IRS employee union relieved after gov't shutdown averted

Accounting Today

OCTOBER 2, 2023

The National Treasury Employees Union expressed a sense of relief after lawmakers in Congress unexpectedly managed to pass a stopgap spending bill.

Accounting Today

OCTOBER 2, 2023

The National Treasury Employees Union expressed a sense of relief after lawmakers in Congress unexpectedly managed to pass a stopgap spending bill.

Xero

OCTOBER 2, 2023

We’re excited to be coming to a city near you with the Xero UK Roadshow, bringing you the latest updates in Xero. From fresh features to the latest industry trends, there’s so much on offer to help you run your practice more efficiently so you can do more of the things that really matter. We’ll be visiting six cities between 31 October and 22 November 2023: London: Tuesday 31 October Bristol: Thursday 2 November Birmingham: Tuesday 7 November Belfast: Thursday 9 November Edinburgh:

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

OCTOBER 2, 2023

Affected individuals and businesses now have until Feb. 15 next year to file various federal tax returns and make tax payments.

Intuit

OCTOBER 2, 2023

How did you get your start in the technology space? I earned degrees in computer science and computer engineering, and I started working for a well-known company as a development manager. I enjoyed the challenges, but I wanted to be part of a team that offered more stability. That’s when my Intuit story begins. I was thrilled to be part of the company, using my skills to focus on location data and improving the lives of our customers’ employees by helping them track their time.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Accounting Today

OCTOBER 2, 2023

Eleven states have created or expanded a fully refundable child tax credit following the expiration at the end of 2021 of the federal measure, which enabled families to get as much as $3,600 per child.

CloudZero

OCTOBER 2, 2023

Implementing any cloud development project can be tricky, and frustrating. Especially when you are pressured with time, reactive approaches, or cost-saving scenarios.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Insightful Accountant

OCTOBER 2, 2023

You can earn valuable 2024 Top 100 Categorical training points by participating in the upcoming Intuit Virtual Event for ProAdvisors supporting the mid-market with QuickBooks Online-Advanced.

Accounting Today

OCTOBER 2, 2023

While each firm has one managing partner, each partner plays a role in managing part of that practice.

Insightful Accountant

OCTOBER 2, 2023

A recent HP global survey found that less than a third think they have a 'healthy' relationship with their job.

Accounting Today

OCTOBER 2, 2023

Nearly half the leaders of corporate tax departments believe they're severely under-resourced when it comes to technology and hiring, according to a recent survey.

Speaker: Jennifer Hill

Payroll compliance is a cornerstone of business success, yet for small and midsize businesses, it’s becoming increasingly challenging to navigate the ever-evolving landscape of federal, state, and local regulations. Mistakes can lead to costly penalties and operational disruptions, making it essential to adopt advanced solutions that ensure accuracy and efficiency.

Dext

OCTOBER 2, 2023

Having joined Dext just a few months ago as Chief Marketing Officer I was excited to attend my first trade show with the team, the Accountex Summit in Manchester. It was a mix of eye-opening insights, meaningful connections, and an immersive exploration into what lies ahead for the accounting world.

Accounting Today

OCTOBER 2, 2023

Top 100 Firms, wealth managers, PE-backed platform firms and others announced a number of acquisitions and mergers.

Insightful Accountant

OCTOBER 2, 2023

Intuit has finally released QuickBooks Desktop 2024 by Sept. 20, so now Murph can give you the low-down. His annual Desktop version of QBTalks is tomorrow, Wednesday Oct. 4, 2 pm (EST). Don't miss it.

Accounting Today

OCTOBER 2, 2023

Over 40 technology leaders discussed their recent accomplishments and plans for the future, and nearly all of them involved AI in some form, mostly for insights and workflow automation.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

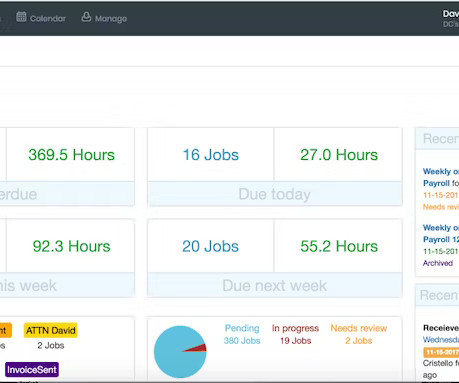

Jetpack Workflow

OCTOBER 2, 2023

At Jetpack Workflow, we know accounting firms want to focus on growing their practice. We work hard to provide a solution that helps them standardize their work and automate workflows. We continually release updates to make our platform even more beneficial. However, we realize we’re not always the right fit for every firm. For example, some firms seek out Jetpack Workflow alternatives because they want practice management software to help them run their entire business.

Blake Oliver

OCTOBER 2, 2023

I'm excited to share the latest Unofficial QuickBooks Accountants Podcast episode with you all. My colleagues at Earmark Media and I are proud to produce this show, already ranking among Apple's top business news podcasts - right up there with Accounting Today, Bloomberg's Talking Tax, and my own The Accounting Podcast. In this episode, Hector Garcia and Alicia Pollock dig into the recent small tweaks and updates in QuickBooks Online, like rolling date ranges in reporting, bulk payroll editing,

Accounting Tools

OCTOBER 2, 2023

Related Courses Business Insurance Fundamentals What are Incurred Losses? Incurred losses are those losses that an organization has sustained during a reporting period , even if the associated liability has not yet been settled. From the perspective of an insurer , incurred losses are the grand total of loss reserves and paid claims in a policy year.

