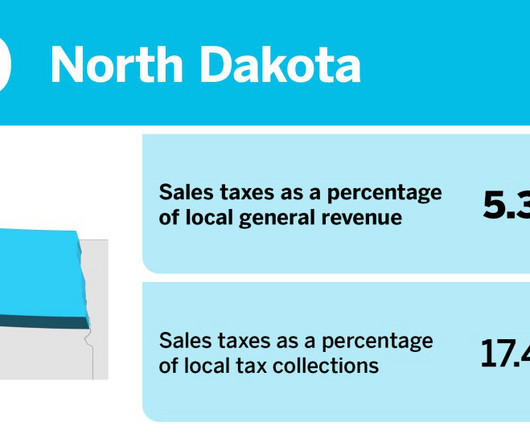

States that rely the most on sales taxes

Accounting Today

JULY 3, 2024

Where does sales tax drive the most local revenue?

Accounting Today

JULY 3, 2024

Where does sales tax drive the most local revenue?

FinOps Foundation

JULY 3, 2024

Key Insight: The FinOps X 2024 Day 1 Keynotes covered the Evolution of FinOps to include more technology spending beyond public cloud, FinOps for AI, cost-aware product decisions, carbon-aware FinOps. Stories from Disney and Uber spoke to the the constantly changing FinOps landscape, the FOCUS 1.0 GA launch landed and an executive panel of VPs from AWS, Microsoft and Google spoke together.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JULY 3, 2024

The job market continued to grow last month, but wage growth slowed, ADP reported.

FinOps Foundation

JULY 3, 2024

Key Insight: At FinOps X in San Diego last week, the three largest cloud service providers took the stage to announce feature launches and improvements to their FinOps offerings. Native FOCUS support was a ubiquitous theme, optimization recommendations were improved, and the use of AI assistants were common threads. Mike Fuller , CTO of the FinOps Foundation, and J.R.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

JULY 3, 2024

Louie Vazquez says he has all the characteristics of a bad employee and a good business owner.

Future Firm

JULY 3, 2024

If your goal is to systematize your firm, improving processes shouldn't be your top priority. Find out why in this episode. The post Process Improvement is Not a Top Priority appeared first on Future Firm.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

finout

JULY 3, 2024

Azure cloud expenses can quickly add up if not managed properly, and Azure’s wide array of services can make cost management feel overwhelming. This blog focuses on essential Azure cost optimization tools and practices that can help you stay on top of your spending. We’ll walk you through tools like Azure Cost Management and Billing, Azure Advisor, and Spot Virtual Machines, offering practical tips to optimize your budget and enhance your cloud efficiency.

Accounting Today

JULY 3, 2024

The IRS's Large Business and International Division is providing companies that claim tax credits for renewable energy and electricity projects an expedited way to report them.

Gaviti

JULY 3, 2024

As the role of the CFO has expanded to include financial planning and predictions, it’s your job to stay on top of the tools and technologies that can best assist you in achieving these tasks. But economic uncertainty, supply chain disruptions and rising interest rates have made these tasks increasingly challenging. By attending a finance conference, however, you can meet with fellow financial professionals who can share their experiences on how they’ve overcome these challenges.

Accounting Today

JULY 3, 2024

Plus, unbundling Office and Teams, Apple and on-device AI, and more.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Accounting Tools

JULY 3, 2024

What is the Going Concern Principle? The going concern principle is the assumption that an entity will remain in business for the foreseeable future. Conversely, this means the entity will not be forced to halt operations and liquidate its assets in the near term at what may be very low fire-sale prices. By making this assumption, the accountant is justified in deferring the recognition of certain expenses until a later period, when the entity will presumably still be in business and using its a

Let's personalize your content