Meet Nova Aurora, a CPA from 2034

Accounting Today

AUGUST 27, 2024

The accountant of the future has come back to share some thoughts on how the profession will improve.

Accounting Today

AUGUST 27, 2024

The accountant of the future has come back to share some thoughts on how the profession will improve.

Intuit

AUGUST 27, 2024

10 AI skills you need for a career in tech By now, it’s no secret that proficiency with artificial intelligence (AI) is a necessity to move forward in the tech job market. Advancements in technology or new platforms roll out seemingly every day, and some of the biggest brands in the world are exploring the best implementations for AI—if it’s not already an integral part of their workflows.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

AUGUST 27, 2024

Taxbit announced it now offers comprehensive support for the new Form 1099-DA, which pertains to digital assets.

Insightful Accountant

AUGUST 27, 2024

Starting October 27, 2024, the price of Xero's most popular plans in the United States will increase. The Early, Growing, and Established plans will see price changes ranging from $2 to $5 dollars per month.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

AUGUST 27, 2024

The Institute of Management Accountants debuted a corporate membership program Tuesday that provides training and resources for teams in organizations.

Nanonets

AUGUST 27, 2024

Introduction In today's fast-paced business world, the ability to extract relevant and accurate data from diverse sources is crucial for informed decision-making, process optimization, and strategic planning. Whether it's analyzing customer feedback, extracting key information from legal documents, or parsing web content, efficient data extraction can provide valuable insights and streamline operations.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Gaviti

AUGUST 27, 2024

Once your finance team is onboard with automating your accounts receivables to streamline and optimize the process, you’ll need to decide whether you want to shop for an outside vendor or build your own accounts receivable automation software in-house. The answer depends on a variety of factors, including your company’s size and available resources, the length of your timeline and need for customization.

Accounting Today

AUGUST 27, 2024

The advice will help in determining the appropriate situations to use the standard.

finout

AUGUST 27, 2024

We are thrilled to announce that Finout has achieved the AWS Cloud Operations Software Competency, underscoring our commitment to delivering cutting-edge FinOps solutions tailored to optimize FinOps practices across industries. This significant milestone underscores our ability to provide secure, scalable, and reliable cost management solutions that meet the demands of modern cloud environments.

Accounting Today

AUGUST 27, 2024

Niching down your CAS practice makes marketing easier … and more effective.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Insightful Accountant

AUGUST 27, 2024

Murph looks at the future of QuickBooks Desktop and Desktop alternatives from Intuit and Non-Intuit sources during this informative webinar being conducted this month as part of Insightful Accountant's Future Forward Event.

Accounting Today

AUGUST 27, 2024

The Treasury Department and the Internal Revenue Service said Tuesday that Maine will be the latest state to join the IRS Direct File free tax prep system for filing season 2025.

Insightful Accountant

AUGUST 27, 2024

This is a prologue to Murph's next part of his in-depth series on Acumatica. a summary of Acumatica ERP's Field Service Management functionality for service industries like HVAC, Plumbers, Oil-field Service Crews, Roadside Assistance, etc.

Accounting Today

AUGUST 27, 2024

The SEC obtained emergency asset freezes against Jonathan Adam and Tanner Adam, and their respective entities, to halt an alleged $60 million cryptocurrency Ponzi scheme.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Insightful Accountant

AUGUST 27, 2024

QB Express has mastered the art of leveraging QuickBooks training to grow your practice. Learn from them in our members only training session.

Accounting Today

AUGUST 27, 2024

Plus Platform Business Advisors adds a firm that serves hotels in Texas.

Blake Oliver

AUGUST 27, 2024

Did you know that the mortgage deduction, while beneficial for individual homeowners, makes housing less affordable and available for everyone? This is just one example of the unintended consequences of tax policies that we must educate people about to achieve any sort of meaningful tax reform. In a recent episode of the Earmark Podcast, Scott Hodge of the Tax Foundation highlighted three key attitudes that need to change: Taxpayers must be willing to give up credits and deductions, Corporations

Accounting Today

AUGUST 27, 2024

Useful tips; pets and tax bills; becoming simply profitable; and other highlights from our favorite tax bloggers.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

CSI Accounting & Payroll

AUGUST 27, 2024

If you own a small business in nearly any industry, it’s very likely that you’ll need to file tangible personal property tax. Let’s make sure you know everything you need to know!

Plooto

AUGUST 27, 2024

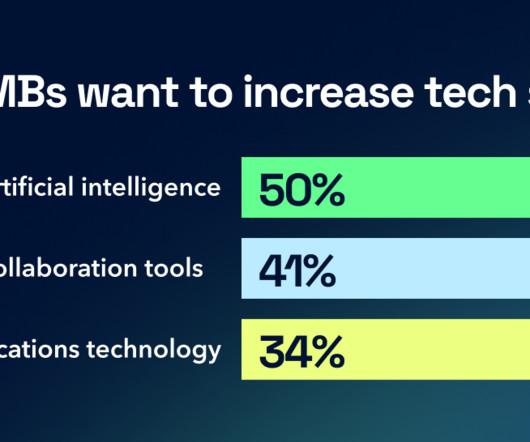

Small businesses are increasingly turning to technology in order to overcome modern business challenges. Technology allows SMBs to do more work with fewer resources and alleviates manual work, helping them focus on growth.

AvidXchange

AUGUST 27, 2024

Why Automate Accounts Payable? A Guide to the Prospective Advantages According to our recent Controllers Council National Survey (March 5-19, 2024, 378 respondents participating across North America), 95% of finance departments are at least partially automated. Survey respondents noted that investment in technology tools, including automation, helps their department increase efficiencies, improve processes, and foster cost savings.

finout

AUGUST 27, 2024

Cloud cost allocation is one of the most fundamental and essential steps in implementing FinOps. It involves assigning cloud expenses to the appropriate teams, projects, or business units, ensuring that costs are visible and accountable. Proper cost allocation is critical for financial transparency and enables organizations to make informed decisions about their cloud spending.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

CapActix

AUGUST 27, 2024

Running a business that relies on independent contractors can be a challenging task, especially when it comes to managing tax obligations. One common challenge businesses face is choosing the correct tax forms to report payments made to contractors. Misunderstanding the 1099 MISC vs 1099 NEC form can lead to errors, potential audits, and costly penalties from the IRS.

oAppsNet

AUGUST 27, 2024

Factur-X is an emerging standard for hybrid electronic invoicing that combines human-readable PDF files with machine-readable XML data. This innovative format facilitates seamless invoice processing by humans and automated systems, enhancing efficiency and accuracy in financial transactions. Understanding Factur-X and its benefits can help businesses optimize invoicing processes and comply with regulatory requirements.

Accounting Today

AUGUST 27, 2024

A look at the tax policy positions of the Republican and Democratic vice presidential nominees.

Let's personalize your content