IRS crypto enforcement could get tougher

Accounting Today

JULY 15, 2024

The Internal Revenue Service could be doing a better job of cracking down on tax noncompliance by users of virtual currency or digital assets, according to a new report.

Accounting Today

JULY 15, 2024

The Internal Revenue Service could be doing a better job of cracking down on tax noncompliance by users of virtual currency or digital assets, according to a new report.

Accounting Department

JULY 16, 2024

Growing a business is a multifaceted challenge that requires careful financial management. For many business owners, juggling daily operations while keeping track of finances is daunting. Enter Client Accounting Services (CAS), a crucial element for business growth that improves financial accuracy, reduces costs, and offers expert financial guidance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Fidesic blog

JULY 19, 2024

We had a blast at Summit Roadshow on Wed. If you missed our live recap yesterday we'll be sharing highlights form it here over the next couple of weeks, starting with Jim Bertler's session Dynamics GP.

accountingfly

JULY 18, 2024

Top Remote Accounting Candidates This Week Looking for remote accountants? Accountingfly can help! With our ‘ Always-On Recruiting ‘ program, you can access highly skilled and experienced remote accounting candidates with no upfront cost. These are just a few of our top remote accounting candidates this week. Sign up now to receive the full list of top accounting candidates available weekly!

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

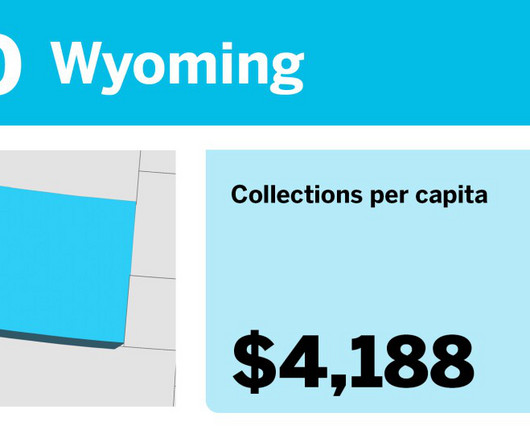

Accounting Today

JULY 18, 2024

The top state takes in $7,200 in tax per capita.

Accounting Department

JULY 18, 2024

Summer can be a challenging time for many businesses, with sales often dipping as customers take vacations and routines shift. But a slowdown doesn't have to mean a cash flow crisis.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Ace Cloud Hosting

JULY 18, 2024

One of a business’s most frequently overlooked elements is its order management. Companies must coordinate the entire process, from when customers place orders until they receive their product or service.

Accounting Today

JULY 18, 2024

The Treasury Department and the Internal Revenue Service issued final regulations Thursday to update the rules for required minimum distributions.

Insightful Accountant

JULY 18, 2024

If you are a ProAdvisor, Consultant, or Accountant wanting to support construction businesses as they digitally transition, you won’t want to miss this survey, which will provide valuable insights into the industry.

Fidesic blog

JULY 18, 2024

Seldom used features in Dynamics GP! Keeping GP fresh with tricks you might not know.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Ace Cloud Hosting

JULY 17, 2024

Lacerte is one of the most popular and reputable tax preparation and filing software for small—to medium-sized businesses. It offers robust features that allow tax professionals to reduce manual work.

Accounting Today

JULY 16, 2024

Accounting firms and vendors alike have stressed the importance of having a "human in the loop" to oversee AI. Just who are these humans and what do they do?

Accounting Tools

JULY 19, 2024

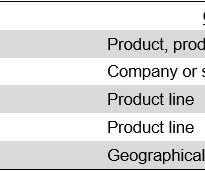

What are Traceable Costs? A traceable cost is a cost for which there is a direct, cause-and-effect relationship with a process, product, customer , geographical area, or other cost object. If the cost object goes away, then the traceable cost associated with it should also disappear. A traceable cost is important, because it is an expense that you can reliably assign to a cost object when constructing an income statement showing the financial results of that cost object.

Insightful Accountant

JULY 16, 2024

The potential expiration of key provisions of the Tax Cuts and Jobs Act (TCJA) at the end of 2025 is a critical issue that requires careful attention and proactive planning, and Section 199A is no exception.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Billing Platform

JULY 15, 2024

Also referred to as yield management, revenue management can be described in extremely simplistic terms ( selling the right product, to the right customer, at the right price, through the right channel ) or defined in a more complex manner. Brought mainstream by industries like hospitality and airlines, revenue management is a discipline that combines data mining, analytics, and operations research to understand customer behavior.

Accounting Today

JULY 16, 2024

Accounting is an industry wedded to traditional techniques, so leveraging new technology will require a cultural shift within the organization.

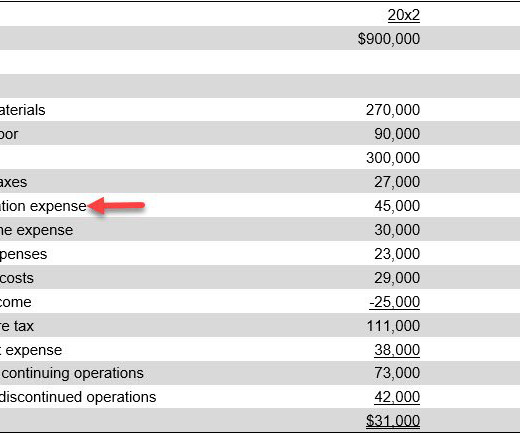

Accounting Tools

JULY 14, 2024

What are Pro Forma Financial Statements? Pro forma financial statements are financial reports issued by an entity, using assumptions or hypothetical conditions about events that may have occurred in the past or which may occur in the future. These statements are used to present a view of corporate results to outsiders, perhaps as part of an investment or lending proposal.

