Tax Strategy: House passes popular tax changes

Accounting Today

FEBRUARY 13, 2024

While passage in the Senate is uncertain, many of the changes could impact 2023 tax returns.

Accounting Today

FEBRUARY 13, 2024

While passage in the Senate is uncertain, many of the changes could impact 2023 tax returns.

Insightful Accountant

FEBRUARY 13, 2024

Based on the latest Intuit QuickBooks Small Business Index, employment for small businesses with one to nine employees decreased by 14,800 jobs in January, 2024.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

FEBRUARY 13, 2024

The Washington National Tax Office of Grant Thornton points out the most important state and local tax developments to keep an eye out for.

Accounting Tools

FEBRUARY 13, 2024

What is the Sales Journal Entry? A sales journal entry records the revenue generated by the sale of goods or services. This journal entry needs to record three events, which are the recordation of a sale , the recordation of a reduction in the inventory that has been sold to the customer, and the recordation of a sales tax liability. The content of the entry differs, depending on whether the customer paid with cash or was extended credit.

Advertisement

Our 2025 Center Travel Survey is clear: as corporate travel increases, so does corporate credit cards distribution, and a rise in off-platform travel booking. This 61% rise causes various challenges: compliance, spend control, reporting problems, and a lack of visibility across organizations. To evolve with the ever-changing needs of travelers, decision-makers need a better solution.

Accounting Today

FEBRUARY 13, 2024

The IRS wants to help businesses know when they don't qualify for an Employee Retention Credit.

Accounting Tools

FEBRUARY 13, 2024

What is Opportunity Cost? Opportunity cost is the profit lost when one alternative is selected over another. The concept is useful simply as a reminder to examine all reasonable alternatives before making a decision. For example, you have $1,000,000 and choose to invest it in a product line that will generate a return of 5%. If you could have spent the money on a different investment that would have generated a return of 7%, then the 2% difference between the two alternatives is the foregone opp

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

FEBRUARY 13, 2024

What is Taking Inventory? Taking inventory is the process of counting the amount of inventory owned by a business. Taking inventory is needed to ensure that a firm’s inventory records match the physical count , to support materials management and to ensure that a correct ending inventory balance is reported on its balance sheet. Taking inventory can require that a company cease its normal warehousing and production activities in order to ensure an accurate count, so the count is commonly conduct

Accounting Today

FEBRUARY 13, 2024

Jim Lee, the head of IRS Criminal Investigation, will step down April 6.

Accounting Tools

FEBRUARY 13, 2024

What is a Dividend? A dividend is a payment made to shareholders that is proportional to the number of shares owned. Dividends are usually issued by companies that will not reap significant growth by reinvesting profits , and so instead choose to return funds to shareholders in the form of a dividend. Companies may also issue dividends in order to attract income investors, who are looking for a steady source of income, and which can be reliable long-term holders of company shares.

Accounting Today

FEBRUARY 13, 2024

The Internal Revenue Service is looking for both corporate income and employment taxes for a four-year period.

Speaker: Susan Richards

Your past-due accounts are growing, cash flow is tightening, and the pressure is on. The big question: Do you handle the collections internally or outsource to experts? Both strategies come with advantages and risks - but which one delivers the best impact for your business? In this session we’ll dive deep into the in-house vs. outsourcing debate, examining cost-effectiveness, efficiency, compliance risks, and overall recovery success rates.

Invoicera

FEBRUARY 13, 2024

Summary A payment software solution makes paying and receiving money online easier and more organized. Payment software enhances financial transactions and overall efficiency for small businesses. Notable options include Square, PayPal, Stripe, and more, with the best security and integration capabilities. Invoicera stands out as a comprehensive invoicing solution, offering core features, customization options, and seamless payment integrations.

Accounting Today

FEBRUARY 13, 2024

There are four critical areas to developing your chief information officer.

Insightful Accountant

FEBRUARY 13, 2024

Early discussions on estate tax planning and planned giving are crucial for clients considering asset transitions later in life. They can lead to significant savings for clients and beneficiaries compared to delaying until after death.

Accounting Today

FEBRUARY 13, 2024

The engagement partner and engagement quality review partner on the audit of Mexican steelmaker owe a combined $165,000.

Speaker: Danny Gassaway and Wayne Richards

Finance leaders are prioritizing efficiency and digital transformation, yet many hesitate to automate due to uncertainty. Without a clear understanding of its impact, organizations risk falling behind competitors who are leveraging automation to drive productivity and cost savings. Join Wayne Richards and Danny Gassaway from AvidXchange for a practical guide on bringing accounts payable (AP) automation to your organization.

Insightful Accountant

FEBRUARY 13, 2024

No touch tax returns are the way of the future, or the present depending on who you ask. In either case, firms need to be jumping on the bandwagon.

Accounting Today

FEBRUARY 13, 2024

Who owns the business and who is going to run it are separate — but equally important — questions.

Insightful Accountant

FEBRUARY 13, 2024

There is one thing 'about time', it changes over time. and so too with our QB Talks monthly webinars. Please join our new host, Alicia Katz Pollock next Wednesday, February 21, 2024 as she presents the new 'QuickBooks Time' interface.

