can help you make an informed choice that aligns with your business goals and needs.

Accounting Today

JANUARY 8, 2024

The struggles at smaller companies could create opportunities for professionals that help companies restructure their debt and turn themselves around.

Insightful Accountant

JANUARY 8, 2024

We delve deep into the world of branding and kickstart your journey to marketing success for accounting firms with Janel Sykora, a seasoned expert from Cajabra Marketing for Accountants.

Accounting Today

JANUARY 8, 2024

The Michigan-based firm has expanded to Massachusetts.

Speaker: Jennifer Hill

Payroll compliance is a cornerstone of business success, yet for small and midsize businesses, it’s becoming increasingly challenging to navigate the ever-evolving landscape of federal, state, and local regulations. Mistakes can lead to costly penalties and operational disruptions, making it essential to adopt advanced solutions that ensure accuracy and efficiency.

Counto

JANUARY 8, 2024

How can a Foreign Business Set Up Operations in Singapore? If a foreign entity, rather than an individual, intends to establish a presence in Singapore, it can explore four entry avenues. Each entry option comes with distinct advantages and limitations. Here’s a brief overview: 1. Representative Office (RO) Ideal for short-term market exploration.

Accounting Today

JANUARY 8, 2024

Financial advisors, tax professionals and their customers can recoup 30% of the cost through credits for qualified upgrades to their residences.

Nanonets

JANUARY 8, 2024

Introduction In the modern business environment, accounts payable teams must be able to process invoices and payments as quickly and efficiently as possible. As the organization grows, the number of invoices that need to be processed also grows, requiring a larger team size and, longer processing times. In addition to this, manual invoice data extraction and processing is also quite error-prone leading to a greater investment of resources than is required.

NACM

JANUARY 8, 2024

?NACM's Credit Congress & Exposition is an annual conference established to bring credit professionals together from across the nation to network, learn about various topics in the credit industry and stay informed about the latest changes in the B2B credit world.?️ On the latest episode of NACM's Extra Credit podcast, listen to credit professi.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Accounting Today

JANUARY 8, 2024

Donald Trump plans to make permanent the 2017 individual tax cuts that he enacted as president while keeping corporate tax levels unchanged in an appeal to working and middle class voters should he retake the White House.

Let's personalize your content