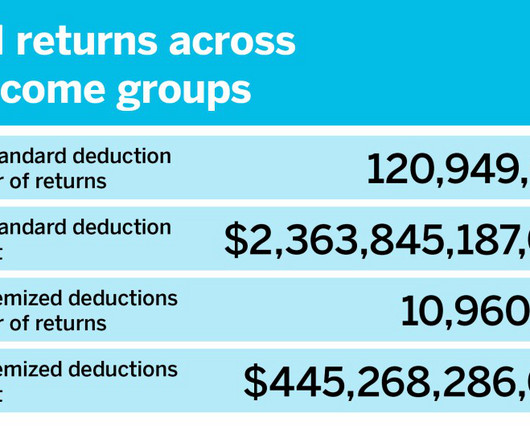

Standard vs. itemized: Who deducts what?

Accounting Today

SEPTEMBER 16, 2024

Taxpayers earning more are more likely to choose to itemize their deductions, while taxpayers earning less tend to favor the standard deduction.

Accounting Today

SEPTEMBER 16, 2024

Taxpayers earning more are more likely to choose to itemize their deductions, while taxpayers earning less tend to favor the standard deduction.

Xero

SEPTEMBER 16, 2024

We know how important it is for small businesses to have access to powerful insights to help them run their business better, no matter the economic environment they’re facing. To accelerate our mission to provide powerful insights, we are thrilled to share that Xero is acquiring Syft, a leading global cloud-based reporting, insights and analytics platform for small businesses, accountants and bookkeepers.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

SEPTEMBER 16, 2024

The Treasury Inspector General for Tax Administration, in two reports, critiqued the IRS on cybersecurity for both its data warehouse and its cloud infrastructure.

The Successful Bookkeeper

SEPTEMBER 16, 2024

From hiring processes to creative production, artificial intelligence is transforming many demanding aspects of business.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Accounting Today

SEPTEMBER 16, 2024

Find out what the client needs and then figure out how to fill that need.

Insightful Accountant

SEPTEMBER 16, 2024

As Congress reconvenes this month, tax practitioners find themselves navigating an uncertain legislative landscape with the looming threat of a government shutdown and its potential impact on year-end tax legislation.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Ace Cloud Hosting

SEPTEMBER 16, 2024

Cloud technology is a game-changing innovation in the IT/ITES industry. It has transformed the way businesses manage and operate, allowing them to store and process data on remote servers hosted.

Accounting Today

SEPTEMBER 16, 2024

John Napolitano of Napier Financial takes a long look at the host of unusual investment opportunities available to your wealthier clients.

Nanonets

SEPTEMBER 16, 2024

Managing and reviewing contracts throughout their lifecycle is quite a challenging task for businesses. Especially since contract data is often scattered across different systems or departments - making it hard to get a quick comprehensive view of contractual obligations. Consider the volume of contracts that businesses typically deal with, the effort required to manually review dense unstructured legal information, and the (legal) expertise required to interpret the data within contracts.

Accounting Today

SEPTEMBER 16, 2024

In the latest example of accounting firms taking on outside investments, the internationally focused firm has sold a minority stake to an Indian billionaire.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Less Accounting

SEPTEMBER 16, 2024

In today’s rapidly evolving business landscape, the role of bookkeeping in small businesses has undergone significant transformations. Gone are the days of relying solely on manual spreadsheets and paper-based record-keeping. Modern technology has revolutionized bookkeeping practices, offering small business owners powerful tools to streamline operations, improve accuracy, and drive growth.

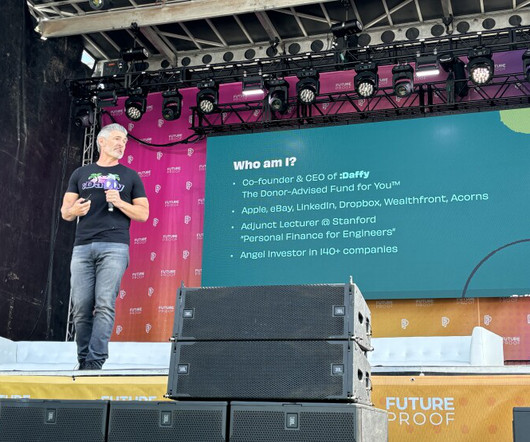

Accounting Today

SEPTEMBER 16, 2024

The accounts are expected to grow by another trillion dollars over the next decade because of their tax and flexibility advantages, Daffy CEO Adam Nash said.

