How AI is transforming accounting

Accounting Today

APRIL 29, 2024

A recent survey from EY found that 90% of respondents already use at least some AI in their work, and other recent developments around the technology.

Accounting Today

APRIL 29, 2024

A recent survey from EY found that 90% of respondents already use at least some AI in their work, and other recent developments around the technology.

Insightful Accountant

APRIL 29, 2024

Insightful Accountant proudly announces this year's Top 100 ProAdvisors along with our Emeritus ProAdvisors of the Year. Congratulations to all being recognized for this year's awards.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

APRIL 29, 2024

Notice 2024-36 announces the second round of credit allocations for a program to allocate the remaining $6 billion in credits.

Cevinio

APRIL 29, 2024

Discover the essential role of a comprehensive training program in our latest blog, which highlights why it's the first critical step in any successful AP automation plan for automated invoice processing.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

APRIL 29, 2024

The truth that most things are writ in water may as well be carved in stone.

Insightful Accountant

APRIL 29, 2024

Tonight is your very last opportunity to cast your vote for our candidates for the 2024 International ProAdvisor Awards.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

APRIL 29, 2024

What is Short-Term Debt? Short-term debt is the amount of a loan that is payable to the lender within one year. Other types of short-term debt include accounts payable, commercial paper , lines of credit , and lease obligations. The balance in the short-term debt account is a major consideration when evaluating the liquidity of a business. Evaluating Short-Term Debt To evaluate short-term debt, compare the current assets figure on the balance sheet to the current liabilities figure.

Accounting Today

APRIL 29, 2024

The IFRS Foundation attributed the increase in revenue and expenses to consolidated operations in its 2023 annual report.

Outsourced Bookeeping

APRIL 29, 2024

Are you stuck with managing your small business’s payroll, bookkeeping, invoicing, inventory, receipts, expenses, and finances without any free time? Then, a small business accounting cloud-based software is the best one-stop solution for all your accounting needs. And out of the many flooded in the market, the Xero bookkeeping software has been a trusted partner among many users.

Accounting Today

APRIL 29, 2024

The PCAOB Investor Advisory Group is accepting public nominations for the most decision-useful CAMs or KAMs of 2023.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

CSI Accounting & Payroll

APRIL 29, 2024

You can know that you want to own a small business – and even which industry you want to operate in – but still not know whether you want to buy or start a business. That’s perfectly normal, and you should weigh out your options before deciding. What are the pros and cons of each? At CSI Accounting & Payroll, we’ve worked with small businesses for over 50 years.

Accounting Today

APRIL 29, 2024

Learn how to get more referrals from existing clients who are truly happy about their relationship with you.

Insightful Accountant

APRIL 29, 2024

FreshBooks expands payment operations for business owners with new and innovative Stripe Connect features.

Tipalti

APRIL 29, 2024

Purchase order forms are a key element of any procurement process, but can differ in format and purpose. Learn how to create your own purchase order form to fit your business’s needs.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Insightful Accountant

APRIL 29, 2024

IRS notices surged in 2024 after a pandemic pause, causing confusion and stress for clients receiving past due balance notifications from as far back as 2020.

Tipalti

APRIL 29, 2024

A procurement audit is a recurring and critical part of the purchasing process to prevent overspending and increase supplier trust. Let’s dive into how to successfully conduct a procurement audit.

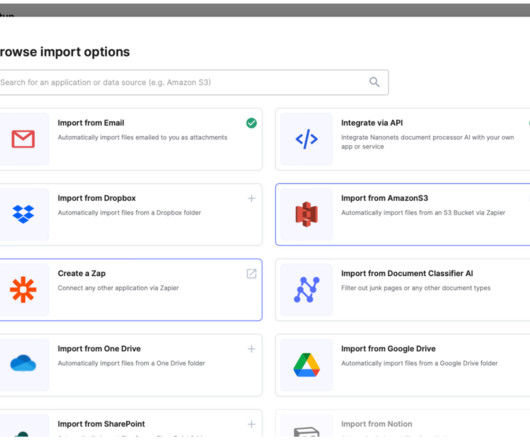

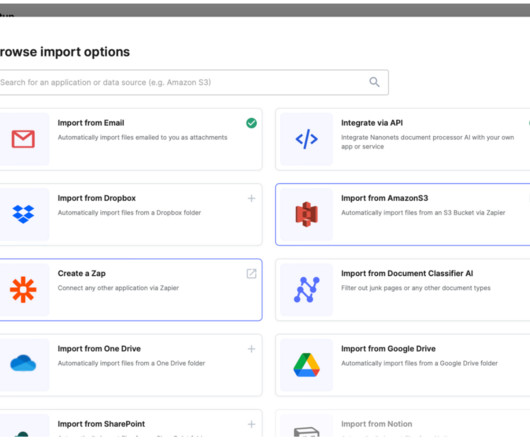

Nanonets

APRIL 29, 2024

If you want to keep your vendors happy, you need to make sure they’re paid on time. That’s where QuickBooks comes in. QuickBooks Online and QuickBooks Desktop offer several ways to make your vendor payment process easier. In this blog post, you’ll learn how to pay vendors in both online and desktop versions of QuickBooks. Whether you prefer online bill pay or traditional checks, we’ll walk you through the process.

