Fifth Circuit rules cell phone tax unconstitutional

Accounting Today

AUGUST 2, 2024

The Supreme Court is likely to take up the case, which hinges on what, exactly, constitutes a tax.

Accounting Today

AUGUST 2, 2024

The Supreme Court is likely to take up the case, which hinges on what, exactly, constitutes a tax.

Economize

AUGUST 2, 2024

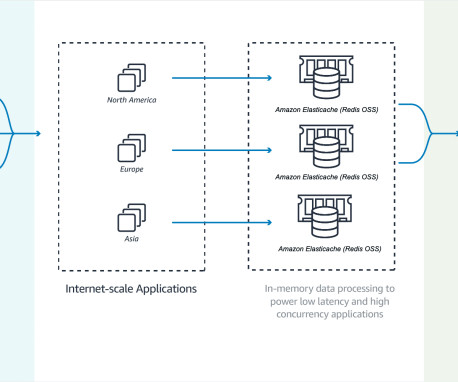

The Importance of Caching in Modern Applications Caching is a fundamental technique in modern computing that enhances the speed and performance of applications by temporarily storing frequently accessed data in a high-speed data storage layer. This allows applications to retrieve data faster than fetching it from a slower, traditional database or external source.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

AUGUST 2, 2024

KPMG announces new partnerships; CAQ releases generative AI guide for audit committees; US Bank announces new AR solution; and other accounting tech news.

Blake Oliver

AUGUST 2, 2024

My latest Earmark course, " How Taxes Shape Our Economy and Lives ," features a podcast interview with Scott Hodge, President Emeritus of the Tax Foundation and author of "Taxocracy." In this course, we explore: The impact of tax policies on housing, healthcare, and education costs Historical tax policies and their relevance to current debates The economic effects of tariffs on consumer goods Unexpected tax policy outcomes Potential improvements to the tax code As accounting and tax professional

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

AUGUST 2, 2024

Three common questions firm leaders ask about building growth strategies that are sustainable, efficient and profitable.

Blake Oliver

AUGUST 2, 2024

The IRS tidal wave is here. After years of going easy, they're back to enforcing tax laws with a vengeance. Millions of taxpayers are in their crosshairs, from average folks to wealthy jet-setters. But here's the thing: their offensive is your opportunity. Three key facts you need to know: The IRS is targeting a massive range of taxpayers and businesses They've got billions in new funding to sustain this surge long-term You can ride this wave by offering subscription-based tax resolution service

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Jetpack Workflow

AUGUST 2, 2024

When accounting firms look to implement practice management software into their operations, they often consider two well-known options: Financial Cents and TaxDome. While there is some overlap between these software solutions, each has notable distinctions that can make one better suited than the other for certain use cases. In this article, we compare Financial Cents and TaxDome based on the features that growing firms care about most.

Accounting Today

AUGUST 2, 2024

Abraham Shafi, former CEO of social media platform IRL, was charged with defrauding investors of $170 million by the Securities and Exchange Commission.

Insightful Accountant

AUGUST 2, 2024

Summer is an excellent time to consider changes you would like to see in your practice. As technology advancements continue, it is increasingly helpful for firms to work closely with vendors to reach solutions that can help clients and employees.

Accounting Today

AUGUST 2, 2024

SD Mayer's 5 Buckets Foundation brings together staff, clients and more to improve financial literacy.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Accounting Fun

AUGUST 2, 2024

Pointless is a popular British TV quiz show where contestants try to find the most obscure correct answers to general knowledge questions. The aim is to score the fewest points, with the best answers being those that no one else has thought of. Normally the questions are tested on a random group of 100 people. But imagine if the questions were tested on HMRC staff.

Accounting Today

AUGUST 2, 2024

The Bonadio Group hosts its seventh annual Purpose Day of volunteering; PwC airs ad during Olympic games; and more news from across the profession.

Accounting Tools

AUGUST 2, 2024

What is a Cancelled Check? A cancelled check is a check payment for which the stated amount of cash has been removed from the payer's checking account. Once the cash draw down is completed, the bank stamps the check as cancelled. Once a check is cancelled it can no longer be used as an authorization to remove additional funds from the account of the payer.

Accounting Today

AUGUST 2, 2024

With firms changing so rapidly, does it still make sense to lock in a long-term plan?

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Tipalti

AUGUST 2, 2024

Retail ERP lets employees check status at any time, including inventory levels, and provides ERP features for forecasting sales demand. Inventory status in real-time makes it easier for retailers to keep inventory in stock and avoid missed sales.

Accounting Tools

AUGUST 2, 2024

What is an Analytical Review? An analytical review is used by auditors to assess the reasonableness of account balances. A CPA does this by comparing changes in account balances over time, as well as by comparing related accounts. Here are several examples of analytical reviews: If sales increase by 20% during the review period, then accounts receivable should increase by a similar amount.

Accounting Tools

AUGUST 2, 2024

An employer is required to withhold certain payroll taxes from employee pay, which it then remits to the government. Since the employer is acting as an agent of the government, these taxes are a liability of the employer. There are several taxes that a company is required to withhold from employee pay, which include federal income taxes, state income taxes, the employee portion of the Medicare tax, and the employee portion of the social security tax.

Accounting Tools

AUGUST 2, 2024

What are Audit Working Papers? Audit working papers are used to document the information gathered during an audit. They provide evidence that sufficient information was obtained by an auditor to support his or her opinion regarding the underlying financial statements. Working papers also provide evidence that an audit was properly planned and supervised.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Accounting Tools

AUGUST 2, 2024

What are Average Operating Assets? Average operating assets refers to the normal amount of those assets needed to conduct the ongoing operations of a business. This figure can be included in the operating assets ratio , which compares the proportion of these assets to the total amount of assets that a business owns. A high ratio indicates that company management is making good use of its assets.

Let's personalize your content