Insightful Accountant

JULY 17, 2024

Ben Richmond, the Managing Director of Xero for North America, gives valuable insights into accounting firms providing 'Fractional CFO' services.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Gaviti

JULY 18, 2024

There are two main types of cash flow forecasting: short term and long term. Short-term forecasting predicts the company’s cash flow for under 12 months, while long-term forecasting looks beyond twelve months. Financial professionals often agonize over which one to use, but most organizations need both. What is Short-Term Cash Forecasting? Short-term forecasting looks at the cash inflows and outflows over a shorter period.

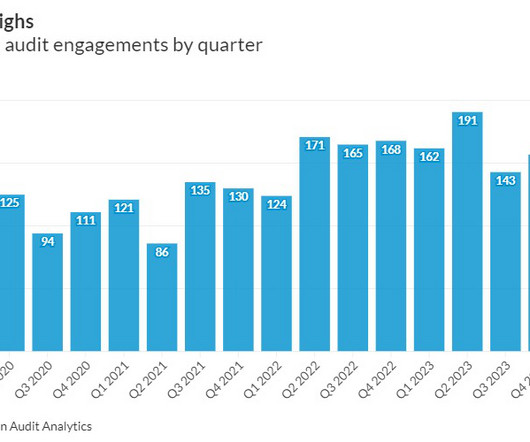

Accounting Today

JULY 16, 2024

The Big Four firm netted the most new SEC audit clients in the first quarter, followed closely by Deloitte.

Accounting Tools

JULY 19, 2024

What is the Purpose of Depreciation? The purpose of depreciation is to match the expense recognition for an asset to the revenue generated by that asset. This is called the matching principle , where revenues and expenses both appear in the income statement in the same reporting period , thereby giving the best view of how well a company has performed in a given reporting period.

Nolan Accounting Center

JULY 15, 2024

As a small business owner, you should want to improve your business operations. Indeed, every business owner should recognize that improving operating efficiency must be an ongoing endeavor. As American editor and publisher Clarence W. Barron stated, “Everything can be improved.” More pointedly, Japanese consultant Masaaki Imai said, “Not a day should go by without some kind of improvement made somewhere in the company.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Reconciled Solutions

JULY 18, 2024

Learn more about the Augusta Rule, a legal way to increase tax deductible business expenses and personal income without paying more in taxes. The post The Augusta Rule: What is it and how can it help me improve my tax-saving strategies? appeared first on Reconciled Solutions.

Accounting Today

JULY 18, 2024

The RSM network made five strategic acquisitions in Europe, including specialist audit and consulting firms in Austria, Denmark and France, plus a prestigious law firm in Spain.

Enterprise Recovery: Accounts Receivable

JULY 15, 2024

Retention marketing is the practice of implementing strategies and techniques to keep existing clients engaged and loyal to your business. While acquiring new customers is important, retaining existing ones is more valuable for the long-term success of your business. By focusing on client retention, you can build strong relationships, increase customer satisfaction, and ultimately drive revenue growth.

Accounting Tools

JULY 17, 2024

What is Continuing Professional Education? Continuing professional education (CPE) is ongoing training that is required in order to remain certified as a professional in certain fields. The intent behind requiring this training is to force professionals to continue to update their knowledge of pertinent information that can improve their ability to serve their clients.

Speaker: Yohan Lobo

In the accounting world, staying ahead means embracing the tools that allow you to work smarter, not harder. Outdated processes and disconnected systems can hold your organization back, but the right technologies can help you streamline operations, boost productivity, and improve client delivery. Dive into the strategies and innovations transforming accounting practices.

Reconciled Solutions

JULY 18, 2024

Creating a budget that actually works can be tough. Use QuickBooks Online’s setup tools and these tips for more effective budgeting. The post Having Trouble Budgeting? QuickBooks Online Can Help appeared first on Reconciled Solutions.

Accounting Today

JULY 15, 2024

The IRS warned about bad advice that's being peddled on social media promoting a bogus "Self Employment Tax Credit" and prompting unsuspecting taxpayers to file false claims for the credit.

Jetpack Workflow

JULY 18, 2024

Podcast Summary On this episode of Growing Your Firm, host David Cristello welcomes Cory Gayman, CPA , the CEO/CFO/Founder of JCG Tax & Advisory Firm. Cory shares insights on establishing common ground with entrepreneurs, addressing the accounting talent shortage, improving accounting efficiencies, and navigating the world of virtual firms. Tune in for valuable tips from a firm owner in the trenches.

Accounting Tools

JULY 17, 2024

What is Investment Property? Investment property is property that an entity holds to earn rental income and/or capital appreciation. It generates cash flows mostly independently of other assets held by an entity. It is not property that an entity uses to supply goods or services, nor is it used for administrative purposes. Examples of Investment Property There are many examples of investment property, including the following: Farmland Forest land Commercial properties held for rent or appreciati

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content