IRS falls behind on tax return scanning goal

Accounting Today

DECEMBER 26, 2023

The Internal Revenue Service is not expected to meet the Treasury Department's goal of scanning millions of returns by the end of the year.

Accounting Today

DECEMBER 26, 2023

The Internal Revenue Service is not expected to meet the Treasury Department's goal of scanning millions of returns by the end of the year.

Accounting Department

DECEMBER 26, 2023

Small and medium-sized businesses (SMBs) are essential to the economy, accounting for more than half of all jobs worldwide. In recent years, several trends have impacted how SMBs operate, and we can expect even more changes to come in 2024. To prepare for the future, businesses must be aware of these shifts and adapt accordingly. In this blog post, we will discuss five SMB trends that we can expect to see in 2024, dealing with AI, customer experience, sustainability, and cybersecurity.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

DECEMBER 26, 2023

The bottom state in the ranking received a total score for financial literacy of 51 out of 100.

Ace Cloud Hosting

DECEMBER 26, 2023

Tax preparation can be a daunting task, especially for those new to the field. Lacerte Software offers a comprehensive solution that simplifies the process and ensures accuracy and compliance. Lacerte.

Advertisement

Our 2025 Center Travel Survey is clear: as corporate travel increases, so does corporate credit cards distribution, and a rise in off-platform travel booking. This 61% rise causes various challenges: compliance, spend control, reporting problems, and a lack of visibility across organizations. To evolve with the ever-changing needs of travelers, decision-makers need a better solution.

Accounting Today

DECEMBER 26, 2023

Federal money is keeping construction businesses busy, but comes with its own complications.

Insightful Accountant

DECEMBER 26, 2023

What better time of the year to find out what you are thinking.ProAdvisors are invited to January's "open microphone' edition of QB Talks to tell us what you think about the ProAdvisor Awards, the ProAdvisor Program and recent QB-Desktop news.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Insightful Accountant

DECEMBER 26, 2023

According to the recently released Intuit QuickBooks Entrepreneurship in 2024 Report, nearly a quarter of US consumers are considering starting a new business in 2024.

Accounting Today

DECEMBER 26, 2023

When companies can accurately portray their financial health, it becomes easier for them to establish credibility, build relationships with stakeholders and access capital.

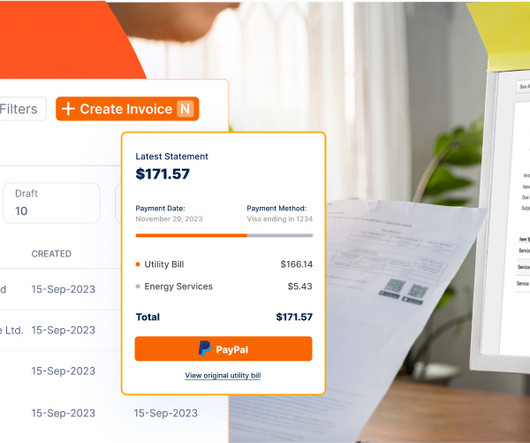

Invoicera

DECEMBER 26, 2023

Introduction Do you know that having the right invoicing software can make a big difference for your business? Nearly 60% of small businesses struggle with late payments. That’s a lot! That’s why it’s essential to pick the right invoicing software. But don’t worry, it’s not complicated. Think about what your business needs.

Accounting Today

DECEMBER 26, 2023

What does the future hold for AI and accounting? While predictions over the long term are dicey, Accounting Today asked AI experts what people may see in the short term.

Speaker: Susan Richards

Your past-due accounts are growing, cash flow is tightening, and the pressure is on. The big question: Do you handle the collections internally or outsource to experts? Both strategies come with advantages and risks - but which one delivers the best impact for your business? In this session we’ll dive deep into the in-house vs. outsourcing debate, examining cost-effectiveness, efficiency, compliance risks, and overall recovery success rates.

Accounting Tools

DECEMBER 26, 2023

What is an Overhead Rate? The overhead rate is the total of indirect costs (known as overhead) for a specific reporting period, divided by an allocation measure. The overhead rate is then used to allocate overhead costs to cost objects, which are usually products or projects. A company uses the overhead rate to allocate its indirect costs of production to products or projects for one of two reasons.

Accounting Today

DECEMBER 26, 2023

The Internal Revenue Service and the Treasury Department have issued a notice saying they intend to propose regulations to address the capitalization and amortization of specified research and experimental expenditures.

Ace Cloud Hosting

DECEMBER 26, 2023

“David vs Goliath” of the Cloud Era The age-old tale of David and Goliath teaches us a lot of lessons. For me, it showcases how David didn’t rely 100% on.

Accounting Today

DECEMBER 26, 2023

Iris supplies software for the U.K. accounting, payroll, human resources and education sectors.