Tipalti

APRIL 29, 2024

A quality spend data management system allows businesses to seamlessly manage their finances and spend more efficiently. Learn the ins and outs of spend management to maximize your bottom line.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Nanonets

APRIL 29, 2024

Unlocking Efficiency: A Guide to Intercompany Reconciliation Software Modern businesses, with the predominance of remote work and globalised operations, often have to deal with intercompany transactions. Managing such transactions can be cumbersome without the right tools and solutions, however. But intercompany reconciliation softwares are an answer to this challenge, streamlining the process and ensuring accuracy in financial reporting.

Accounting Tools

APRIL 29, 2024

What is Lawyer Leverage? Lawyer leverage is the ratio of equity partners to all other lawyers in a firm. When there is a high leverage ratio, this indicates that the distributable income of the equity partners should increase, since they are benefiting from the profits generated by everyone else in the firm. This concept only works when the non-partner personnel are sufficiently highly utilized to generate enough fee income to cover their direct costs.

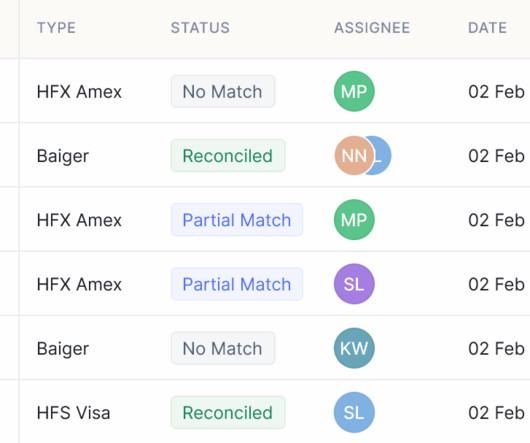

Nanonets

APRIL 29, 2024

The Top Credit Card Reconciliation Softwares in 2024 Credit card reconciliation is a crucial aspect of financial management for businesses of all sizes. It is the process of comparing and matching credit card transactions with corresponding spends and financial records to ensure accuracy and transparency in financial reporting. As businesses increasingly rely on credit cards for various expenses, the need for efficient reconciliation processes becomes more important.

Accounting Tools

APRIL 29, 2024

What is Out of Stock? Out of stock is an inventory condition, stating that an item is not currently available for sale or use. An out of stock condition can cost a company a sale , so these items are usually closely monitored. When inventory is not available, a business may offer to sell a comparable item, or will backorder goods until they are available at a later date.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Nanonets

APRIL 29, 2024

Imagine you're a financial manager at a bustling enterprise, entrusted with the responsibility of ensuring the accuracy and integrity of your company's financial records. As you look into the labyrinth of spreadsheets and ledger entries, you stumble upon discrepancies in your balance sheet—a familiar scenario for many finance professionals.

Tipalti

APRIL 29, 2024

Learn how to optimize and future-proof your purchase requests by overcoming fragmented, siloed workflows by using modern procurement tools, such as procurement automation.

Accounting Tools

APRIL 29, 2024

What is a Scrip Dividend? A scrip dividend is new shares of an issuer's stock that are issued to shareholders instead of a dividend. Scrip dividends may be used when issuers have too little cash available to issue a cash dividend, but still want to pay their shareholders in some manner. Scrip dividends may also be offered to shareholders as an alternative to a cash dividend, so that their dividend payments are automatically rolled into more shares.

Accounting Today

APRIL 29, 2024

In recent weeks, informal advisers have floated ideas such as a proposal for a flat tax, penalties for countries that shift away from the dollar, and reforms to the Fed.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Accounting Tools

APRIL 29, 2024

What is a Statutory Audit? A statutory audit is an examination of an entity's financial records in accordance with the requirements of a government agency. A number of organizations must undergo statutory audits, including banks, brokerage firms, insurance companies, and municipalities. These entities must undergo statutory audits because they are subject to a certain amount of governmental oversight.

Accounting Tools

APRIL 29, 2024

What is a Surplus in Business? A surplus is the residual amount of resources remaining after a period of usage. In the manufacturing area, a surplus refers to the excess amount of goods that were produced but could not be sold; in this case, a surplus may be bad, since the extra goods tie up working capital and may need to be written off if they become obsolete or spoil.

Accounting Tools

APRIL 29, 2024

What is Simple Yield? Simple yield is the amount of interest received from an investment, divided by the current market price or face value of the associated investment. This is a simplified calculation used to approximate the return on an investment, without accounting for the compounding effect of these returns over time. This measure also does not account for any realized or unrealized gains or losses on these investments.

Accounting Tools

APRIL 29, 2024

What is a Stockholder? A stockholder is a person or entity that owns shares in a corporation. A stockholder may own the preferred stock or common stock of a corporation (or both). Preferred stock may have special voting rights, dividends , and other features that are not available for common stock. A stockholder is accorded certain rights in respect to the shares held, which most commonly involve voting for members of the corporate board of directors and voting on certain policy issues, as well

Speaker: Yohan Lobo

In the accounting world, staying ahead means embracing the tools that allow you to work smarter, not harder. Outdated processes and disconnected systems can hold your organization back, but the right technologies can help you streamline operations, boost productivity, and improve client delivery. Dive into the strategies and innovations transforming accounting practices.

Let's personalize your content