Accounting Today

OCTOBER 2, 2023

An IRS consultant allegedly leaked confidential tax information on former President Donald Trump and billionaires to The New York Times and ProPublica.

Speaker: Debra L. Robinson

CPAs know the drill: taxes, compliance, rinse, repeat. But what about the sneaky cash flow that’s quietly messing with your organization’s success? It’s time to step into the spotlight and expose the “dirty little secrets” of cash flow to fuel strategic growth. By upskilling your accounting practices and shifting focus from tax compliance to the strategic movement of money, you can transform your role from reactive accountant to proactive financial strategist.

Accounting Tools

OCTOBER 2, 2023

Related Courses Bookkeeping Guidebook Optimal Accounting for Payroll Payroll Management A business routinely deducts a portion of health insurance costs from the pay of its employees. This is done in order to split the cost of the insurance between the employer and employees. To illustrate the accounting for this withholding, ABC International incurs a health insurance cost of $500 per month for Mr.

Accounting Today

OCTOBER 2, 2023

The former president wanted to get higher on the Forbes billionaires list and save a fortune on loan terms by overvaluing his properties, according to evidence previewed for a packed courtroom.

Accounting Tools

OCTOBER 2, 2023

Related Courses Bookkeeping Guidebook Optimal Accounting for Payables Payables Management When there are old outstanding checks on a bank reconciliation , they should be eliminated. The first step in doing so is to contact the payee , to see if the check was lost. If so, cancel the original check, reverse the payment transaction in the accounting records , and send them a replacement check.

Accounting Tools

OCTOBER 2, 2023

Related Courses Corporate Finance Treasurer's Guidebook What is a Debt Security? A debt security is any type of security that must be paid back in full to the investor , along with interest. The investor has the right to trade the security to a third party. The risk associated with a debt security is generally less than that of an equity security , since the amount on loan should eventually be paid back.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Accounting Tools

OCTOBER 2, 2023

Related Courses Real Estate Accounting Real Estate Tax Guide What is a Fractional Interest? A fractional interest is an ownership share in real estate. For example, three families jointly purchase a vacation property, under an agreement to split their use of the property based on their ownership percentages. The owners must also pay for their respective shares of the property’s maintenance and taxes.

Accounting Tools

OCTOBER 2, 2023

Related Courses Accounting for Retirement Benefits What is Net Periodic Pension Cost? Net periodic pension cost is the cost of a pension plan for a reporting period , as stated in an employer’s financial statements.

Accounting Tools

OCTOBER 2, 2023

Related Courses Fixed Asset Accounting GAAP Guidebook What is Accretion Expense? Accretion expense is the ongoing, scheduled recognition of an expense related to a long-term liability. The amount charged to expense represents the change in the remaining discounted cash flows of the liability. The concept is most commonly applied to asset retirement obligations , which usually extend for many years into the future, and so are measured using a discounted cash flows analysis.

Accounting Tools

OCTOBER 2, 2023

Related Courses Property Management Accounting Real Estate Accounting What is a Common Interest Realty Association? A common interest realty association governs a common interest community, such as a condominium development or timeshare units. The association is responsible for property maintenance and repairs, management services, and other tasks defined in its governing documents, which are frequently subcontracted to a property management company.

Advertisement

Bleisure travel — where employees combine work and leisure — has been around since the advent of corporate travel and is here to stay. Successful bleisure policies strike a balance between employee preferences and company goals — workers report a 64% improvement in work-life balance, while companies benefit from reduced travel costs and increased workforce innovation.

Accounting Tools

OCTOBER 2, 2023

Related Courses Fair Value Accounting What is Exit Price? Exit price is the price that a seller would receive in exchange for the sale of an asset or would pay to transfer a liability. This price should be obtained in an orderly transaction between market participants. A exit price is a bid price, since the seller is setting an offer price for prospective buyers.

Accounting Tools

OCTOBER 2, 2023

Related Courses Business Insurance Fundamentals What is Group Insurance? Group insurance covers more than one person, typically a cluster of employees and their dependents, or the members of a professional association. Group insurance is typically offered for health insurance and life insurance. This insurance is usually renewed on an annual basis. Advantages of Group Insurance Selling group insurance reduces selling costs for insurers , which allows them to offer reduced prices to employers.

Accounting Tools

OCTOBER 2, 2023

Related Courses Auditing Nonprofit Entities Nonprofit Accounting What are Supporting Activities? Supporting activities are those actions taken by a nonprofit organization other than program services. Supporting activities typically include fundraising activities, management and general activities, and membership development activities. Donors prefer to see a low ratio of supporting activities to program services, which indicates that the bulk of their donations are being used to further the main

Accounting Tools

OCTOBER 2, 2023

What is an Affiliate? An affiliate is a relationship between two businesses where one firm owns a minority interest in the other organization. The concept can also describe the relationship between two subsidiaries that are owned by the same parent company. Affiliation can also exist when two firms have interlocking directorships. For example, if ABC International owns 25% of Grouch Electronics, then the two entities can be considered affiliates.

Speaker: Timothy Allsopp

Payment challenges often lead to delayed projects, financial bottlenecks, and strained relationships. With construction projects becoming more complex, outdated processes are no longer sustainable. By refining financial workflow, companies can improve cash flow, reduce error, and foster trust between stakeholders. Discover practical strategies for redesigning payment systems to overcome workflow challenges while creating a smoother, more reliable process for contractors and subcontractors alike.

Let's personalize your content