Speaker: Danny Gassaway and Wayne Richards

Finance leaders are prioritizing efficiency and digital transformation, yet many hesitate to automate due to uncertainty. Without a clear understanding of its impact, organizations risk falling behind competitors who are leveraging automation to drive productivity and cost savings. Join Wayne Richards and Danny Gassaway from AvidXchange for a practical guide on bringing accounts payable (AP) automation to your organization.

CSI Accounting & Payroll

DECEMBER 26, 2023

As a small business owner, you know that businesses can owe a lot in taxes. Of course, you want to keep that as low as legally possible. Business entities, or business structures , can play a part in tax liability – but how much do they matter? At CSI Accounting & Payroll, we’ve worked with small business accounting for over 50 years. During that time, small business owners have wanted to know a lot about business entities and taxes, such as: How much do business entities affect tax liabilit

Accounting Today

DECEMBER 26, 2023

The International Ethics Standards Board for Accountants approved an exposure draft on ethics and independence standards for sustainability reporting and assurance and a final ethics standard for tax planning and related services.

Insightful Accountant

DECEMBER 26, 2023

Unleashed is cloud-based inventory management software that unlocks your cashflow and saves time – so you can concentrate on growing your business.

Accounting Today

DECEMBER 26, 2023

In a recent case, the Tax Court addressed the issue of when limited partners may be subject to self-employment tax.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Accounting Tools

DECEMBER 26, 2023

What is a Trustee? A trustee is someone who is legally responsible for trust assets. This person administers assets as mandated in the instructions associated with a trust. In many cases, the person who created a trust steps into the role of trustee, and stays there until he or she is incapacitated. From that point onward, a successor trustee takes over responsibility for the trust assets.

Accounting Today

DECEMBER 26, 2023

Technology helps financial advisors unlock much more value by being able to switch up clients' buckets of investments at any time throughout the year.

Accounting Tools

DECEMBER 26, 2023

What is a Cap Table? A cap table is a spreadsheet that itemizes the ownership positions of the investors in a business. If a business has issued several types of equity , then the cap table is subdivided into stock types. This means that, for example, an investor might have acquired shares of common stock , Series A preferred stock , and Series B preferred stock.

Accounting Today

DECEMBER 26, 2023

ART programs provide a number of benefits, including more control over premiums and a more stable renewal process. However, the tax consequences require a thorough vetting.

Speaker: Jennifer Hill

Payroll compliance is a cornerstone of business success, yet for small and midsize businesses, it’s becoming increasingly challenging to navigate the ever-evolving landscape of federal, state, and local regulations. Mistakes can lead to costly penalties and operational disruptions, making it essential to adopt advanced solutions that ensure accuracy and efficiency.

Accounting Tools

DECEMBER 26, 2023

What is a Bond? A bond is a fixed obligation to pay that is issued by a corporation or government entity to investors. The issuer is obligated to make a series of interest payments to the bond holders over the life of the bond, and to buy back the bonds at their maturity date. This is a form of debt for the issuer. The Present Value of a Bond The issuer may have an interest in paying off the bond early, so that it can refinance at a lower interest rate.

Accounting Today

DECEMBER 26, 2023

You may have been up to date yesterday, but there's probably an advance in current technology, or an entirely new technology, that can help you or your clients be more accurate, and more productive.

Accounting Tools

DECEMBER 26, 2023

What is the Basic Earnings per Share Formula? Basic earnings per share is the amount of a company’s earnings allocable to each share of its common stock. It is a useful measure of performance for companies with simplified capital structures that only contain common stock. If a business only has common stock in its capital structure, the company presents only its basic earnings per share for income from continuing operations and net income.

Accounting Tools

DECEMBER 26, 2023

What is a Business Transaction? A business transaction is an economic event with a third party that is recorded in an organization's accounting system. Such a transaction must be measurable in money. Once a business transaction has been recorded, it will flow through the accounting system and appear in a firm’s financial statements. Examples of Business Transactions Examples of business transactions are: Buying insurance from an insurer.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Accounting Tools

DECEMBER 26, 2023

What is Economic Value Added? Economic value added is the incremental difference in the rate of return over a company's cost of capital. In essence, it is the value generated from funds invested in a business. If the economic value added measurement turns out to be negative, this means that management is destroying the value of the funds invested in a business.

Accounting Tools

DECEMBER 26, 2023

What is Transaction Exposure? Transaction exposure is the risk of loss from a change in exchange rates during the course of a business transaction. This exposure is derived from changes in foreign exchange rates between the dates when a transaction is booked and when it is settled. This is a particular concern when there is a lengthy gap between the start of a transaction and when payment is received.

Let's personalize your content