IRS warns of new tax scams spread by social media

Accounting Today

MAY 14, 2024

The Internal Revenue Service cautioned consumers to beware of inaccurate advice which prompted thousands of taxpayers to file overblown claims and held up their refunds.

Accounting Today

MAY 14, 2024

The Internal Revenue Service cautioned consumers to beware of inaccurate advice which prompted thousands of taxpayers to file overblown claims and held up their refunds.

Cevinio

MAY 14, 2024

AR Invoice Delivery Automation is a software solution designed to transform invoicing processes, mitigate errors, and enhance cash flow […]

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

MAY 14, 2024

The Internal Revenue Service published final regulations officially lowering the fees for new Preparer Tax Identification Numbers and renewed PTINs.

Insightful Accountant

MAY 14, 2024

Intuit, Inc. has appointed Vasant Prabhu, former Chief Financial Officer and Vice Chairman of Visa, to its board of directors.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

MAY 14, 2024

Reliable data is the foundation of effective climate-related disclosures, and audit and tax professionals' experience is essential in supporting this data's integrity.

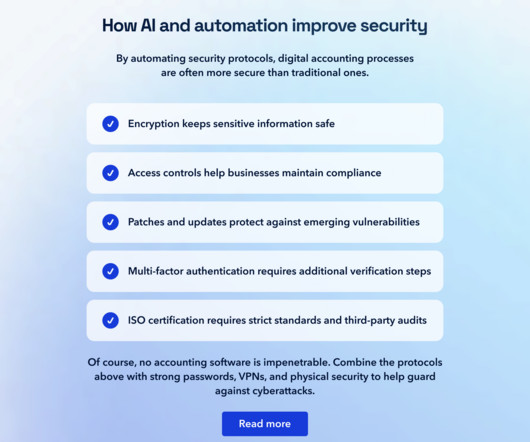

Plooto

MAY 14, 2024

Experienced accountants are hard-wired to remain audit-ready. But for small and medium-sized businesses (SMBs), are their financial team really prepared to provide detailed financial recordings, having their time monopolized and day-to-day responsibilities disrupted?

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Outsourced Bookeeping

MAY 14, 2024

Running a small business can cause you to shoulder a lot of burdens, especially in the financial realm. Keeping track of revenues and expenditures to maintain a proper cash flow must be cautiously organized so that you are not off track on your funds or financial records when you are filing taxes. However, in today’s world, you can hire a freelance accountant or a bookkeeper to help you focus on developing other aspects of your business.

Accounting Today

MAY 14, 2024

KKR & Co. is in talks for a new loan with private credit lenders for MYOB, an Australian accounting software firm that the private equity giant acquired in 2019, people familiar with the matter said.

Insightful Accountant

MAY 14, 2024

Alicia will host special guest Ted Callahan, Intuit’s Accountant Leader, Ted Callahan, to discuss how Intuit sees QuickBooks Live Expert Assist as a benefit to ProAdvisors.

Accounting Today

MAY 14, 2024

The convergence of machine learning, generative AI and autonomous sourcing gives organizations the ability to realize most of the ZBB ideal.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Insightful Accountant

MAY 14, 2024

Caseware Financials delivers the power of cloud, data, automation and localized content in one dynamic app for statutory reporting.

Accounting Today

MAY 14, 2024

Old IRS tech; lead, don't manage; an MP want-ad; and other highlights from our favorite tax bloggers.

oAppsNet

MAY 14, 2024

Streamlining accounts receivable collections is a strategic imperative for businesses to enhance their cash flow and operational efficiency. Efficient collection processes improve a company’s financial health and strengthen customer relationships by ensuring transparency and consistency. This article explores practical strategies and techniques for streamlining accounts receivable collections, addressing challenges, and leveraging technology to optimize this critical aspect of business fin

Tipalti

MAY 14, 2024

Material procurement is critical for any business that relies on direct procurement. Learn about the different types and steps of material procurement for efficient workflow.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Nanonets

MAY 14, 2024

Are you tired of the time-consuming and error-prone process of manually copying Excel tables into Word documents? Anyone who frequently works with data knows how frustrating it can be to ensure that your tables maintain their formatting and accuracy when transferred between applications. This comprehensive guide will explore various methods for seamlessly copying Excel tables into Word.

Ace Cloud Hosting

MAY 14, 2024

Since the tax season just ended pro and with the upcoming National Accounting Day on May 19th, Financial firms must recognize the unsung tax-saving heroes: CPAs and Accountants deserve an.

Accounting Tools

MAY 14, 2024

What is Realization in Accounting? Realization is the point in time when revenue has been generated. Realization is a key concept in revenue recognition. Realization occurs when a customer gains control over the good or service transferred from a seller. Realization Indicators There are numerous indicators of when realization can occur, such as the following: When the seller has the right to receive payment.

Billah and Associates

MAY 14, 2024

What is the Canadian Dental Care Plan (CDCP)? The Canadian Dental Care Plan (CDCP) provides much-needed assistance for qualified Canadians without dental insurance. The objective of this plan is to ensure the well-being of people across the country by providing critical dental care coverage for maintaining optimal oral health. Eligible residents can receive preventative, diagnostic, and restorative dental care for free.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Let's personalize your content