Ace Cloud Hosting

SEPTEMBER 16, 2024

As a business owner, you are always looking for technological solutions to make the process streamlined and error-free. However, with various options available in the market, it becomes challenging to.

Accounting Today

SEPTEMBER 16, 2024

The IRS has postponed payment and filing deadlines for those affected by the storm.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Insightful Accountant

SEPTEMBER 16, 2024

You still have plenty of time to apply for the International ProAdvisor Awards, but why wait. you can start your application and come and go as you complete new training, earn certifications and use/learn new Apps.

Accounting Today

SEPTEMBER 16, 2024

Hong Kong's Accounting and Financial Reporting Council said its review of PwC's local practice, which is separate from China's probe, is still "in progress.

Insightful Accountant

SEPTEMBER 16, 2024

Murph will host Dawn Brolin, Kelly Gonsalves, and Jeff Siegel to review the Top 100 ProAdvisors' Top 10 most popular eCommerce Connector Apps today, September 17 at 2 PM Eastern.

Counto

SEPTEMBER 16, 2024

Double Taxation: DTAs vs. UTCs for Singaporean Businesses As a small business owner navigating international operations, managing tax liabilities can be complex. Double Taxation Agreements (DTAs) and Unilateral Tax Credits (UTCs) are two mechanisms designed to alleviate the burden of being taxed twice on the same income. Understanding their differences is crucial for effective tax planning.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Billah and Associates

SEPTEMBER 16, 2024

In Canada, the tax authorities apply capital gains tax to the profit earned from selling or disposing of capital property, such as real estate, stocks, or other investments. When the sale price of an asset exceeds its original purchase price, the difference is considered a capital gain. Currently, 50% of your capital gains are taxable, regardless of the total amount.

Counto

SEPTEMBER 16, 2024

Corporate Social Responsibility (CSR) in Singapore: Why It Matters and How SMEs Can Get Started As a small business owner in Singapore, you might wonder how engaging in Corporate Social Responsibility (CSR) can benefit your business. CSR is not just a buzzword but a vital strategy that can enhance your brand reputation, build trust with stakeholders, and contribute positively to your community and the environment.

IMA's Count Me

SEPTEMBER 16, 2024

Join Adam Larson as he sits down with Christian Hyatt , co-founder and CEO of risk 3sixty , in this eye-opening episode of the Count Me In. From starting out in the world of public accounting to leading a successful cybersecurity firm, Christian shares his unique journey and offers valuable insights into the complex world of cyber threats. Discover who the real "bad guys" are, the surprising sophistication of criminal organizations, and how businesses can better protect themselves in an increasi

Counto

SEPTEMBER 16, 2024

Navigating Cross-Border Taxation for Singapore-Based SMEs As Singapore-based SMEs venture into international markets, understanding cross-border taxation becomes crucial. Managing tax obligations across different jurisdictions can be complex, but with the right knowledge and strategies, you can navigate these challenges effectively. This guide offers essential insights to help you handle cross-border taxation with confidence. 1.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Accounting Today

SEPTEMBER 16, 2024

Former President Donald Trump's agenda of higher tariffs on U.S. imports would help offset his expanding tax-cut proposals if he's reelected in November, according to his running mate, Ohio Senator JD Vance.

Counto

SEPTEMBER 16, 2024

How Double Taxation Agreements (DTAs) Benefit Singaporean Businesses Investing Abroad For Singaporean businesses eyeing international expansion, managing taxes across borders can be complex. Double Taxation Agreements (DTAs) are designed to simplify these challenges by preventing income from being taxed in both Singapore and the foreign country. Understanding the benefits of DTAs can help streamline international operations and enhance investment opportunities. 1.

Let's personalize your content