Accounting Today

FEBRUARY 13, 2024

SALT benefits; taxing blockchain tech; how to onboard; and other highlights from our favorite tax bloggers.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Nanonets

FEBRUARY 13, 2024

Smart entrepreneurs know the devil is in the details—particularly when it comes to financial clarity. At the heart of such clarity is the strategic step of categorizing business expenses. This means meticulously sorting every dollar spent into clearly defined buckets, enabling a bird's eye view of where funds flow. In this blog, we're diving into why and how to categorize your business expenses.

AvidXchange

FEBRUARY 13, 2024

By choosing an enhanced direct deposit option , Leading Edge Construction Services Inc. maintains steady receivables Located in the San Jose and Central Valley areas of California, Leading Edge Construction Services, Inc. has a team comprised of over 100 years of experience providing general construction services for residential, commercial, public works and governmental projects.

Counto

FEBRUARY 13, 2024

Applying for a Dormant Company In Singapore’s corporate landscape, the concept of a dormant company plays a crucial role for businesses that temporarily halt operations or have no active trading. Understanding the process and requirements for applying as a dormant company can streamline administrative tasks and alleviate unnecessary burdens. What Defines a Dormant Company?

Jetpack Workflow

FEBRUARY 13, 2024

Running an accounting firm can be a stressful, but very rewarding business. You get to help clients, deliver value, and make a comfortable living. But running a firm, managing your team, and managing client expectations can also get overwhelming quickly. And especially if you are rapidly expanding your business. And it’s why accounting workflows are so important to your firm and client success.

Speaker: Jennifer Hill

Payroll compliance is a cornerstone of business success, yet for small and midsize businesses, it’s becoming increasingly challenging to navigate the ever-evolving landscape of federal, state, and local regulations. Mistakes can lead to costly penalties and operational disruptions, making it essential to adopt advanced solutions that ensure accuracy and efficiency.

Counto

FEBRUARY 13, 2024

Key Things Dormant Companies Need to Be Aware of When your Singapore company enters a dormant state, indicating no significant accounting transactions during the financial year, there are essential steps to heed to comply with regulations set by the Accounting and Corporate Regulatory Authority (ACRA). 1. Submit Annual Returns Despite dormancy, filing annual returns with ACRA within 30 days of the Annual General Meeting (AGM) or within 6 months after the financial year’s end is mandatory.

Nanonets

FEBRUARY 13, 2024

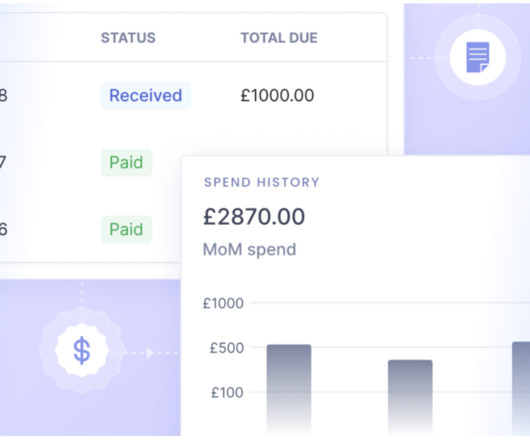

Accounts payable and spend management platforms are a tricky selection to make; many offer a range of services that can either be “too much” or “too little” for your business, depending on your needs. At the same time, though, there’s a glut of information available that makes determining the best platform for your needs a difficult endeavor.

finout

FEBRUARY 13, 2024

Discover practical tips for integrating DevOps and FinOps to boost cost efficiency and operational excellence in cloud environments.

Nanonets

FEBRUARY 13, 2024

Welcome to Expense Policy 101! Whether you’re the captain of a startup ship or steering a more established enterprise, grappling with expenses is as inevitable as those awkward team-building exercises. This guide seeks to demystify the enigma of creating and implementing a business expense policy that doesn’t just sit pretty in a company handbook but actually works.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

oAppsNet

FEBRUARY 13, 2024

In today’s digital age, managing content across various platforms and devices is essential for businesses to stay organized, efficient, and competitive. Content Management Content Document Sync, often called CM CDS, is a powerful tool that enables seamless synchronization and management of content documents across multiple channels and systems.

Accounting Tools

FEBRUARY 13, 2024

What is an Activity Cost Pool? An activity cost pool is an account in which is aggregated a number of costs that are related to a certain type of activity. The grand total of these costs is then allocated to products and other cost objects in order to gain a better understanding of the total costs incurred by a product or cost object. The cost pool concept is most heavily used in an activity-based costing system, and least used when there are few overhead costs to be allocated.

NACM

FEBRUARY 13, 2024

Your success can be measured by a multitude of factors: your desire, how big your goals are and how you bounce back from adversity are just a few to name. But in the B2B credit world, credit professionals' success can be measured through educational goals—pushing their career goalpost even further. Dan Erickson, CBA, collections representative at D.

Accounting Tools

FEBRUARY 13, 2024

What is the Actuarial Basis of Accounting? The actuarial basis of accounting is the method used to calculate the amount of ongoing, periodic contributions to be made into a pension fund. This basis of accounting mandates that the amount of contributions plus the assumed investment earnings must at least equal the amount of payments made by the fund to pensioners.

Speaker: Debra L. Robinson

CPAs know the drill: taxes, compliance, rinse, repeat. But what about the sneaky cash flow that’s quietly messing with your organization’s success? It’s time to step into the spotlight and expose the “dirty little secrets” of cash flow to fuel strategic growth. By upskilling your accounting practices and shifting focus from tax compliance to the strategic movement of money, you can transform your role from reactive accountant to proactive financial strategist.

Let's personalize your content